The Wise app has become a popular choice for fast money transfers, multi-currency accounts, and a variety of other financial features. In this detailed review, we will explore the extensive functionalities of the Wise app, ensuring you can maximize your experience. Let’s jump right in!

Wise App Overview

The Wise app is not just about sending money; it is a comprehensive financial tool. It offers a user-friendly interface that allows you to manage your finances seamlessly. The app is regularly updated, which means new features are consistently added to enhance user experience. However, it’s important to note that some features may not be available in every region.

Updates

With each update, the Wise app improves its functionalities and user interface. Users can expect enhancements that refine their experience without changing core functionalities. Regular updates ensure that the app remains relevant and continues to meet user needs effectively.

Login & Sign Up

Upon opening the app, users are greeted with options to either log in or sign up. The sign-up process is straightforward, allowing new users to create an account quickly. Once logged in, you land on the home page, where all functionalities are easily accessible.

Home Page

The home page is the central hub of the Wise app. Here, users can view their total balance, recent transactions, and current exchange rates. The layout is designed for easy navigation, making it simple to find what you need at a glance.

Wise Money Transfers

One of the standout features of the Wise app is its money transfer service. Known for offering mid-market exchange rates, Wise ensures that users can send money internationally with low fees and no hidden charges. You can send money to over 160 countries, making it a reliable option for global transactions.

Return To The Home Page

After completing a transfer, you can easily return to the home page to continue managing your finances. This seamless navigation enhances the user experience, allowing for a fluid transition between different functionalities.

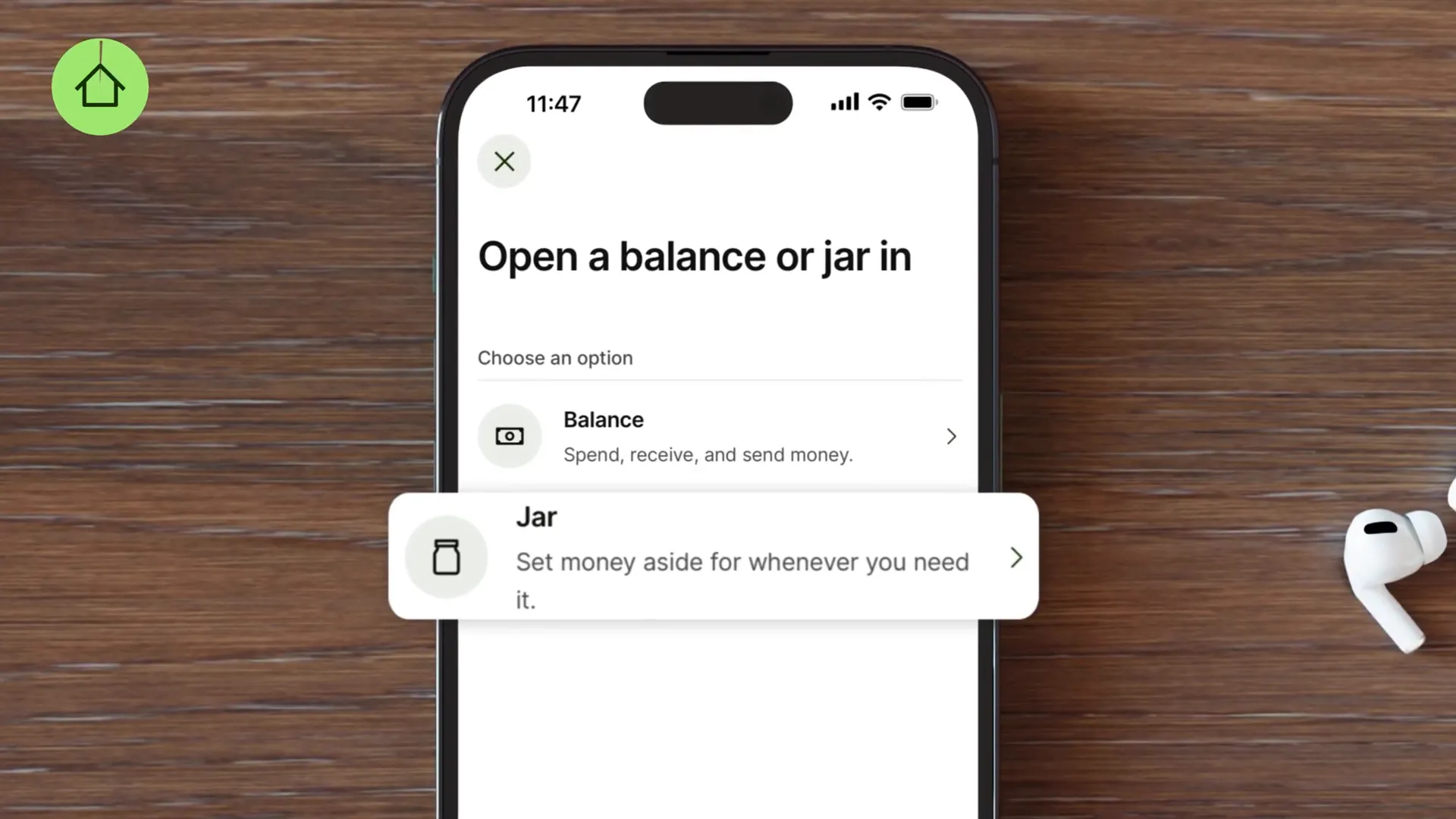

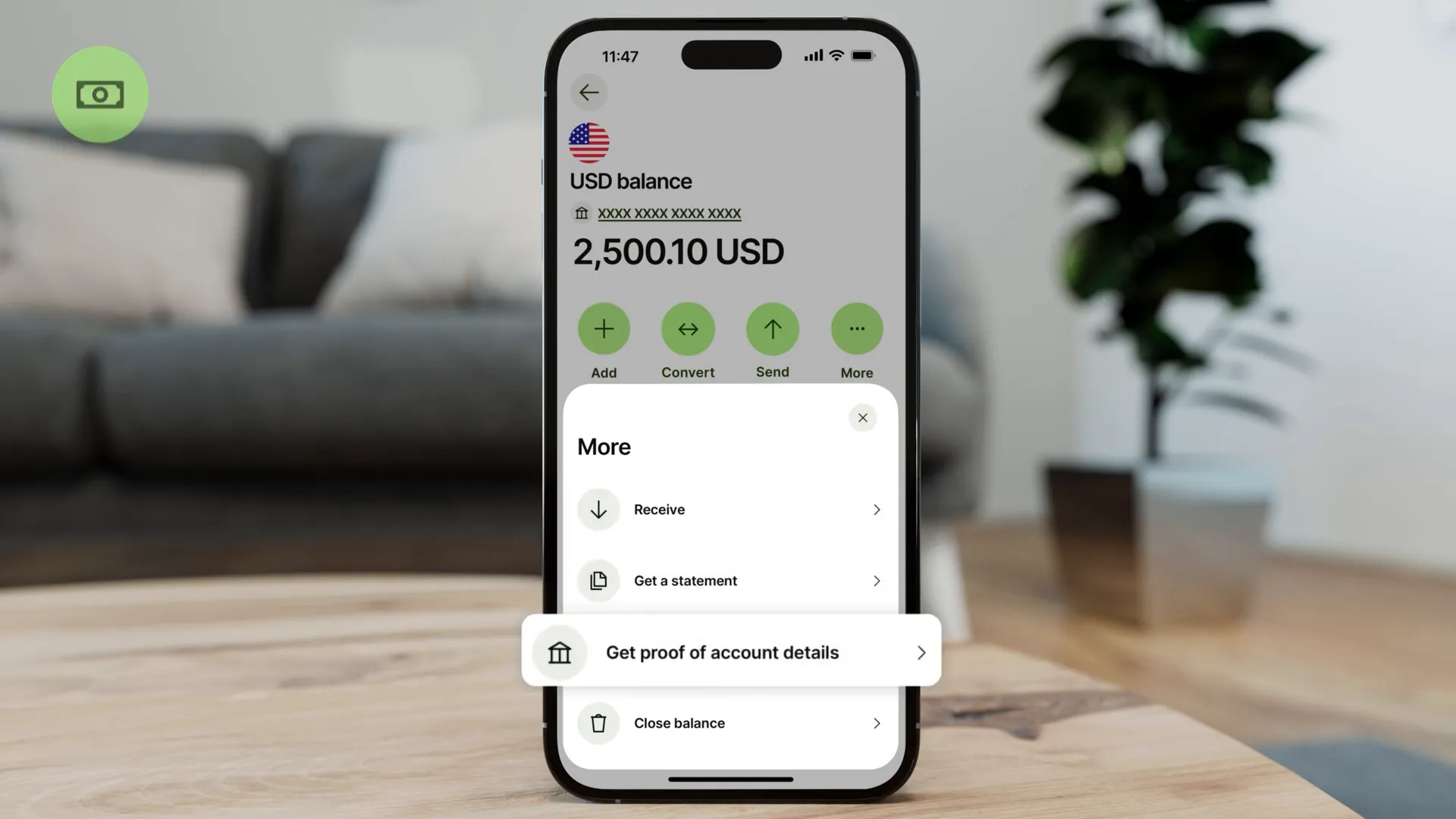

Balances

On the balances page, users can view all their currency balances and create new ones. The app allows you to open either a balance or a “jar.” A balance is used for immediate spending, while jars are designed for saving towards specific goals.

Jars

Jars are a unique feature that helps users save money for future expenses. They can be customized for various purposes, such as saving for a vacation or setting aside funds for monthly bills. This feature promotes financial discipline and goal tracking.

Wise Assets

For users interested in investing, the Wise app offers the Wise Assets functionality. Users can choose to invest their balances in interest-earning funds or stocks. This feature allows your money to work for you while still being accessible for transactions.

Wise Interest

Wise Interest enables users to earn interest on their savings. When you switch your balance or jar to interest, your funds are invested in government-backed assets, providing a steady return. This feature is an excellent way to grow savings over time.

Wise Stocks

If you’re looking to invest in stocks, the Wise app allows you to invest in the iShares World Equity Index Fund. This fund includes major global companies, spreading the risk across a diverse portfolio. Keep in mind, though, that investing always carries risks, and returns are not guaranteed.

Wise Cards

The card tab within the app is where users manage their physical and digital Wise cards. You can add money, view card details, freeze cards, and even manage spending limits. The flexibility of digital cards adds an extra layer of security for online transactions.

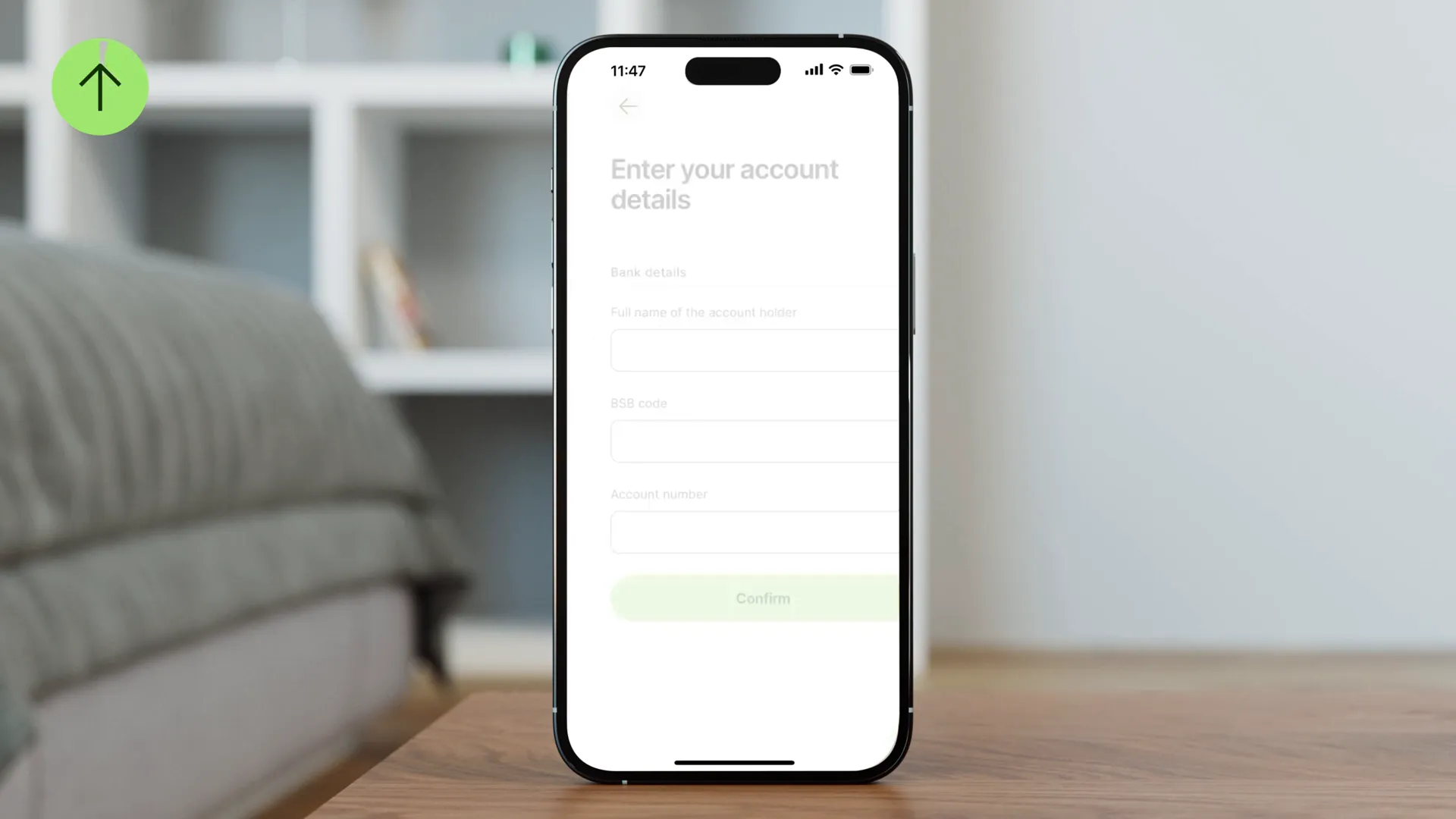

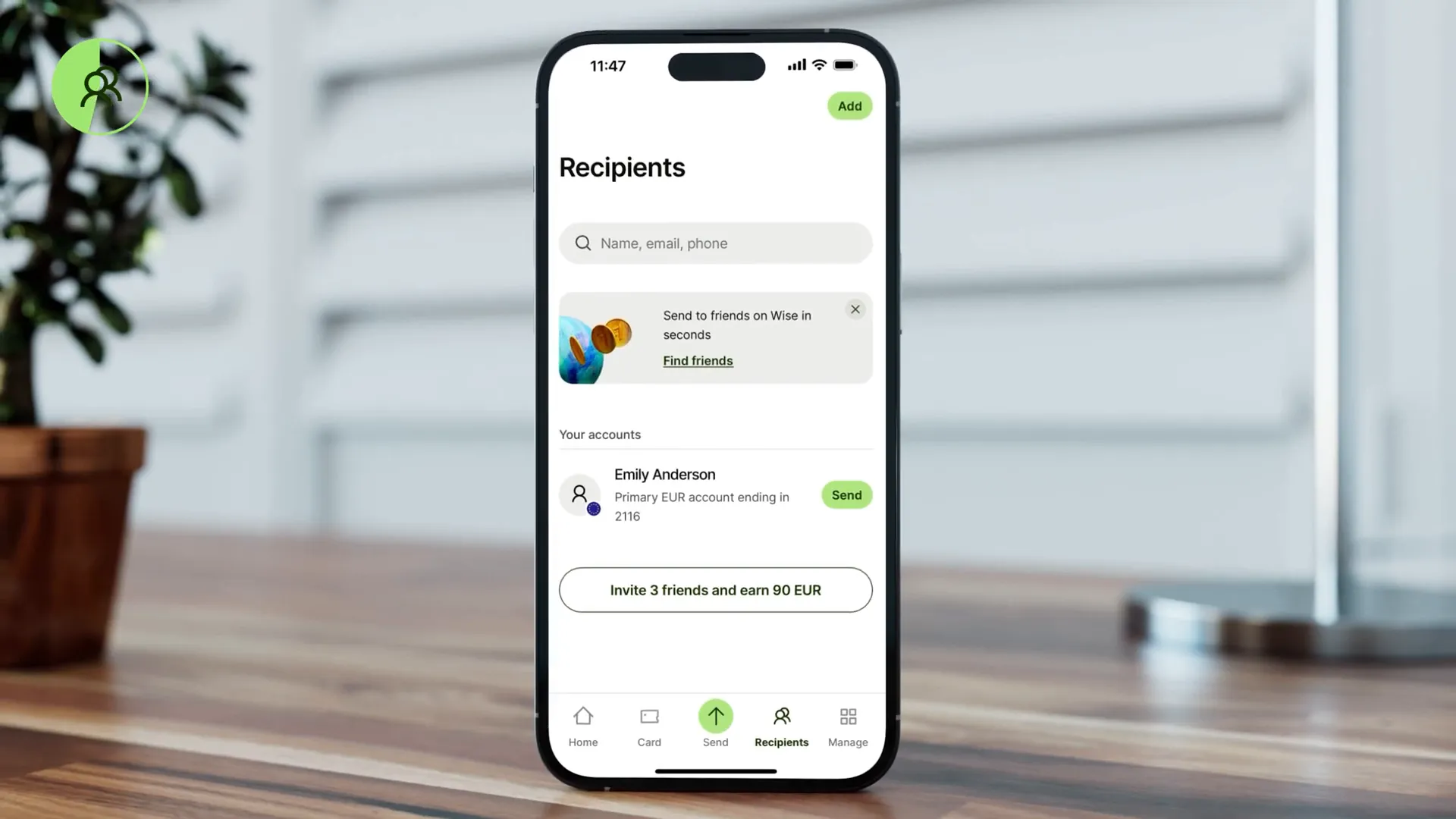

Recipients

The recipients tab simplifies the process of sending money. Users can add and manage their contacts, making future transactions quicker and more efficient. This feature reduces the hassle of re-entering details for regular transfers.

Invite Program

Wise also offers an invitation program that rewards users for referring friends. The specific conditions may vary by region, but this feature encourages users to share the benefits of Wise with others.

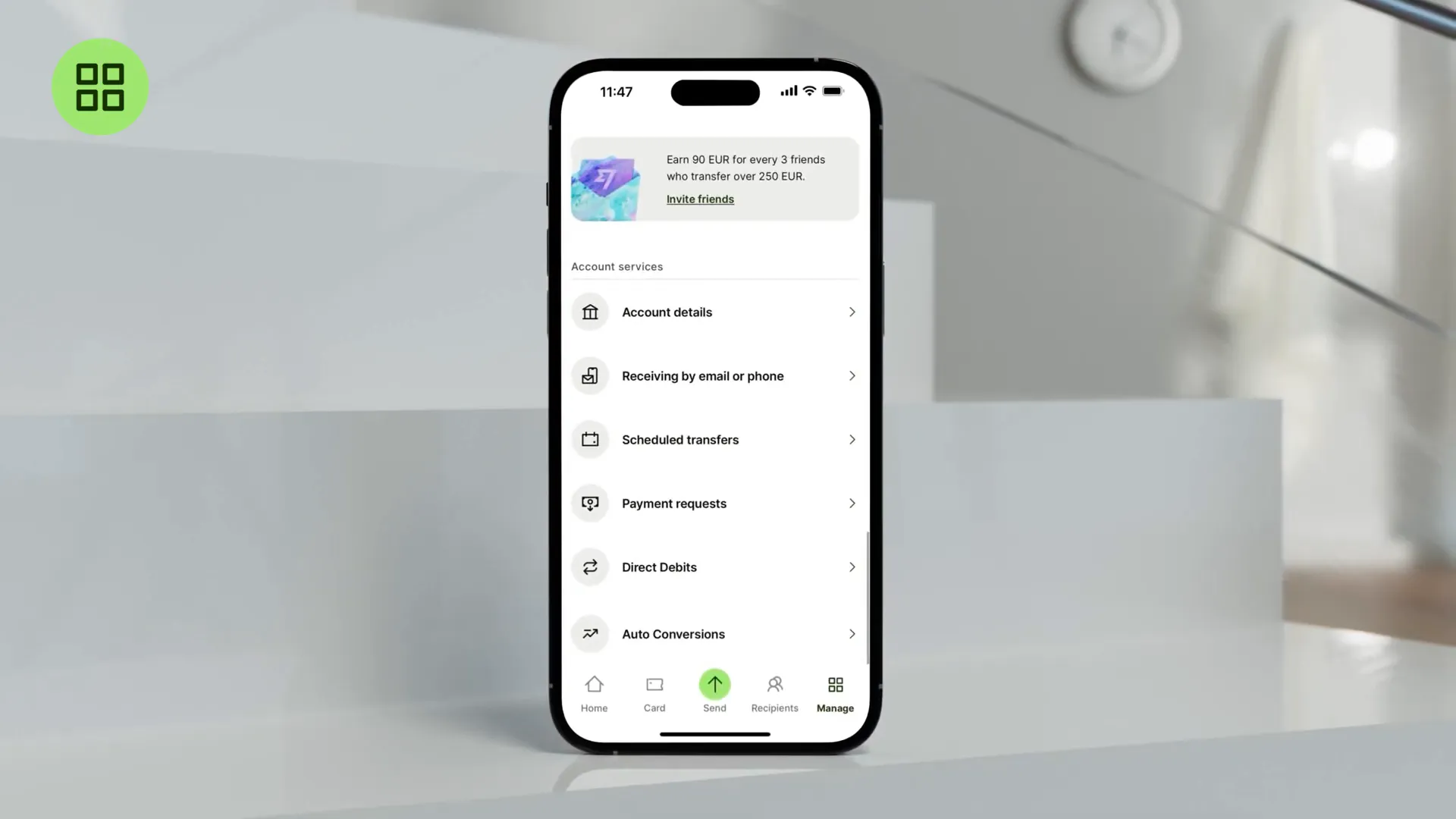

Manage: Extended Functionality

In the manage section, users can access additional features such as requesting payments via email or phone. This functionality is particularly useful for freelancers or anyone who needs to receive payments easily.

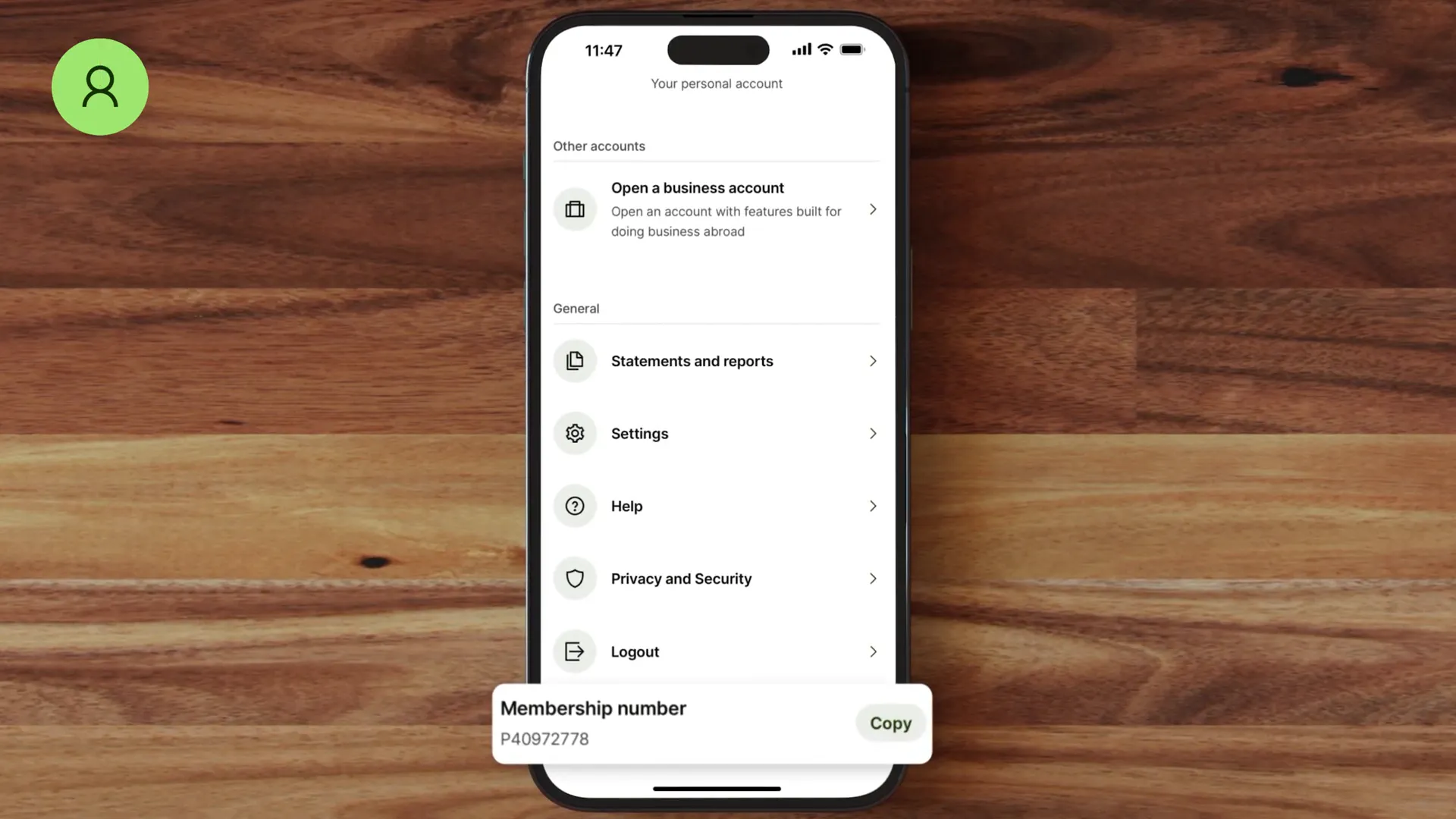

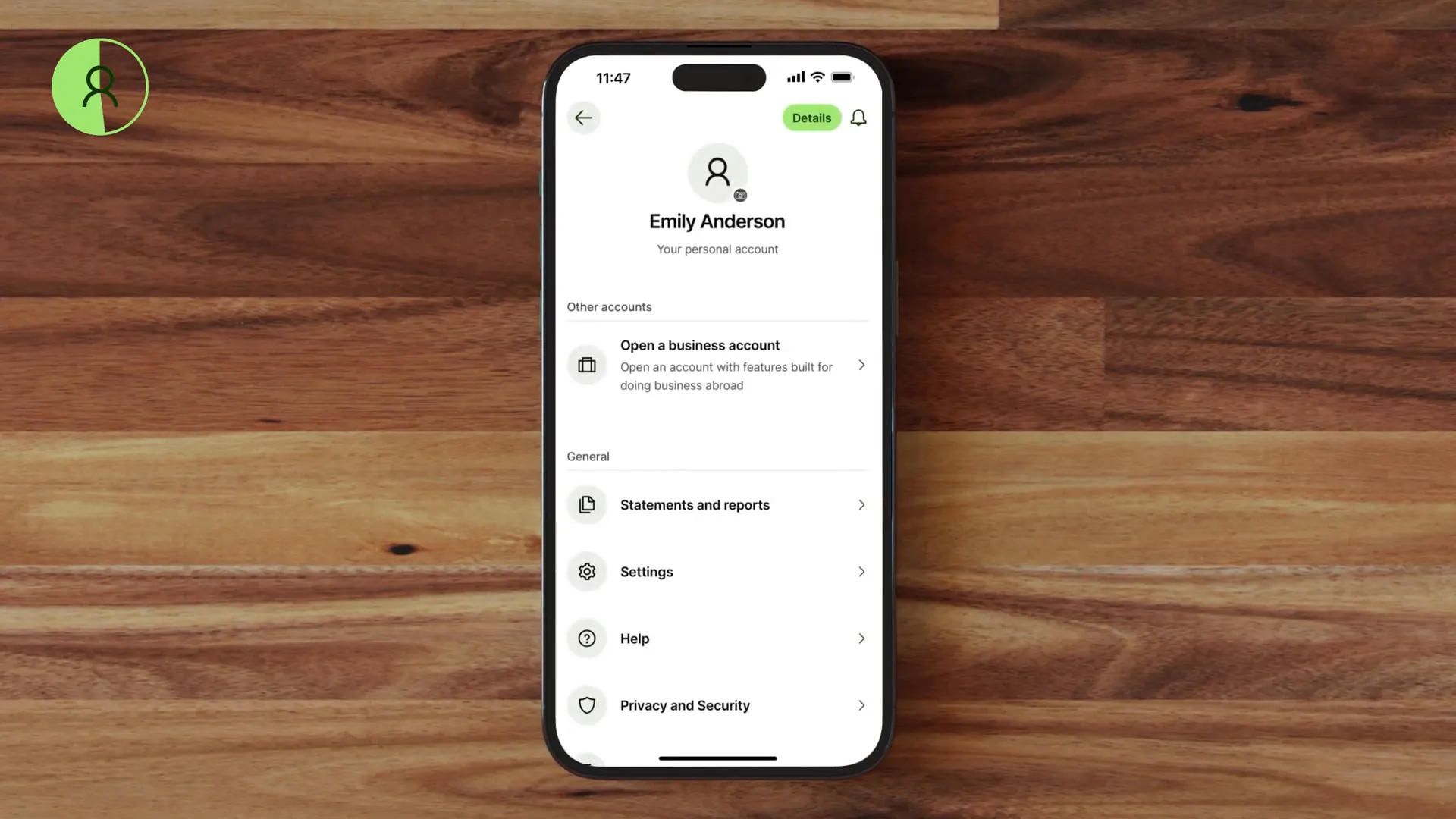

Profile & Settings

Users can customize their profiles and settings within the app. This includes adjusting notifications, exploring the help center, and managing privacy and security settings. Features like two-step verification enhance security, giving users peace of mind.

Privacy

Privacy is a top priority for Wise. Users can manage their privacy settings, ensuring their data is protected. The app includes options for contact syncing, making it easier for friends to send money without needing detailed account information.

Wrap Up

In conclusion, the Wise app offers a comprehensive suite of features designed to simplify money management and enhance user experience. From money transfers to investment options, it provides a robust platform for managing your finances. If You Want Gift in your Wise you must Sign Up Here.