Wise has emerged as a game-changer for global transactions, particularly for those who frequently deal with multiple currencies. With its innovative features and low fees, Wise provides an efficient way to manage your financial activities internationally. In this review, we will explore the various aspects of Wise, including its safety, unique features, pricing, and more.

Is Wise safe?

One of the primary concerns for users considering Wise is the safety and legitimacy of the service. Wise is a publicly listed company in the United Kingdom, subjecting it to stricter regulations compared to private companies. Additionally, Wise operates under licenses in multiple countries, including Malaysia and Singapore. In Malaysia, Wise is regulated by Bank Negara Malaysia, while in Singapore, it is overseen by the Monetary Authority of Singapore.

Your funds with Wise are held separately in reputable banks, such as OCBC Bank in Malaysia, ensuring that your money is safeguarded. Furthermore, Wise employs a two-factor authentication system to enhance the security of your account. This combination of regulatory oversight and robust security measures makes Wise a safe choice for managing your money.

Special Exchange Rate

One of Wise‘s standout features is its access to the mid-market exchange rate, which is the most favorable rate available for currency conversion. Unlike traditional banks that may charge up to 5% in hidden fees, Wise typically offers rates that are less than 0.7% on average. This transparency in pricing allows users to save significantly on currency conversions, making Wise an attractive option for international transactions.

Multi-Currency Account with Debit Card

Wise allows users to hold over 40 different currencies in a single multi-currency account. This feature enables you to lock in favorable rates when converting currencies, providing flexibility for future transactions. The Wise debit card can be obtained for a nominal fee, allowing you to spend in multiple currencies without incurring hefty fees.

Additionally, Wise offers a notification feature that alerts you when a specific exchange rate is reached, enabling you to convert at the best possible rate. This is particularly useful for travelers or those planning large purchases in foreign currency.

Virtual Card

For users who prefer not to carry a physical card, Wise provides up to three virtual cards at no extra charge. These digital cards can be used for online transactions, providing an added layer of security. With a virtual card, your actual card details are protected, reducing the risk of fraud when shopping online.

Furthermore, these virtual cards can easily be added to payment platforms like Apple Pay, Google Pay, or Samsung Pay, making them convenient for everyday use. If you ever feel your card information has been compromised, you can freeze your card instantly through the Wise app.

Cash Withdrawal

Wise allows users to withdraw cash from ATMs globally with competitive fees. Users can make two free withdrawals up to a certain limit each month, after which a small fee applies. This feature is particularly beneficial for travelers who may need cash in local currency while abroad.

For example, a withdrawal of 30,000 yen may incur a minimal fee of around 220 yen, which translates to approximately 0.7% on top of the mid-market exchange rate. This competitive pricing further solidifies Wise’s position as a cost-effective solution for managing international finances.

Smart Auto Convert Technology

Wise’s Smart Auto Convert Technology automatically converts your spending into the appropriate currency, utilizing the lowest fees and best exchange rates available. This means that if you do not have enough balance in one currency, Wise will seamlessly convert funds from another currency you hold, ensuring that your transactions are hassle-free.

This feature is especially beneficial for users who may not be comfortable with currency conversion, as it simplifies the process and saves users money. The automatic nature of this conversion allows for a smooth transaction experience.

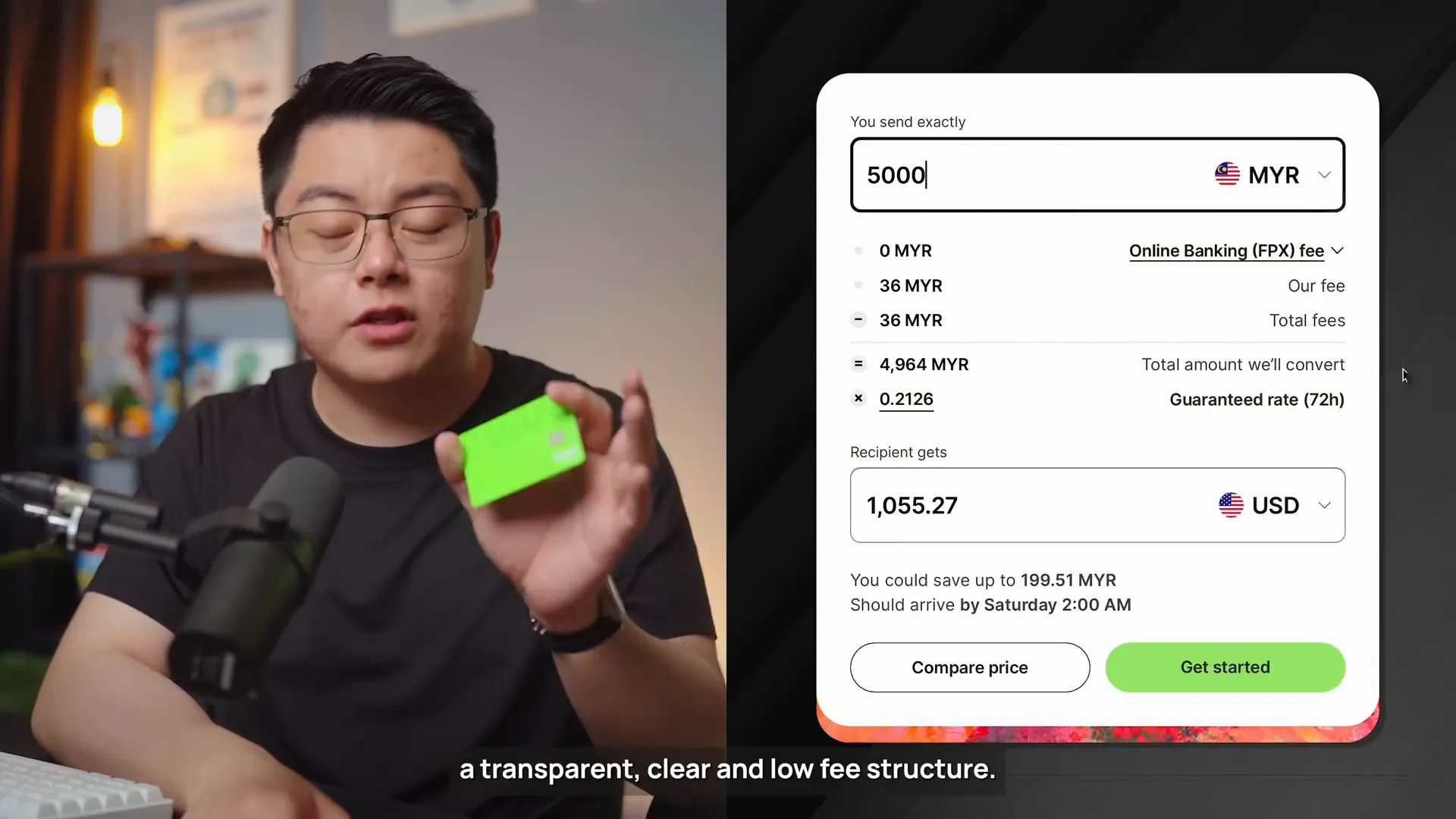

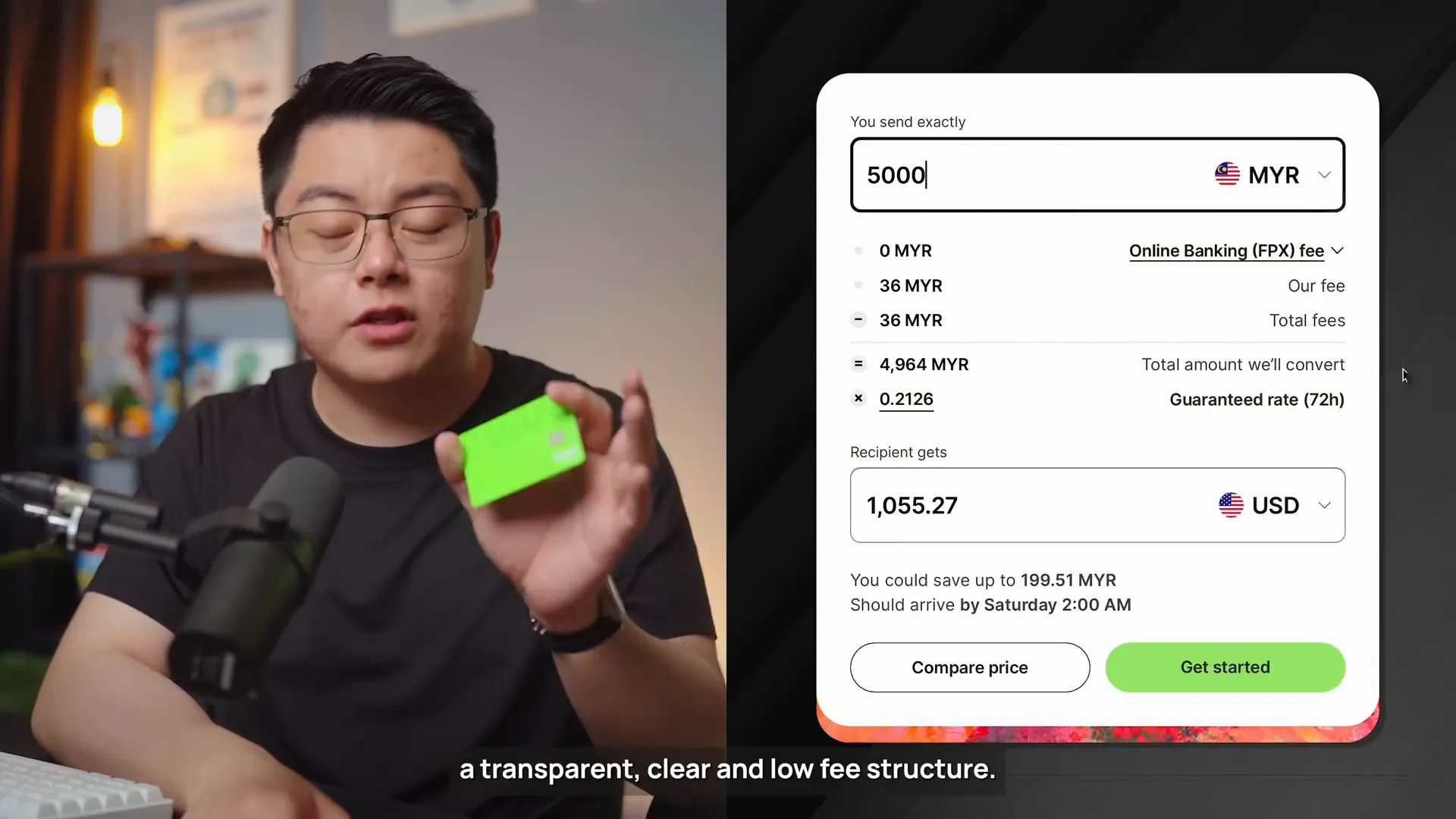

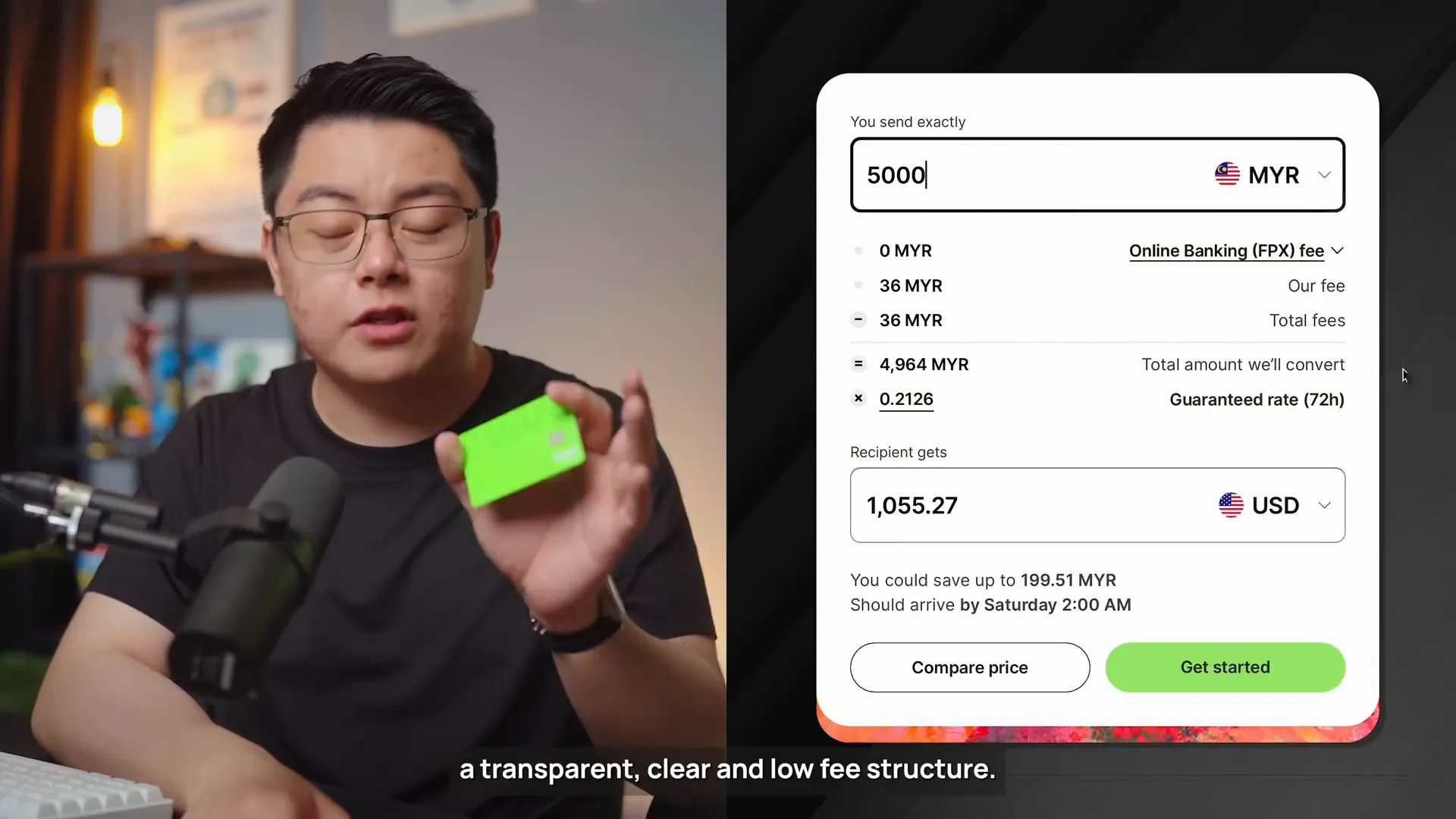

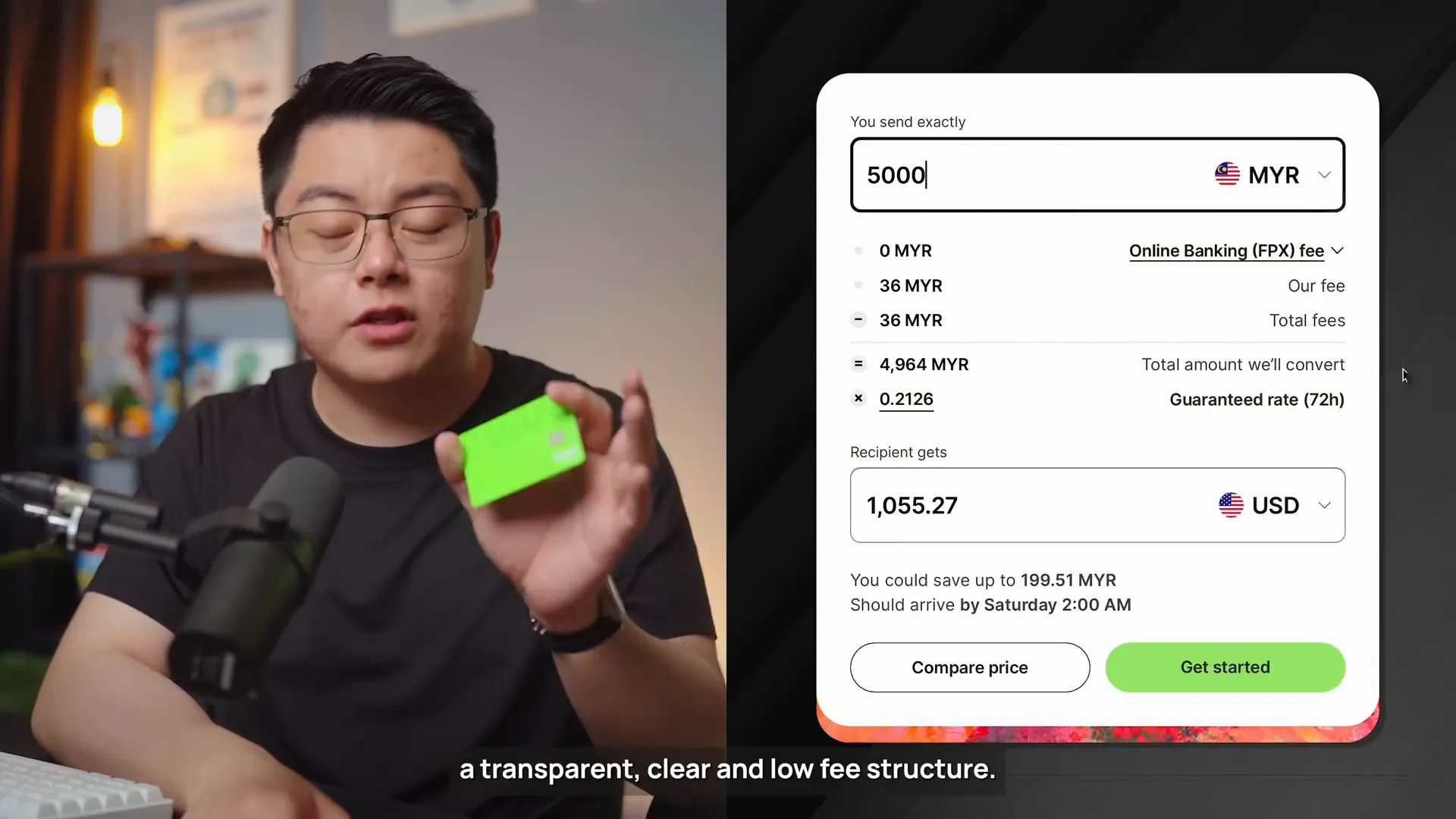

Wise Pricing

Wise operates on a transparent pricing model, meaning users are aware of the fees associated with their transactions upfront. There are no hidden fees or maintenance charges, making it easy to understand your costs. The cost to open an account and obtain the debit card is minimal, and users can enjoy several free ATM withdrawals each month.

For example, the card can be acquired for around 13.70 MYR, and users can withdraw up to 1,000 MYR for free each month. After that, a small fee applies for subsequent withdrawals, keeping costs manageable.

How I Use Wise for Investment Purposes

Many users, including myself, utilize Wise for investment purposes, especially for funding accounts with platforms like Interactive Brokers. Traditional banks can charge exorbitant fees for currency conversions, often exceeding 5%. In contrast, Wise offers a much more competitive rate, typically under 1% for transfers, making it an ideal choice for investors.

With quick transaction times and the ability to fund investment accounts directly from a Wise account, it has become a go-to solution for many investors looking to keep costs low.

Wise Limitations

Despite its many advantages, Wise does have some limitations. For instance, while it supports over 40 currencies, it may not be available in certain countries or for specific currencies, such as the New Taiwan Dollar. Users should check Wise’s website to confirm availability in their region.

Additionally, Wise has transaction limits that may feel restrictive for users making larger purchases, although these limits can be adjusted through the app. Lastly, Wise does not have physical branches, which may be a drawback for users who prefer in-person support.

Conclusion

Overall, Wise offers a powerful solution for individuals needing to manage multi-currency transactions efficiently. With its competitive rates, robust security features, and user-friendly interface, Wise is well-suited for travelers, expatriates, and investors alike. While there are some limitations, the benefits far outweigh the drawbacks, making Wise a top choice for international financial management.

If you’re considering opening a Wise account, I highly recommend doing so to take advantage of its features and benefits.