In today’s global economy, sending and receiving money across borders has become a necessity for many. Whether you’re traveling, supporting family abroad, or running a business, knowing how to do this efficiently can save you time and money. This is where Wise comes in. Wise, previously known as TransferWise, has revolutionized the way we think about international money transfers. In this guide, we will explore what Wise is, how it works, and how you can leverage its features to save money.

Step 1: What is Wise?

Wise is a financial technology company that specializes in cross-border transactions, allowing users to send and receive money internationally without incurring hefty fees associated with traditional banks. With over 16 million customers worldwide, Wise has established itself as a reliable alternative to conventional money exchange services.

One of the standout features of Wise is its ability to provide users with the mid-market exchange rate—essentially the real exchange rate you see on Google—without the typical markup. This allows for significant savings, especially when transferring larger sums of money. Wise also offers a multi-currency account and an international debit card, which enables users to hold, convert, and spend different currencies seamlessly.

Step 2: How does Wise Work?

The operation of Wise is straightforward yet differs significantly from how traditional banks conduct international money transfers. Wise holds local bank accounts in approximately 50 countries, carrying balances in those local currencies.

When you initiate a transfer, you send your money to Wise’s local bank account in your country. For instance, if you’re sending $1,000 USD to the U.S., you’ll send the equivalent amount in your local currency (for example, AUD) to Wise. Once Wise receives your funds, they notify their corresponding bank account in the U.S. to transfer the funds domestically to your recipient. This means your money never actually crosses borders, which is why Wise can offer cheaper rates and faster transfers.

Step 3: Different Use Cases & How You Can Save Money

Wise is not just for personal use; it offers various scenarios where you can save money. Here are some examples:

- Traveling Abroad: Instead of using traditional currency exchange services like Travelex, you can use Wise to convert your money before traveling. For instance, if you wanted to purchase 50,000 THB for a trip to Thailand, Wise would save you around AUD 60 compared to other services.

- Business Transactions: Businesses can benefit from Wise by sending payments to suppliers or receiving payments from clients at a lower cost. For example, sending USD 10,000 to a supplier in China might cost you AUD 400 less using Wise compared to a typical bank.

- Receiving Payments: If you’re a freelancer or contractor working with international clients, Wise allows you to receive payments in foreign currencies and convert them into your local currency at a better rate than PayPal.

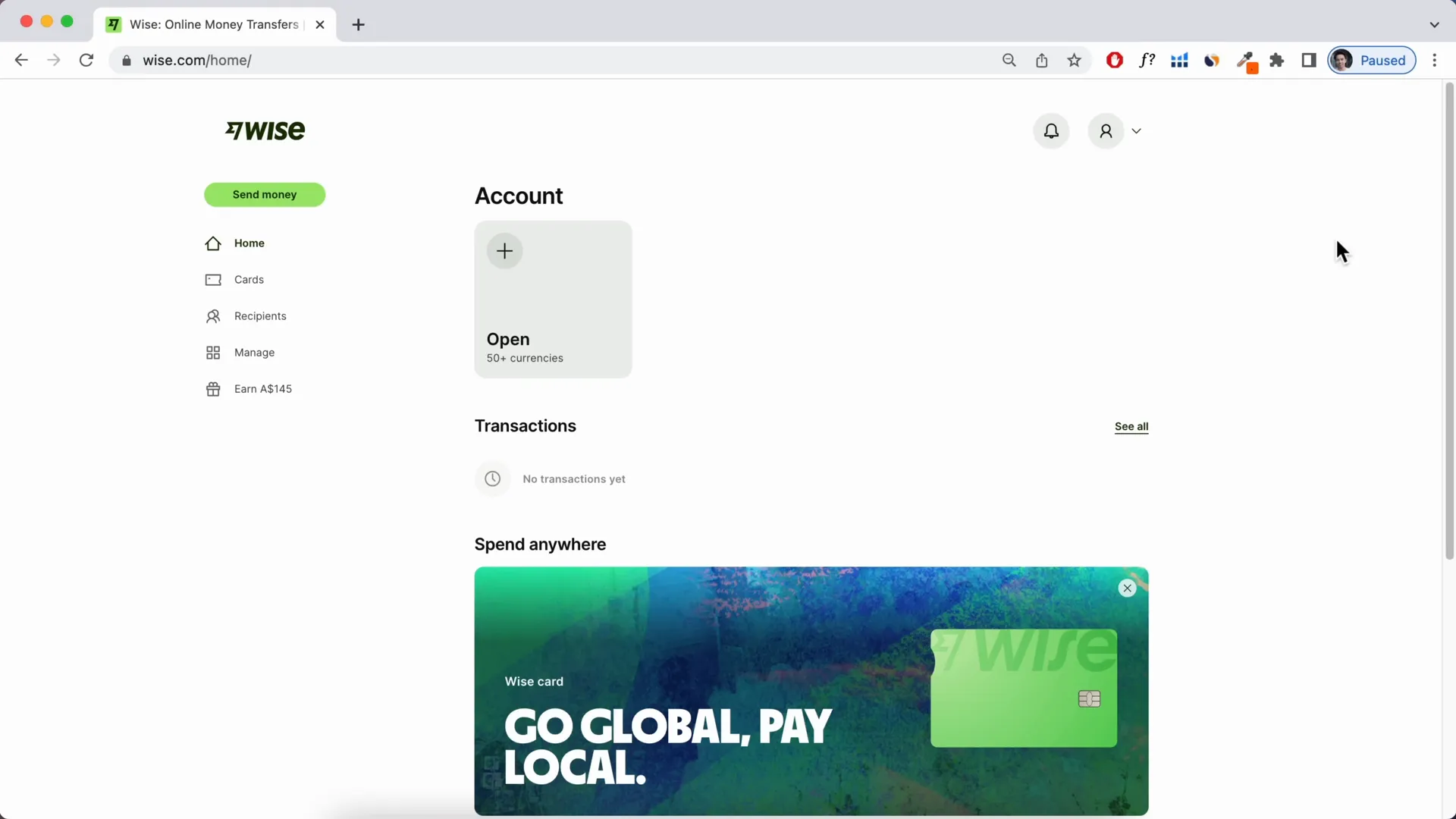

Step 4: How to Create a Free Account

Creating a Wise account is a simple process. You will need a valid photo ID for verification. Here’s how to get started:

- Visit the Wise website and click on “Open an Account.”

- Select whether you want a personal or business account (start with personal for most users).

- Enter your email address and set a password.

- Select your country of residence and click “Sign Up.”

Once your account is set up, you’ll be prompted to verify your identity the first time you make a transaction. This process ensures the security and compliance of your transfers.

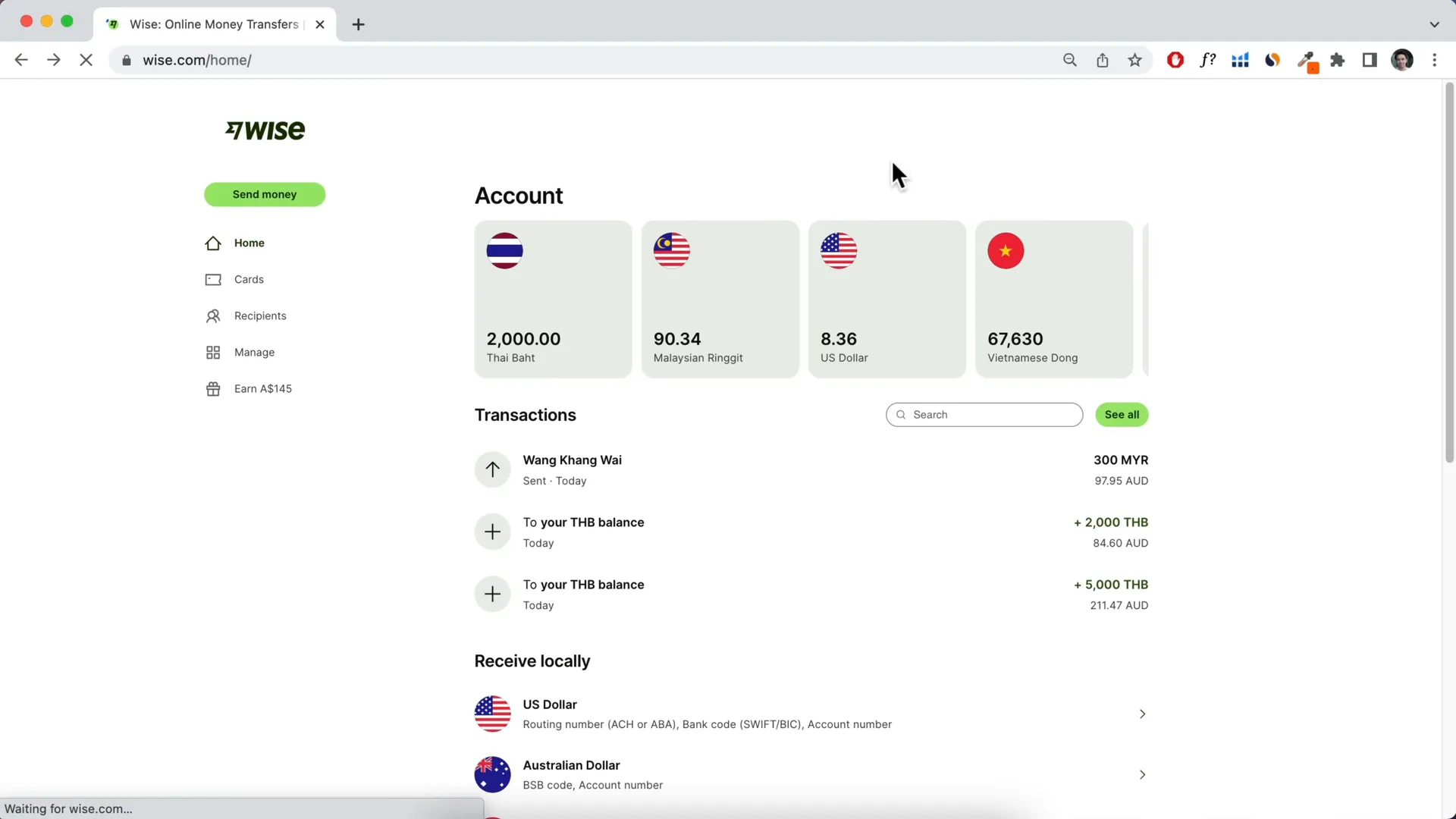

Step 5: How to Transfer Money Internationally

Once your account is created, transferring money internationally is straightforward. Follow these steps:

- Log into your Wise account and click on “Send Money.”

- Select the amount and currency you wish to send. For example, if you want to send 300 Malaysian Ringgit, Wise will automatically calculate how much Australian Dollars you need to send to its bank account.

- Choose your payment method. You can pay via bank transfer, debit card, or credit card, although fees may vary.

- Enter the recipient’s details, including their email and bank information.

- Review the transfer details and confirm.

Wise will notify you once the transfer is complete, which is often very quick depending on the destination country.

Step 6: Other Important Features of Wise

Besides money transfers, Wise offers several important features that enhance your experience:

- Multi-Currency Account: You can hold and manage multiple currencies in one account, making it easy to convert and spend abroad.

- International Debit Card: Wise provides a debit card that allows you to spend in local currencies without incurring conversion fees.

- Auto Conversion: You can set up automatic conversions based on exchange rates, so you don’t have to constantly monitor the market.

- Direct Debits: You can set up direct debits for recurring payments, such as utilities or subscriptions, making it convenient to manage your expenses.

In conclusion, Wise is a powerful tool for anyone needing to send or receive money internationally. With its competitive rates, user-friendly interface, and multi-currency capabilities, it stands out as a leader in the financial technology space. By following the steps outlined in this guide, you can leverage Wise to save money and simplify your financial transactions across borders.