Welcome to the ultimate guide to Binance, the largest cryptocurrency exchange in the world. In this comprehensive tutorial, we will explore all the features of the platform from A to Z. As the platform frequently updates its functionalities, this guide is essential for both newcomers and experienced users.

This tutorial is divided into chapters for easy navigation. You can jump to specific sections by clicking on the timestamps provided. Let’s dive into everything you need to know about Binance!

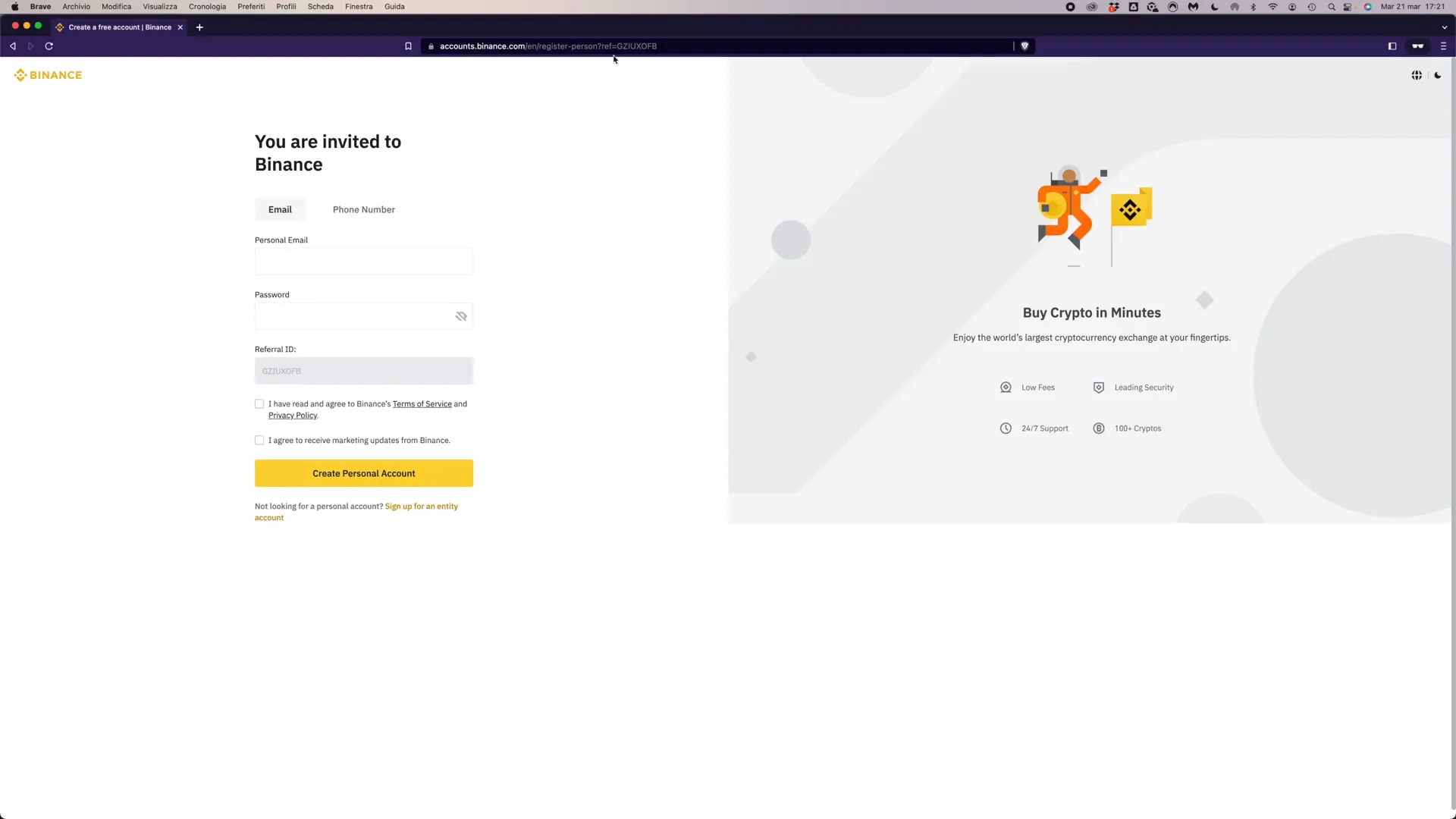

Step 1: How to Create an Account on Binance

To start using Binance, you need to create an account. Binance is regulated in Italy, and it recently opened an Italian office, ensuring compliance with local regulations. When registering, you’ll need to complete a Know Your Customer (KYC) verification process.

Using my referral link provided in the description, you can enjoy a double bonus: a refund of up to $100 on your first trading fees and a 20% discount on all future fees. This discount is applicable for life after the initial refund.

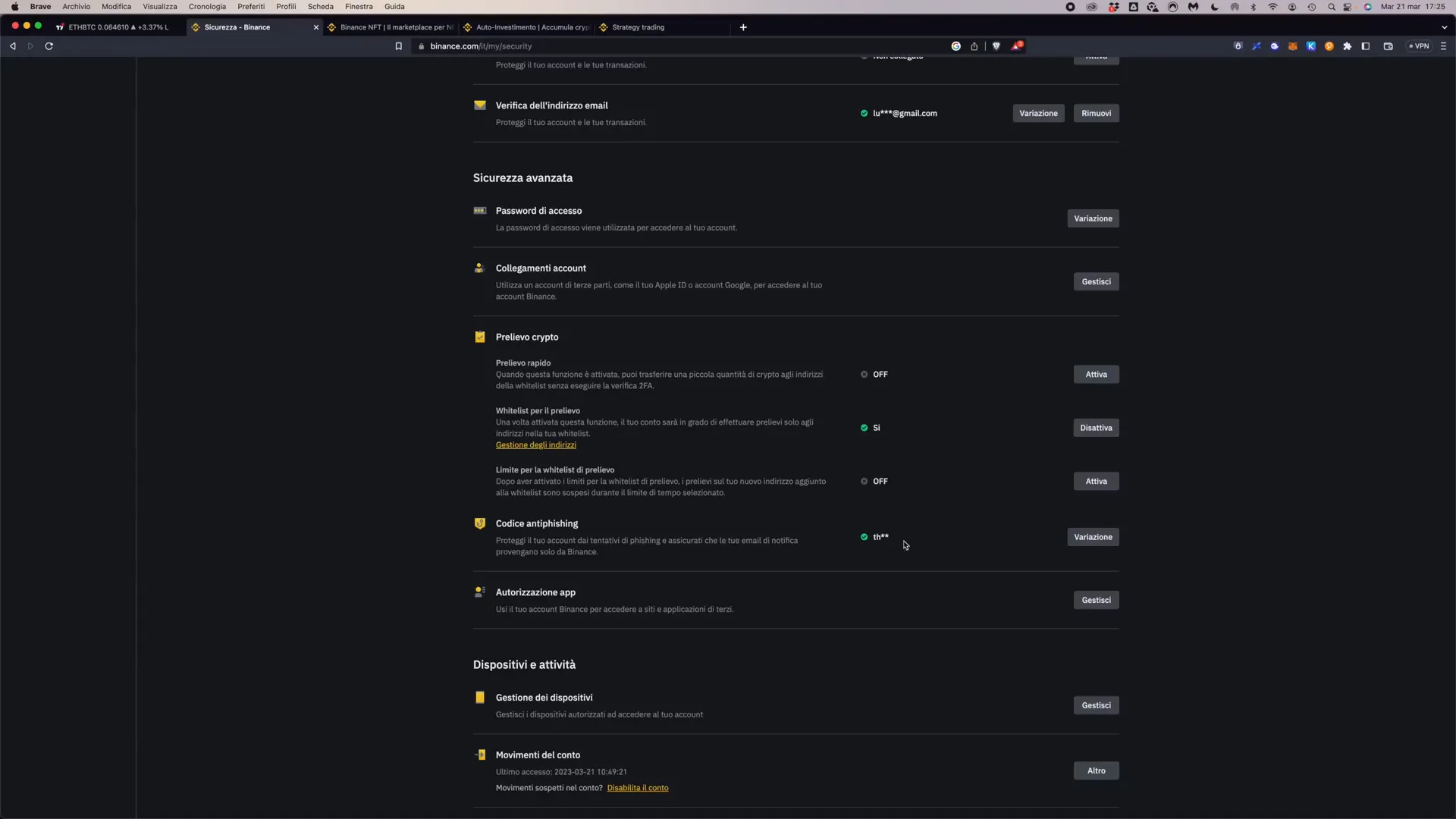

Step 2: Securing Your Binance Account

After registering, the first step is to secure your account. It’s crucial to set up security measures before starting to deposit funds. Navigate to the security settings in your account menu to access various security options.

The most important security feature is two-factor authentication (2FA). This adds an extra layer of security by requiring a second factor, such as a code from the Google Authenticator app. Avoid using SMS for 2FA, as it is less secure and vulnerable to SIM swap attacks.

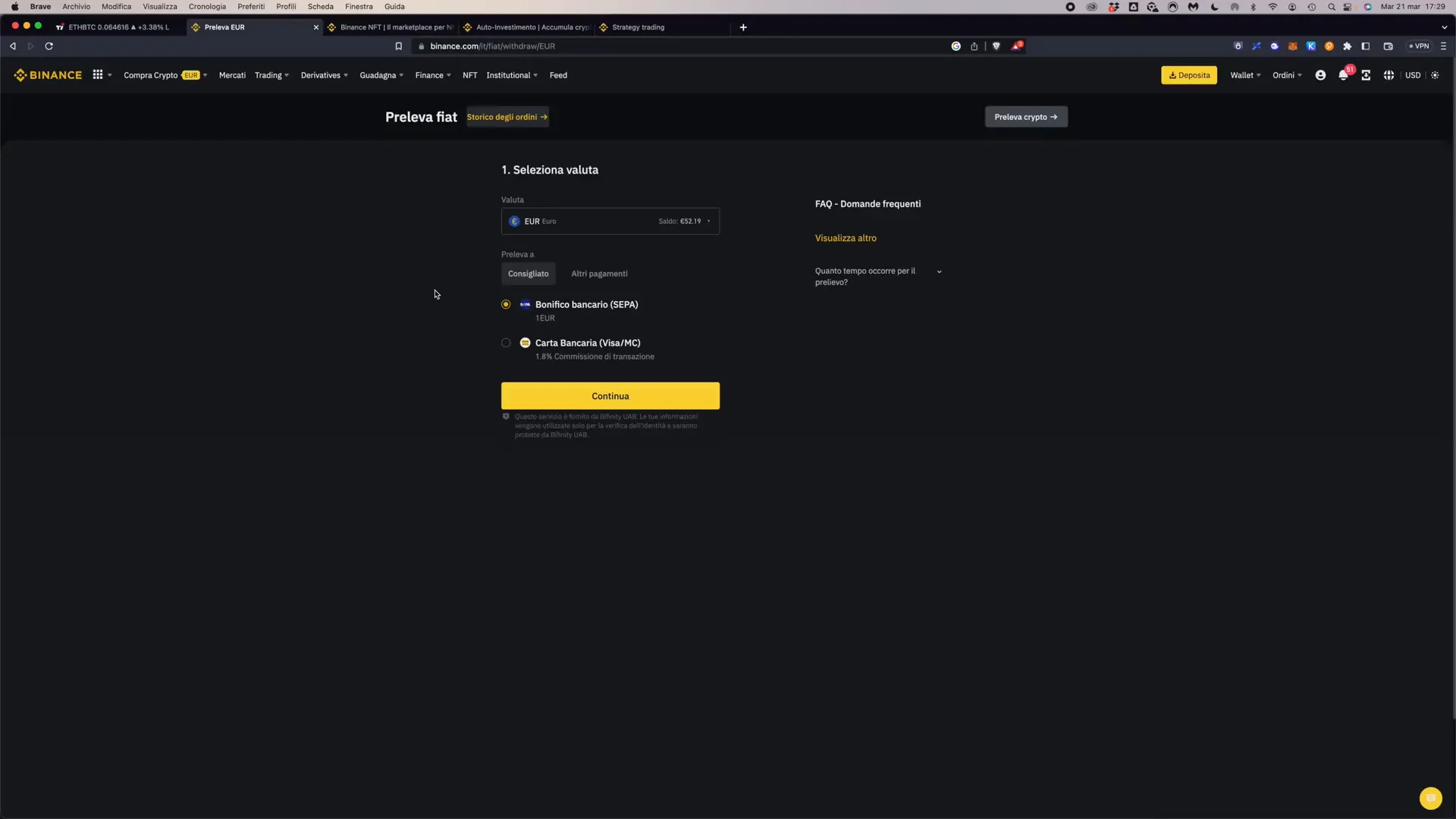

Step 3: Depositing and Withdrawing Euros on Binance

Depositing and withdrawing Euros (EUR) on Binance can be done through bank transfers or credit/debit cards. Bank transfers have minimal fees and are recommended, while card payments incur higher fees (about 2%).

To deposit EUR, go to the fiat deposit section and select your preferred method. For withdrawals, you can use the same methods. Always ensure you are aware of the associated fees and processing times.

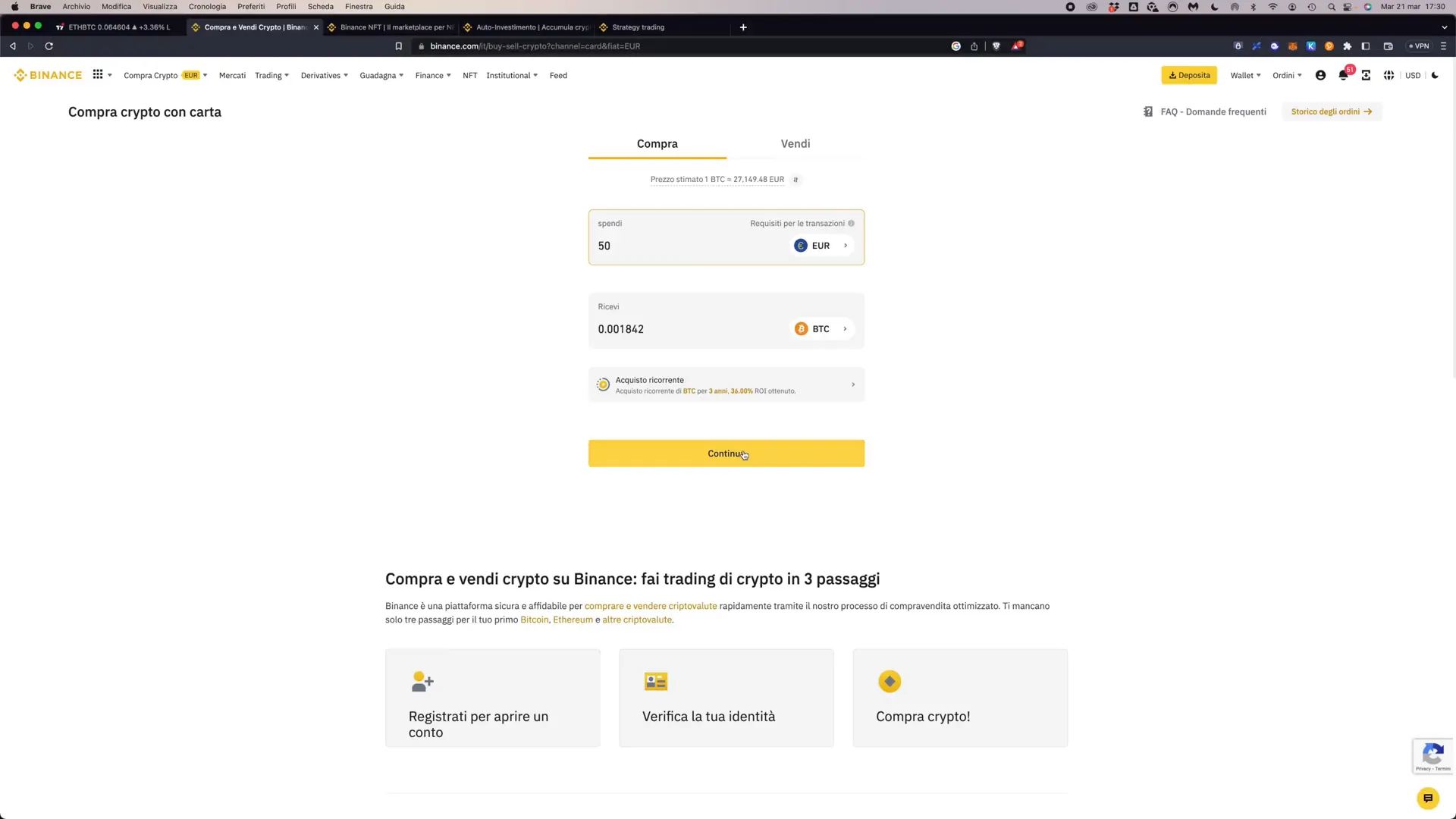

Step 4: Buying and Selling Crypto on Binance with Credit and Debit Cards

Binance allows users to buy and sell cryptocurrencies using credit and debit cards. This process is straightforward; you can select the cryptocurrency you wish to purchase and enter the amount in Euros.

Be mindful of the fees associated with card transactions, as they can be significant. For larger purchases, bank transfers are preferable due to their lower costs.

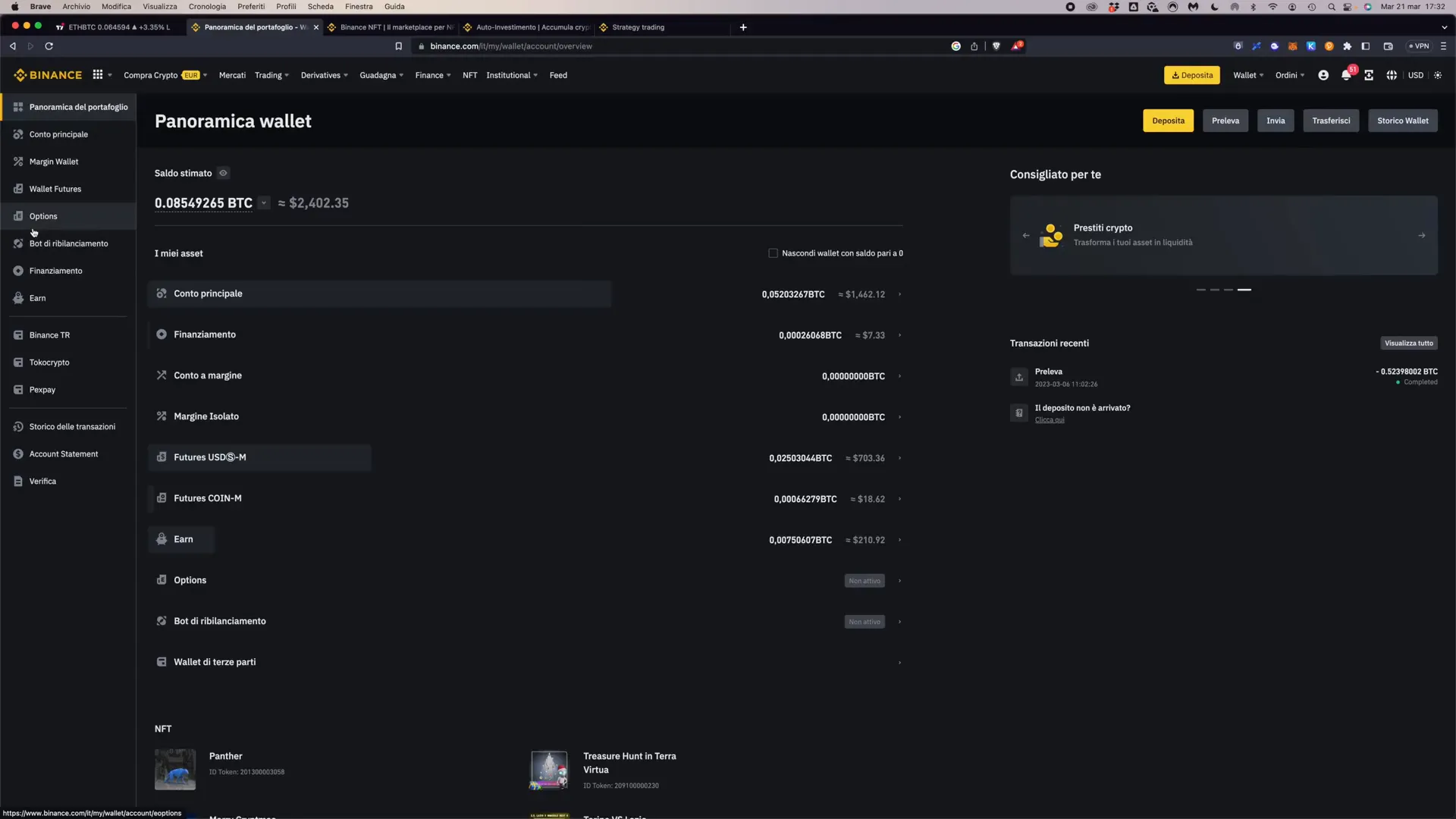

Step 5: Understanding the Binance Wallet Section

The Wallet section on Binance is where you manage your funds. It includes different wallets for various purposes, such as the Spot Wallet, Funding Wallet, and Earn Wallet.

Each wallet serves a specific function, and it’s crucial to understand how they work to effectively manage your assets.

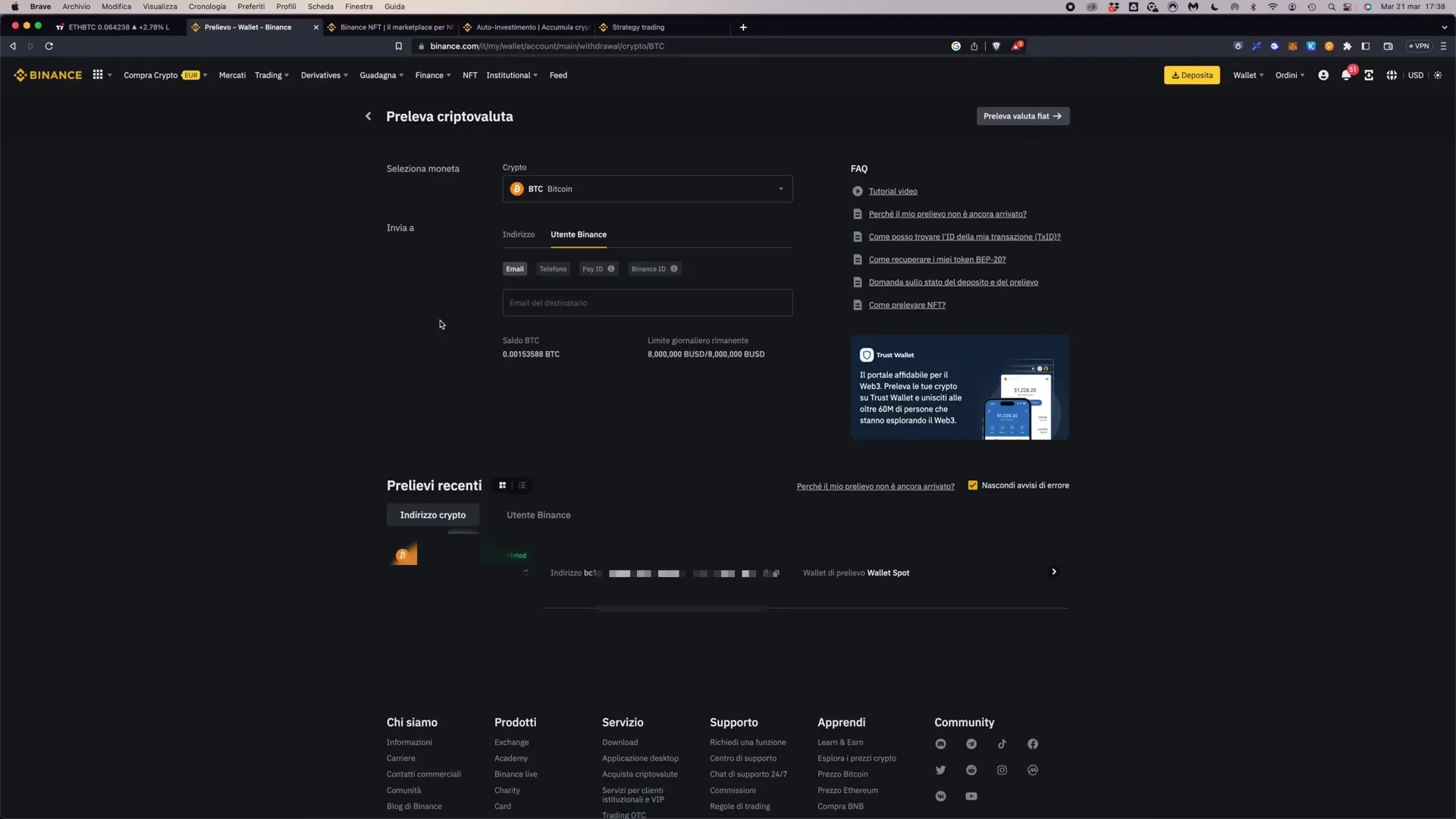

Step 6: Depositing and Withdrawing Crypto on Binance

To deposit cryptocurrencies into your Binance account, select the cryptocurrency you wish to deposit and choose the appropriate network. Be cautious when selecting the network, as sending to the wrong address can result in the loss of funds.

For withdrawals, ensure that the receiving address is added to your whitelist for enhanced security. This prevents unauthorized access to your funds.

Step 7: Trading and Buying/Selling Crypto on Binance

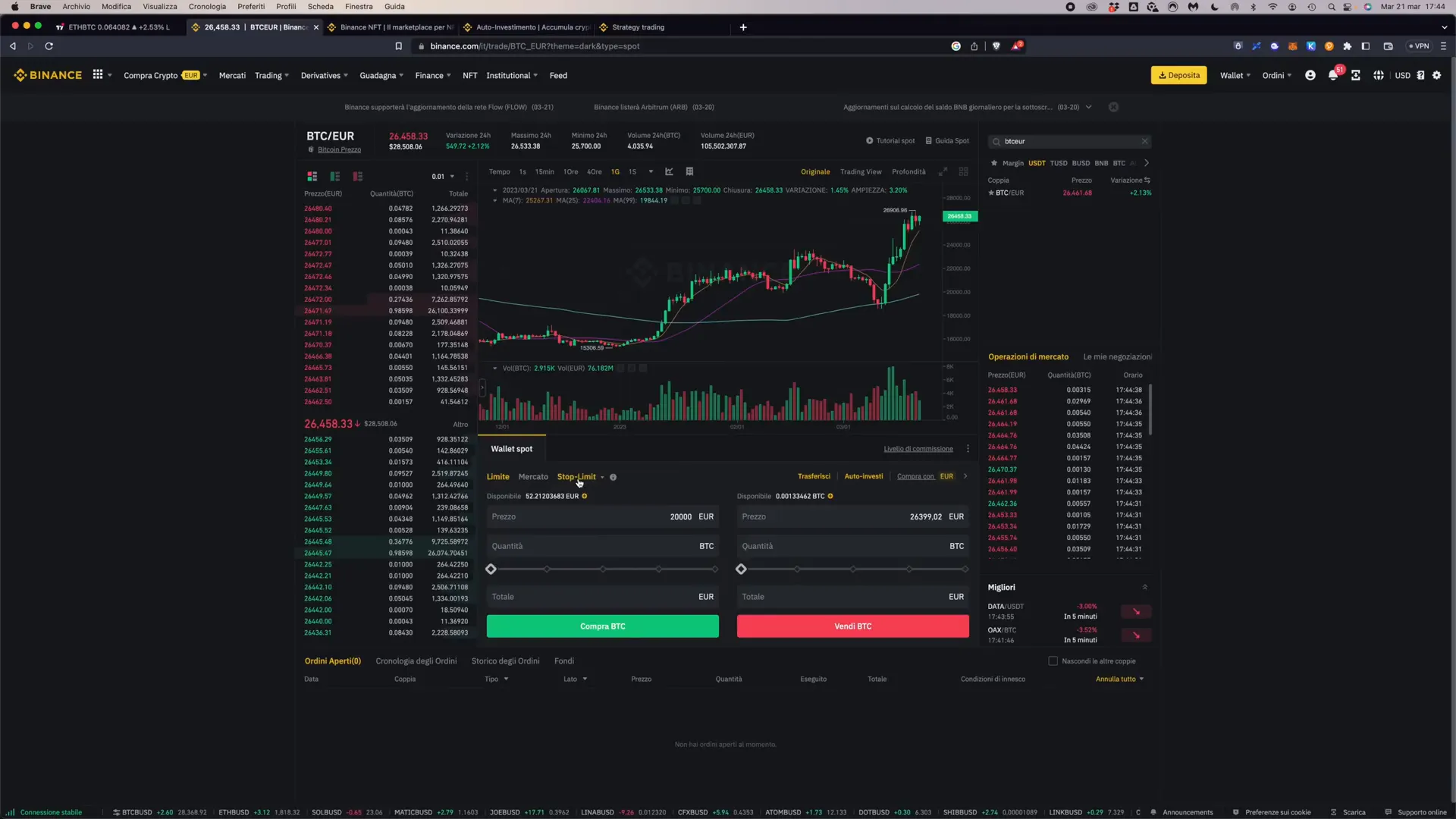

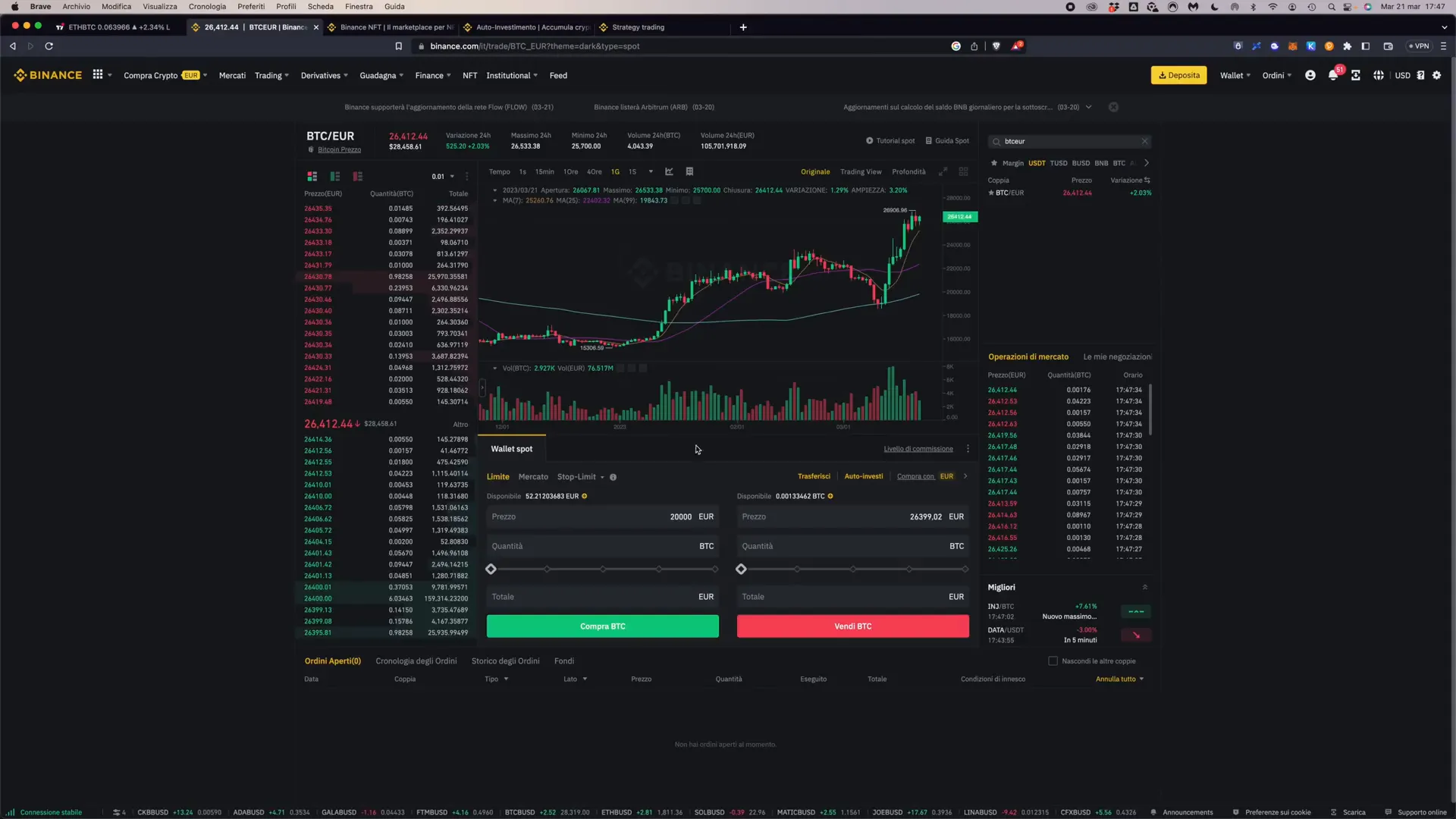

Binance offers various trading options, including spot trading, futures, and margin trading. Spot trading is the most common method, allowing users to buy and sell cryptocurrencies at current market prices.

To trade, select the cryptocurrency pair you wish to trade and choose your order type: market, limit, or stop limit. Each order type has its own advantages and is suitable for different trading strategies.

Step 8: Types of Orders Available on Binance

Understanding the types of orders available on Binance is crucial for effective trading. The main order types include:

- Market Orders: Buy or sell immediately at the current market price.

- Limit Orders: Set a specific price at which you want to buy or sell.

- Stop Limit Orders: Automatically sell if the price drops below a specified level.

Each order type serves a different purpose and can be used strategically depending on market conditions.

Step 9: How to Set a Stop Loss on Binance

A stop loss order is essential for managing risk in trading. It allows you to set a predetermined price at which your order will be executed to limit potential losses.

To set a stop loss, enter the stop price and the limit price, and specify the amount of cryptocurrency you wish to sell. This order will trigger automatically when the market reaches your stop price.

Step 10: Binance Fees and Commissions

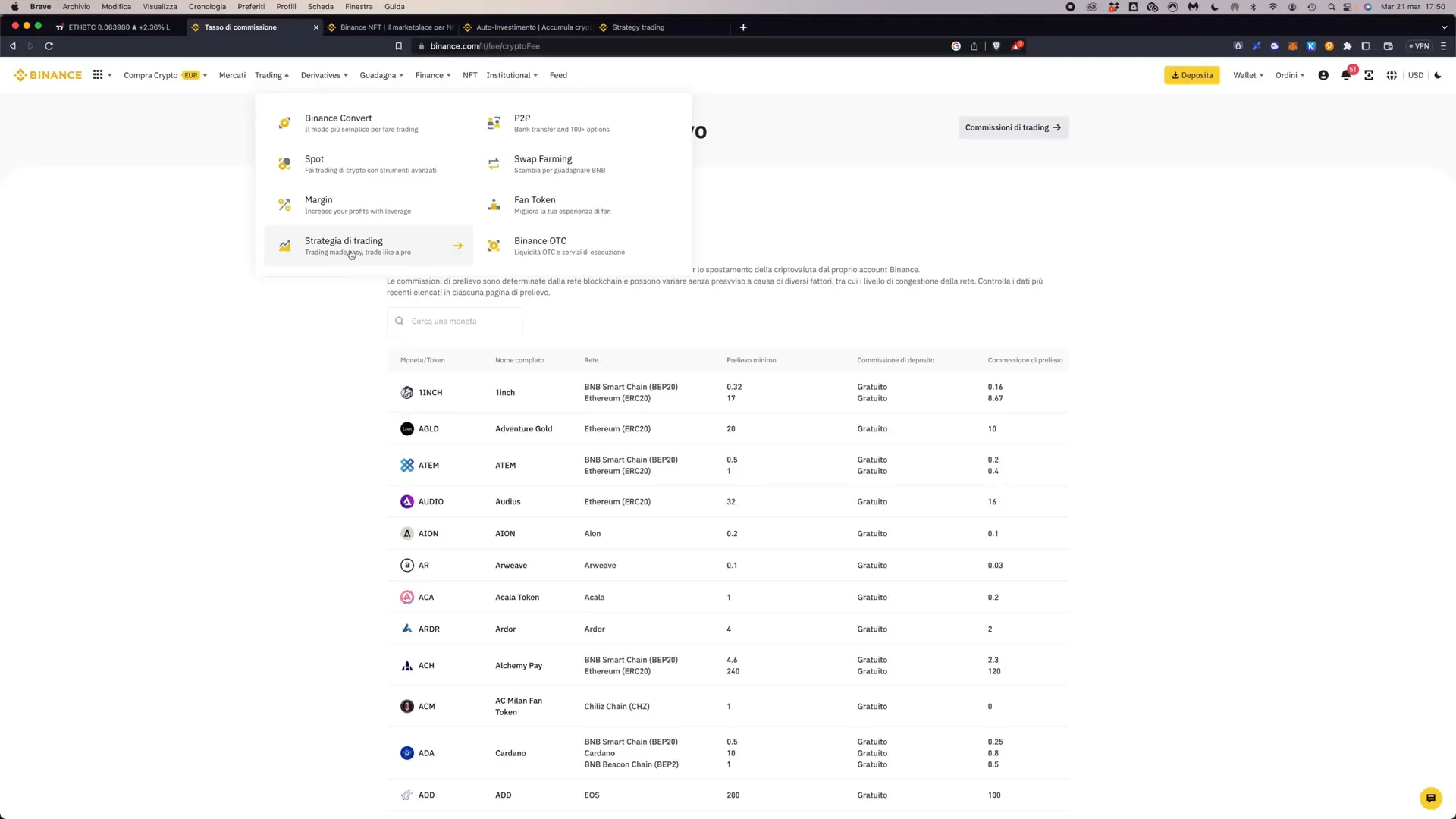

Binance charges fees for trading, which can be reduced by using BNB (Binance Coin) to pay for transactions. The standard trading fee is typically 0.1%, but users can receive discounts based on their trading volume or if they are part of the referral program.

Withdrawal fees vary depending on the cryptocurrency and network congestion. Always check the fee schedule before trading to ensure you are aware of any charges.

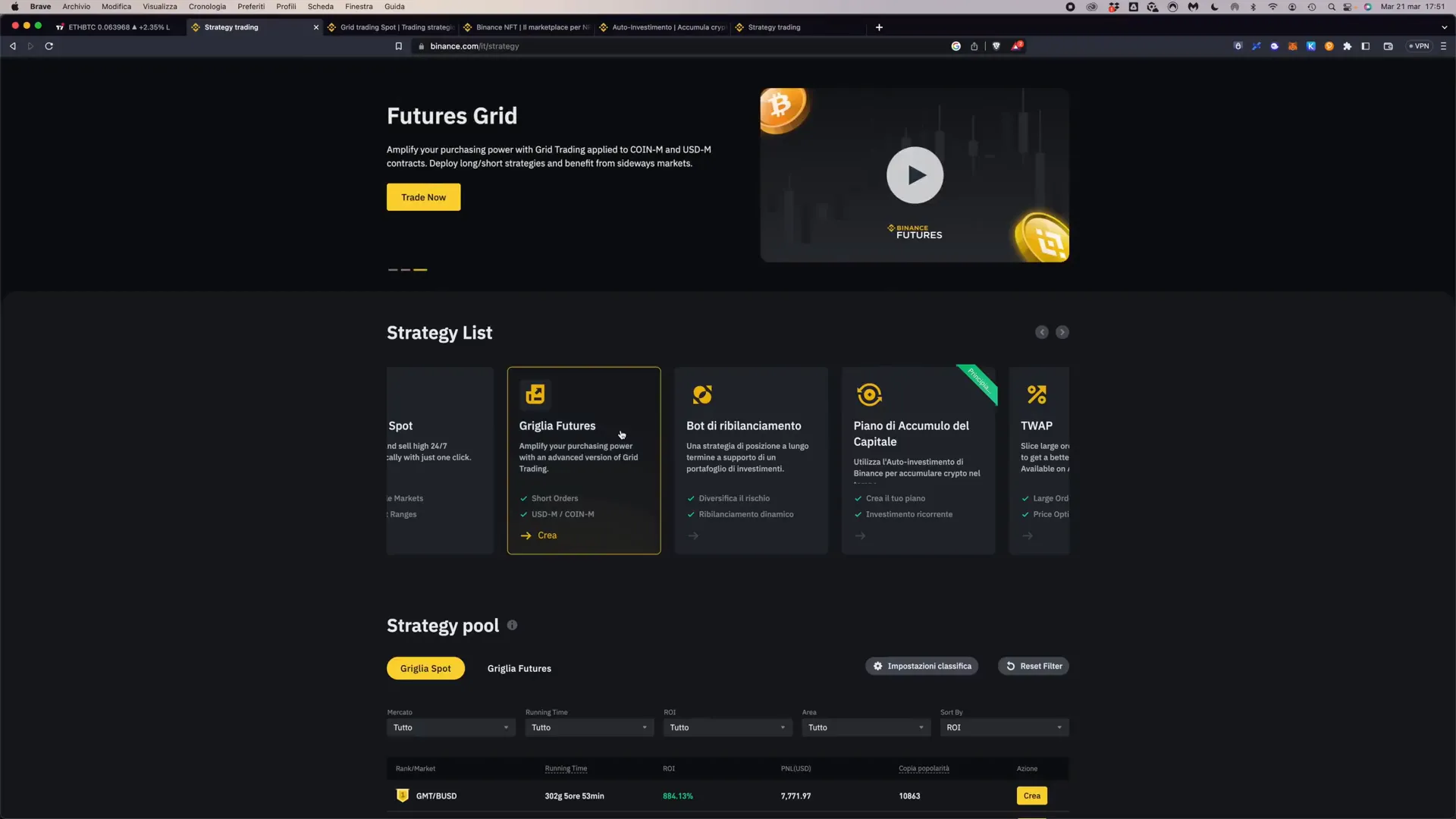

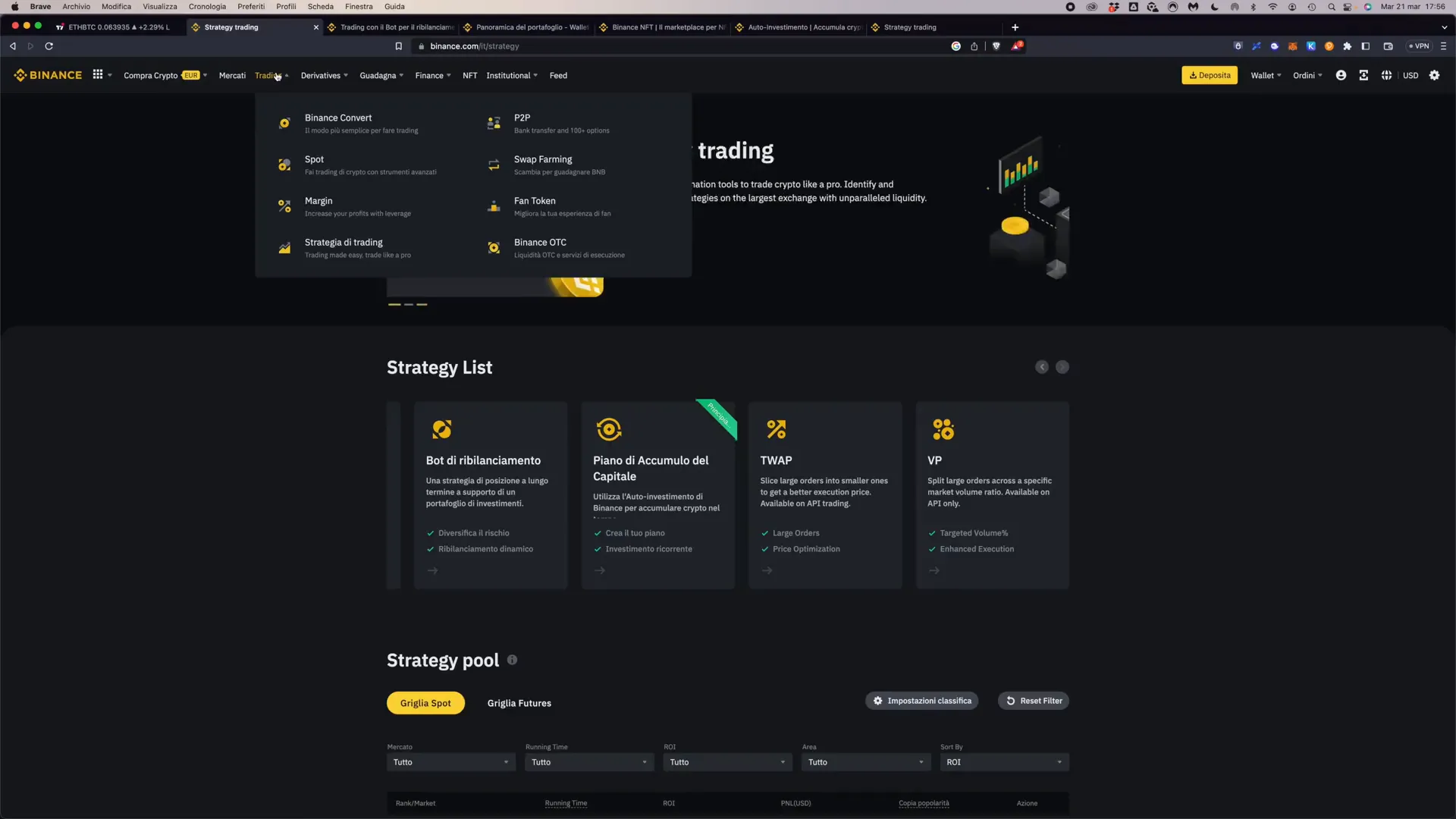

Step 11: Free Trading Bots on Binance: Grid Bot

Binance offers a free grid trading bot that allows users to automate their trading strategies. This bot can help to capitalize on market fluctuations by buying low and selling high within a specified price range.

Setting up the grid bot is straightforward; you can define your parameters and let the bot execute trades on your behalf.

Step 12: Creating a Self-Rebalancing Portfolio

Binance provides a feature for creating a self-rebalancing portfolio. This allows users to allocate their assets across different cryptocurrencies based on predetermined percentages.

The bot will automatically rebalance your portfolio to maintain your desired allocation, helping you manage risk and optimize returns.

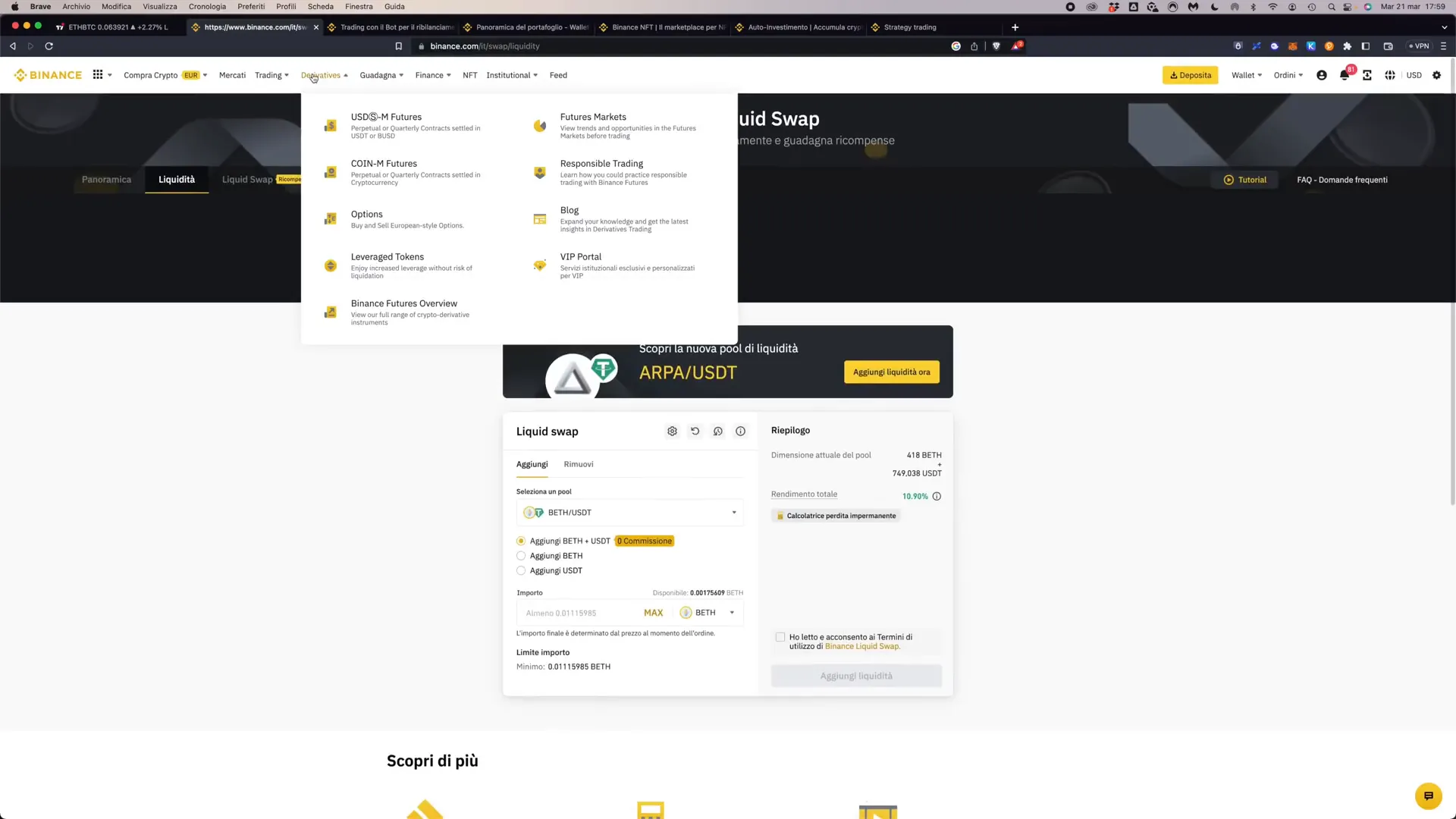

Step 13: Swap Farming or Binance Liquid Swap

Swap farming, also known as Binance Liquid Swap, allows users to provide liquidity to the exchange and earn rewards. Users can swap between different cryptocurrencies with minimal slippage and fees.

This feature is akin to decentralized exchanges and allows users to earn passive income through their crypto holdings.

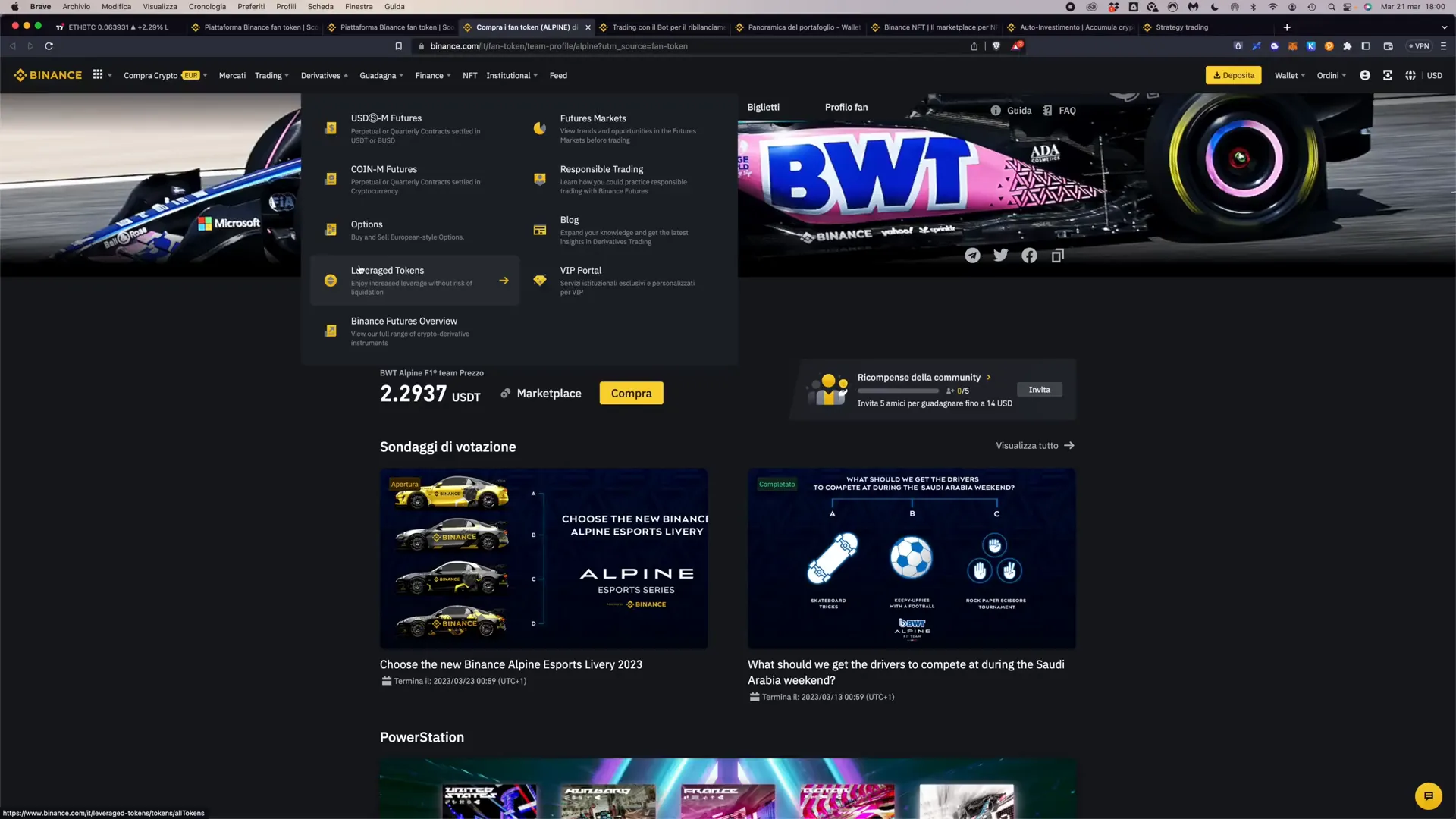

Step 14: Binance Fan Tokens

Binance Fan Tokens are cryptocurrencies that represent ownership in a sports team. These tokens allow fans to engage with their favorite teams through voting, exclusive content, and other benefits.

Fans can buy and trade these tokens on the Binance platform, creating a new way to interact with sports franchises.

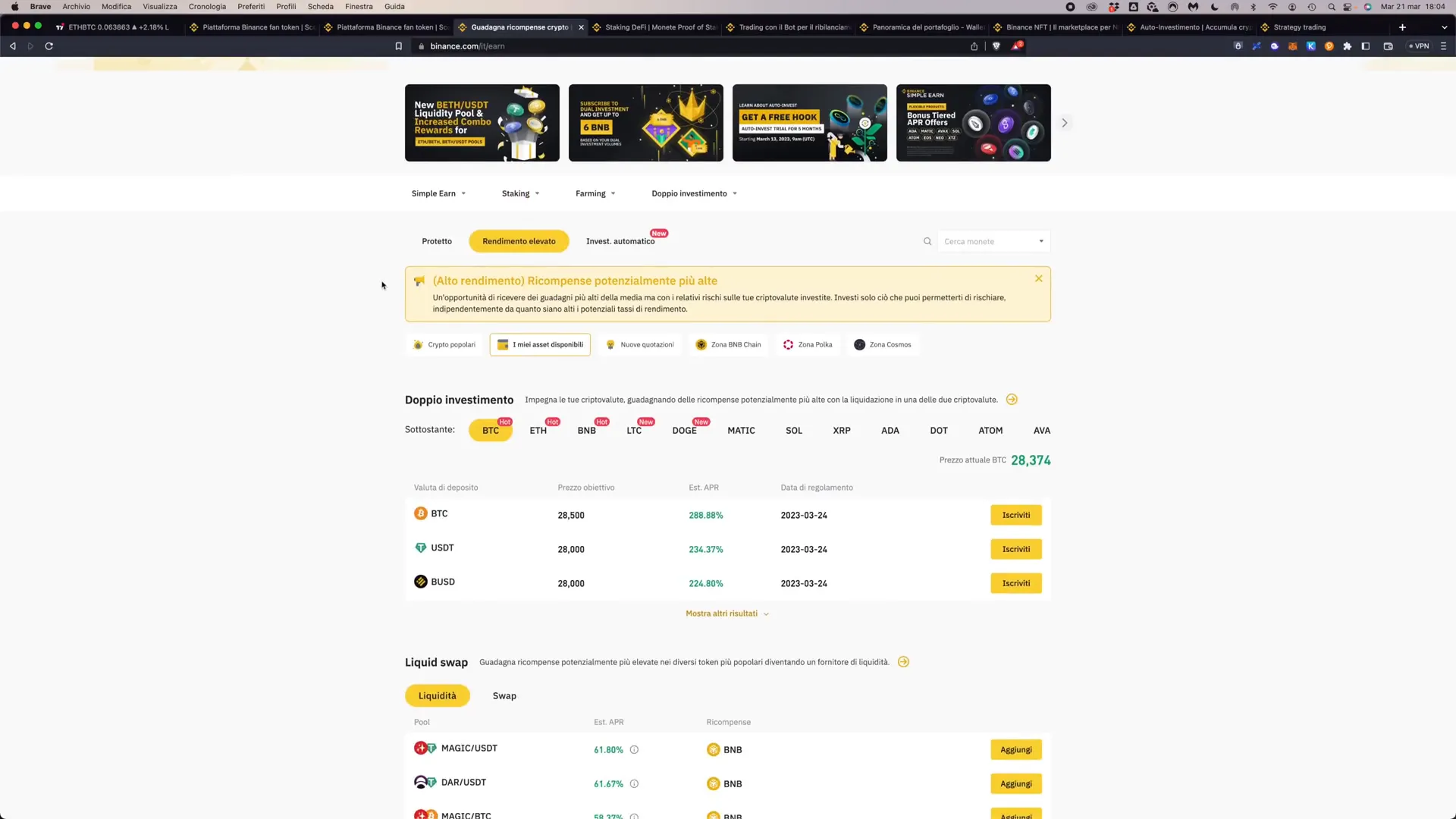

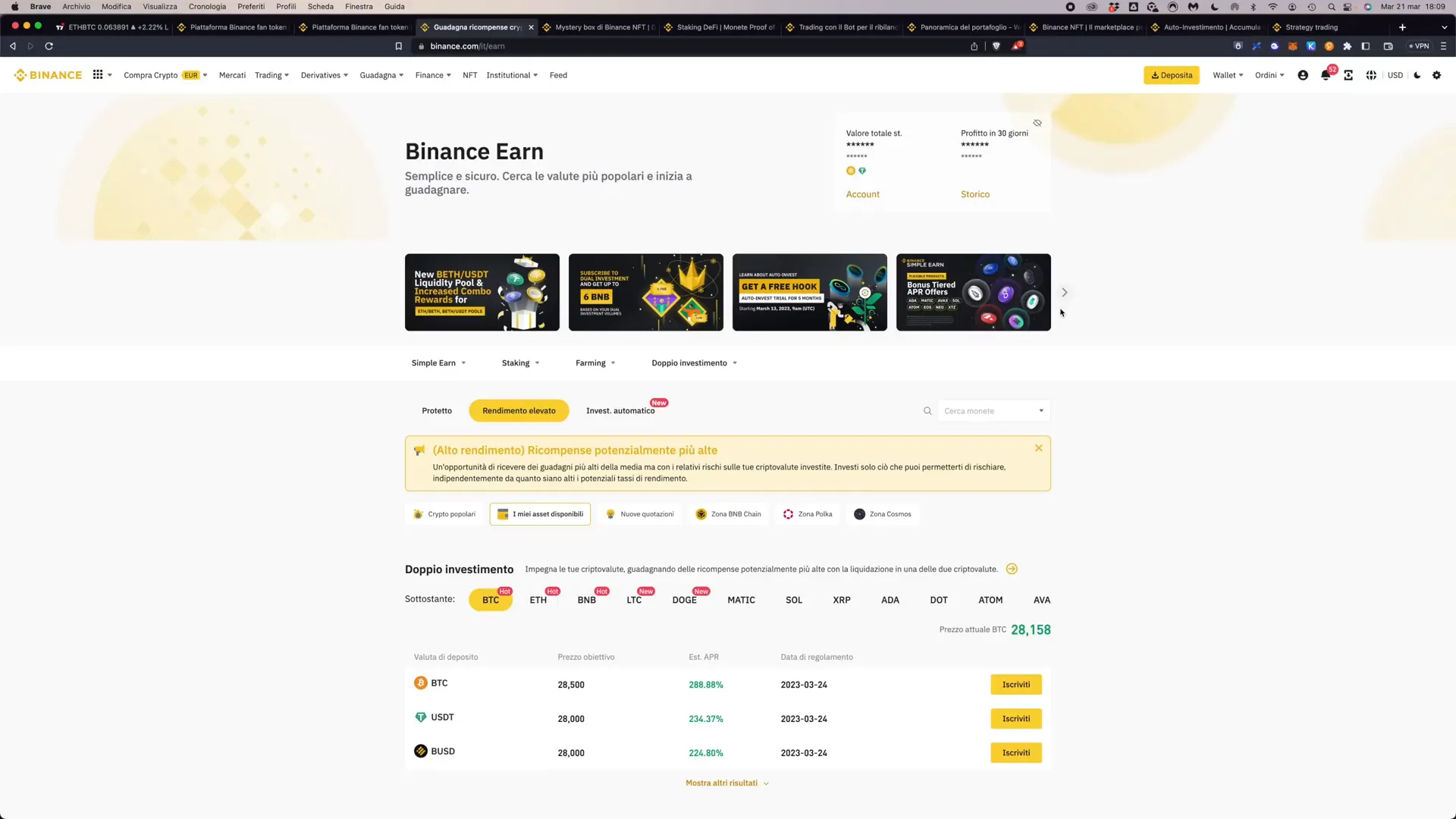

Step 15: Binance Earn and Staking: Ways to Generate Income on Binance

Binance Earn offers various products for users to earn passive income on their cryptocurrency holdings. This includes flexible and fixed-term savings products, staking options, and liquidity farming.

Each product comes with its own risks and rewards, so it’s essential to evaluate options based on your investment strategy and risk tolerance.

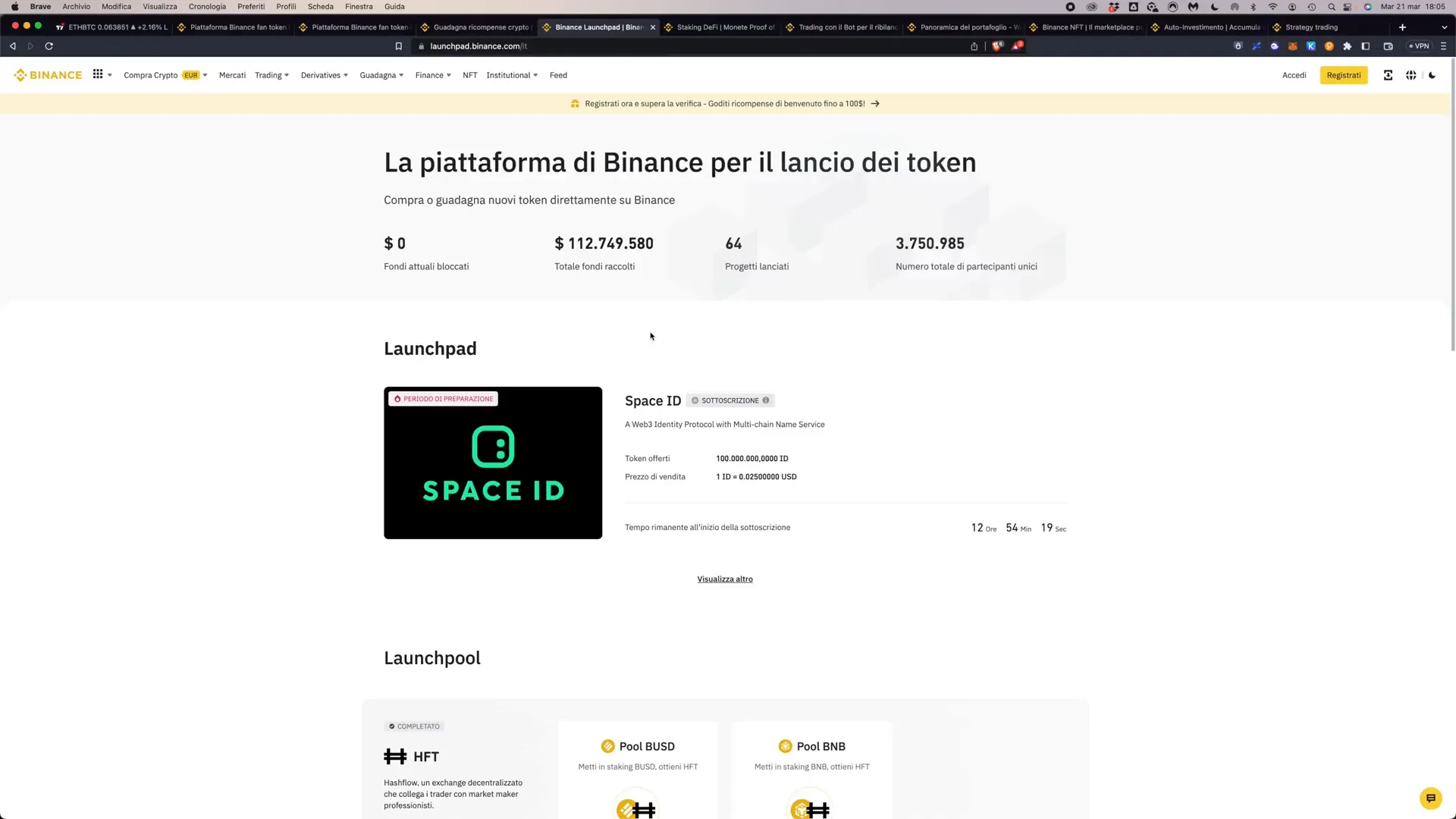

Step 16: Binance Launchpad

The Binance Launchpad is a platform for launching new cryptocurrency tokens. Users can participate in token sales and potentially benefit from early investment opportunities.

Participation usually requires holding a certain amount of BNB and meeting specific criteria set by the project. Always research projects thoroughly before investing.

Step 17: Binance NFT

Binance NFT is the platform’s marketplace for non-fungible tokens (NFTs). Users can buy, sell, and trade various NFT collections, including digital art and collectibles.

The marketplace integrates with other platforms, allowing seamless transactions and access to a wide range of NFTs.

Final Thoughts

In summary, Binance offers a comprehensive platform for trading, investing, and earning cryptocurrency. With its array of features, users can tailor their experience to meet their investment goals and risk preferences.

Always stay informed about the latest updates and changes on Binance to maximize your trading potential. Happy trading!

![Read more about the article [Hostinger] Step-by-Step Best Guide to Setting Up Your WordPress Website with Hostinger](https://store.woowhouse.com/wp-content/uploads/2024/09/image-5-1-300x169.webp)