Exploring the World of Cryptocurrency: Unveiling Binance – A Leading Exchange Platform

In the dynamic realm of digital finance, Binance has emerged as a towering figure, reshaping the landscape of cryptocurrency trading and investment. Since its inception in 2017 by the visionary Changpeng Zhao, Binance has swiftly ascended to become the world’s largest cryptocurrency exchange platform, captivating the attention of traders, investors, and enthusiasts worldwide. With its unparalleled range of services, user-friendly interface, and unwavering commitment to security and innovation, Binance has become synonymous with reliability, trust, and opportunity in the fast-paced world of digital assets. In this article, we embark on a journey to explore the transformative power of Binance, delving into its features, benefits, and the profound impact it has had on the global cryptocurrency ecosystem.

Table of Contents

Maybe you’re wondering :

Is Binance trustworthy?

- Security Measures: Binance implements robust security measures to protect user funds and data, including two-factor authentication (2FA), cold storage for the majority of funds, encryption protocols, and regular security audits. While no system is entirely immune to hacking attempts, Binance has a track record of swiftly addressing security incidents and compensating affected users.

- Regulatory Compliance: Binance has made efforts to comply with regulatory requirements in various jurisdictions where it operates. This includes obtaining licenses and approvals from regulatory authorities and implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to enhance transparency and prevent illicit activities.

- Transparency and Communication: Binance maintains transparency in its operations and communicates openly with its users. The platform regularly updates users on security measures, system upgrades, new listings, and other important developments through blog posts, announcements, and social media channels.

- Reputation and Track Record: Binance has earned a strong reputation in the cryptocurrency industry since its launch in 2017. It has grown to become the world’s largest cryptocurrency exchange platform by trading volume, indicating a high level of trust and confidence from users worldwide.

What is trading, and how does it work?

is a fundamental question that many individuals ask when they’re exploring the world of finance, particularly cryptocurrency trading platforms like Binance.

Binance, as one of the world’s largest cryptocurrency exchanges, facilitates trading by providing a platform where users can buy, sell, and trade various digital assets. Here’s how trading works on Binance:

- Registration: To start trading on Binance, users need to register for an account on the platform. The registration process typically involves providing an email address and creating a password. Additionally, depending on the jurisdiction and regulatory requirements, users may need to complete identity verification (KYC) procedures.

- Deposit Funds: After registering, users can deposit funds into their Binance account. Binance supports various deposit methods, including bank transfers, credit/debit cards, and cryptocurrency deposits. Once the funds are credited to the account, users can proceed to the trading interface.

- Asset Selection: Binance offers a wide range of cryptocurrencies for trading, including popular coins like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as numerous altcoins and tokens. Users can select the desired trading pair based on their preferences and market analysis.

- Trading Interface: Binance provides an intuitive and user-friendly trading interface that allows users to place buy and sell orders easily. The trading interface typically includes features such as real-time price charts, order books, order types (market orders, limit orders, stop-loss orders), and trading history.

- Order Placement: To execute a trade, users can specify the amount and price at which they want to buy or sell a particular cryptocurrency. Market orders are executed immediately at the current market price, while limit orders allow users to set a specific price at which they’re willing to buy or sell.

- Execution and Settlement: Once a buy or sell order is placed, Binance matches the order with corresponding orders from other users on the platform. When a match is found, the trade is executed, and the assets are transferred between the parties involved. The settlement process typically takes seconds to minutes, depending on market liquidity and network congestion.

- Monitoring and Management: After executing a trade, users can monitor their positions and portfolio performance using Binance’s portfolio management tools and real-time market data. Additionally, users can set price alerts, customize trading strategies, and access advanced trading features for more sophisticated trading strategies.

- Withdrawal: Users can withdraw their funds and assets from Binance at any time by initiating a withdrawal request. Binance supports withdrawals in various cryptocurrencies and fiat currencies, depending on the user’s preferences and available withdrawal options.

What are the different types of trading, such as stocks, forex, cryptocurrencies, and commodities?

Binance, as one of the world’s leading cryptocurrency exchanges, primarily focuses on facilitating trading in cryptocurrencies. However, it’s essential to understand the broader spectrum of trading types to grasp the context in which Binance operates. Here are the different types of trading, including cryptocurrencies, and how they relate to Binance:

- Stocks Trading: Stocks trading involves buying and selling shares of publicly-listed companies on traditional stock exchanges such as the New York Stock Exchange (NYSE) or NASDAQ. Investors trade stocks with the aim of profiting from price fluctuations, dividends, and capital appreciation. Binance does not facilitate stocks trading; it is primarily focused on cryptocurrencies.

- Forex (Foreign Exchange) Trading: Forex trading involves the buying and selling of currencies in the foreign exchange market. Traders speculate on the price movements of currency pairs, such as EUR/USD or GBP/JPY, with the goal of profiting from changes in exchange rates. Binance does not offer forex trading; its platform is dedicated to cryptocurrency trading.

- Cryptocurrency Trading: Cryptocurrency trading involves buying, selling, and exchanging digital assets such as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) on cryptocurrency exchanges. Traders speculate on the price movements of cryptocurrencies, aiming to profit from short-term price fluctuations or long-term investment strategies. Binance is a prominent cryptocurrency exchange platform that facilitates a wide range of cryptocurrency trading pairs, including BTC/USDT, ETH/BTC, and BNB/ETH.

- Commodities Trading: Commodities trading involves buying and selling physical goods such as gold, silver, crude oil, and agricultural products. Traders speculate on the future price movements of commodities, with the goal of profiting from changes in supply and demand dynamics. While Binance primarily focuses on cryptocurrencies, it does not offer trading in traditional commodities.

Binance‘s primary function is to provide a platform for buying, selling, and trading cryptocurrencies. It offers a wide range of features and tools to facilitate cryptocurrency trading, including spot trading, futures trading, margin trading, and staking. Users can trade various cryptocurrencies against fiat currencies (such as USD, EUR, and GBP) or other cryptocurrencies.

How much money do I need to start trading?

The amount of money needed to start trading on Binance or any other platform varies depending on several factors, including the individual’s financial situation, trading goals, risk tolerance, and trading strategy. Here’s a breakdown of the considerations when starting trading on Binance:

- Minimum Deposit: Binance does not impose a minimum deposit requirement, meaning users can start trading with any amount of funds they are comfortable with. This flexibility allows users to begin trading with as little as a few dollars worth of cryptocurrency or fiat currency.

- Trading Fees: While Binance does not charge fees for depositing funds into your account, trading fees apply when executing buy or sell orders on the platform. Binance’s trading fees typically range from 0.1% to 0.5% per trade, depending on factors such as trading volume and membership level (VIP status). Traders should consider these fees when determining the amount of funds needed to start trading and factor them into their trading strategy.

- Risk Management: It’s crucial for traders to practice proper risk management and only invest what they can afford to lose. Starting with a smaller amount of capital allows traders to gain experience and develop their skills without risking significant losses. As traders gain confidence and proficiency, they can gradually increase their trading capital over time.

- Diversification: Diversifying your investment portfolio across different assets and trading strategies can help mitigate risk and maximize potential returns. Instead of investing all your funds in a single trade or asset, consider diversifying across multiple cryptocurrencies, trading pairs, or investment strategies to spread risk and enhance opportunities for profit.

- Education and Research: Investing time and effort in learning about trading, cryptocurrency markets, and fundamental analysis can significantly improve your chances of success as a trader. Take advantage of educational resources such as tutorials, articles, webinars, and demo accounts to gain knowledge and refine your trading skills before committing significant capital.

You can start with 0$:

Register from here to get free 100$ : Click Here

What are the risks associated with trading, and how can I manage them?

Trading, including cryptocurrency trading on platforms like Binance, carries various risks that traders should be aware of. Here are some of the risks associated with trading on Binance and strategies for managing them:

- Volatility Risk: Cryptocurrency markets are known for their high volatility, with prices often experiencing significant fluctuations over short periods. This volatility can lead to rapid price movements, both up and down, resulting in potential gains or losses for traders. To manage volatility risk, traders should conduct thorough research, use risk management tools such as stop-loss orders, and avoid overleveraging their positions.

- Market Risk: Market risk refers to the risk of losses due to adverse market conditions, such as sudden price crashes or market manipulation. Cryptocurrency markets are influenced by various factors, including market sentiment, regulatory developments, and macroeconomic trends, which can impact prices unpredictably. Traders can manage market risk by diversifying their portfolios, staying informed about market news and trends, and avoiding emotional trading decisions based on short-term market fluctuations.

- Liquidity Risk: Liquidity risk arises when there is insufficient trading volume in a particular cryptocurrency or trading pair, making it challenging to buy or sell assets at desired prices. Low liquidity can result in slippage, where the executed trade deviates from the expected price, leading to potential losses for traders. To mitigate liquidity risk, traders should focus on trading assets with adequate liquidity, monitor order books for bid-ask spreads, and avoid trading illiquid or low-volume assets.

- Security Risk: Security risk refers to the risk of unauthorized access, theft, or loss of funds due to security breaches or vulnerabilities in trading platforms like Binance. While Binance employs robust security measures to protect user funds and data, such as two-factor authentication (2FA) and cold storage for the majority of funds, users should also take precautions to secure their accounts, such as using strong passwords, enabling 2FA, and avoiding phishing scams.

- Regulatory Risk: Regulatory risk pertains to changes in regulatory policies and legal frameworks governing cryptocurrency trading, which can impact market liquidity, trading volumes, and investor confidence. Traders should stay informed about regulatory developments in their jurisdictions and consider the potential implications for their trading activities. Adhering to regulatory compliance measures, such as completing identity verification (KYC) procedures on Binance, can also help mitigate regulatory risk.

- Counterparty Risk: Counterparty risk refers to the risk of default or non-performance by counterparties involved in trading transactions, such as exchanges, brokers, or trading partners. While Binance is a reputable and well-established cryptocurrency exchange, traders should be cautious when dealing with unknown or unverified counterparties, conduct due diligence before engaging in transactions, and only trade on trusted platforms with a proven track record of reliability and security.

What are the potential rewards and benefits of trading?

Trading, including cryptocurrency trading on platforms like Binance, offers several potential rewards and benefits for traders. Here are some of the key advantages of trading on Binance:

- Profit Potential: One of the primary motivations for trading is the potential to generate profits. By buying low and selling high, traders can capitalize on price movements in the cryptocurrency markets and potentially earn significant returns on their investments. Binance provides a platform for traders to access a wide range of cryptocurrencies and trading pairs, allowing them to explore various trading strategies and profit opportunities.

- Diversification: Trading on Binance enables traders to diversify their investment portfolios beyond traditional asset classes such as stocks and bonds. With hundreds of cryptocurrencies available for trading, Binance offers traders the opportunity to diversify across different digital assets, sectors, and markets, reducing overall portfolio risk and enhancing potential returns.

- Accessibility: Binance offers a user-friendly and intuitive trading platform that is accessible to traders of all experience levels. Whether you’re a beginner or an experienced trader, Binance provides a seamless and intuitive interface, advanced charting tools, and a wide range of trading features to facilitate trading activities effectively. Additionally, Binance offers mobile trading apps for iOS and Android devices, allowing traders to trade on the go from anywhere at any time.

- Liquidity: Binance is one of the largest and most liquid cryptocurrency exchanges globally, providing traders with access to deep liquidity and competitive pricing. High liquidity ensures that traders can buy and sell cryptocurrencies quickly and efficiently without experiencing significant price slippage. This liquidity also allows traders to execute large orders with minimal impact on market prices, enhancing overall trading efficiency and execution quality.

- Flexibility: Binance offers a variety of trading options and features to cater to diverse trading preferences and strategies. Whether you prefer spot trading, futures trading, margin trading, or staking, Binance provides a comprehensive suite of trading services to meet your needs. Additionally, Binance offers a range of order types, leverage options, and trading pairs, allowing traders to customize their trading experience and optimize their trading strategies accordingly.

- Innovation: Binance is known for its commitment to innovation and continuous development of new products and services to meet the evolving needs of traders and investors. From the launch of Binance Coin (BNB) and the Binance Launchpad for token sales to the development of decentralized finance (DeFi) solutions and the Binance Smart Chain, Binance continues to lead the way in driving innovation and adoption within the cryptocurrency ecosystem, offering traders access to cutting-edge technologies and opportunities for growth.

How do I choose a trading platform or brokerage?

Choosing the right trading platform or brokerage is crucial for your success as a trader, and Binance offers several key factors to consider when making this decision:

- Reputation and Trustworthiness: When selecting a trading platform, it’s essential to choose one with a strong reputation and a track record of reliability and trustworthiness. Binance is one of the largest and most reputable cryptocurrency exchanges globally, trusted by millions of users worldwide. Its commitment to security, transparency, and regulatory compliance has earned it a reputation as a trusted and reliable platform for cryptocurrency trading.

- Range of Assets: Consider the range of assets available for trading on the platform. Binance offers a wide selection of cryptocurrencies, including major coins like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as numerous altcoins and tokens. With hundreds of trading pairs available, Binance provides traders with ample opportunities to diversify their portfolios and explore new investment opportunities.

- Trading Fees: Pay attention to the trading fees charged by the platform, as these can impact your overall trading profitability. Binance offers competitive trading fees that vary depending on factors such as trading volume and membership level (VIP status). Additionally, Binance frequently offers promotions and discounts on trading fees, further enhancing its cost-effectiveness for traders.

- User Interface and Experience: Evaluate the platform’s user interface and experience to ensure it meets your needs and preferences. Binance provides an intuitive and user-friendly trading interface that is accessible to traders of all experience levels. Its platform features advanced charting tools, real-time market data, and a wide range of trading features to facilitate effective trading activities.

- Security Measures: Security is paramount when choosing a trading platform, as you’ll be entrusting your funds and personal information to the platform. Binance employs robust security measures to protect user funds and data, including two-factor authentication (2FA), cold storage for the majority of funds, encryption protocols, and regular security audits. Additionally, Binance has a dedicated security team tasked with monitoring for potential threats and vulnerabilities.

- Customer Support: Consider the level of customer support provided by the platform and how responsive and helpful the support team is in addressing your inquiries and resolving any issues that may arise. Binance offers multilingual customer support available 24/7 via email, live chat, and social media channels, ensuring prompt assistance for users worldwide.

What factors should I consider when selecting assets to trade?

When selecting assets to trade on a platform like Binance, it’s essential to consider several factors to make informed decisions and maximize your trading success. Here are some key factors to consider when choosing assets to trade on Binance:

- Market Capitalization: Market capitalization refers to the total value of a cryptocurrency, calculated by multiplying its current price by the total number of coins in circulation. Assets with higher market capitalization, such as Bitcoin (BTC) and Ethereum (ETH), are generally more liquid and less volatile, making them suitable for traders seeking stability and liquidity.

- Trading Volume: Trading volume represents the total number of assets traded within a specific period, typically 24 hours. High trading volume indicates strong market liquidity and active trading activity, providing traders with ample opportunities to enter and exit positions quickly and efficiently. Assets with high trading volume on Binance are generally preferred by traders due to their liquidity and price stability.

- Price Volatility: Volatility refers to the degree of price fluctuations observed in an asset over time. While high volatility presents opportunities for profit, it also entails higher risk and uncertainty. Traders should consider the volatility of assets when selecting trading opportunities, balancing the potential for profit with the associated risks.

- Fundamental Analysis: Fundamental analysis involves evaluating the underlying factors that influence the value and performance of an asset, such as its technology, development team, use case, adoption, and market demand. Conducting fundamental analysis can help traders identify undervalued assets with strong fundamentals and growth potential.

- Technical Analysis: Technical analysis involves analyzing historical price data and chart patterns to identify trends, support and resistance levels, and potential trading opportunities. Traders use technical indicators and charting tools to make informed decisions based on price action and market trends. Technical analysis can help traders identify entry and exit points and optimize their trading strategies.

- News and Market Sentiment: News and market sentiment play a significant role in influencing asset prices and market dynamics. Traders should stay informed about relevant news and developments in the cryptocurrency space, including regulatory announcements, technological advancements, partnerships, and industry trends. Monitoring market sentiment can help traders anticipate market movements and adjust their trading strategies accordingly.

- Risk Management: Risk management is essential when selecting assets to trade, as it helps mitigate potential losses and protect trading capital. Traders should diversify their portfolios across different assets, use stop-loss orders to limit losses, and avoid overleveraging their positions. Additionally, traders should only invest what they can afford to lose and maintain discipline and patience in their trading approach.

What strategies can I use to maximize my chances of success in trading?

Maximizing your chances of success in trading on platforms like Binance requires a combination of knowledge, skills, and effective strategies. Here are some strategies you can use to improve your trading performance and increase your chances of success on Binance:

- Educate Yourself: Continuously educate yourself about trading concepts, strategies, and market dynamics. Take advantage of educational resources such as tutorials, articles, webinars, and demo accounts to gain knowledge and refine your trading skills. Understanding fundamental and technical analysis, risk management principles, and market psychology is essential for making informed trading decisions.

- Develop a Trading Plan: Develop a well-defined trading plan that outlines your trading goals, risk tolerance, entry and exit criteria, and position sizing strategy. Your trading plan should be based on thorough research and analysis, incorporating both fundamental and technical factors. Stick to your trading plan consistently and avoid making impulsive decisions based on emotions or market noise.

- Practice Risk Management: Implement effective risk management strategies to protect your trading capital and minimize potential losses. Use stop-loss orders to limit your downside risk on each trade and avoid risking more than a predetermined percentage of your capital on any single trade. Diversify your portfolio across different assets and trading strategies to spread risk and enhance your chances of success.

- Start Small and Scale Up: Start with a small amount of capital and gradually scale up your trading activity as you gain experience and confidence. Avoid investing more than you can afford to lose and focus on preserving your trading capital while building consistent profits over time. Treat trading as a marathon, not a sprint, and prioritize long-term sustainability and growth.

- Stay Informed: Stay informed about market news, trends, and developments in the cryptocurrency space. Monitor Binance’s announcements, social media channels, and market analysis to stay updated on relevant information that may impact asset prices and market dynamics. Being aware of market sentiment and emerging trends can help you anticipate price movements and adjust your trading strategies accordingly.

- Adapt and Evolve: Be adaptable and open to adjusting your trading strategies based on changing market conditions and feedback from your trading performance. Continuously evaluate your trading results, identify areas for improvement, and refine your strategies accordingly. Embrace a growth mindset and view trading as a learning process that requires continuous improvement and adaptation.

- Utilize Trading Tools: Take advantage of the trading tools and features offered by Binance to enhance your trading experience and efficiency. Utilize advanced charting tools, technical indicators, and trading signals to analyze market trends and identify potential trading opportunities. Additionally, consider using features such as stop-loss orders, take-profit orders, and trailing stops to automate and optimize your trading strategies.

How do I perform technical analysis and fundamental analysis?

Performing technical analysis and fundamental analysis are essential skills for traders looking to make informed decisions in the cryptocurrency markets, including on platforms like Binance. Here’s how you can perform both types of analysis:

- Technical Analysis:

- Technical analysis involves analyzing historical price data and chart patterns to predict future price movements. Traders use various technical indicators and charting tools to identify trends, support and resistance levels, and potential trading opportunities.

- On Binance, you can access advanced charting tools and technical indicators to perform technical analysis. Binance’s trading platform offers features such as candlestick charts, line charts, and bar charts, as well as a wide range of technical indicators such as moving averages, MACD, RSI, and Bollinger Bands.

- To perform technical analysis on Binance, follow these steps: a. Select the cryptocurrency or trading pair you want to analyze. b. Choose your preferred chart type and time frame (e.g., 1-hour, 4-hour, daily). c. Apply technical indicators and charting tools to the chart to identify patterns and trends. d. Analyze price movements, support and resistance levels, and other relevant factors to identify potential entry and exit points for trades.

- Fundamental Analysis:

- Fundamental analysis involves evaluating the underlying factors that influence the value and performance of an asset, such as its technology, development team, use case, adoption, and market demand. Traders use fundamental analysis to assess the intrinsic value of an asset and identify potential investment opportunities.

- On Binance, you can perform fundamental analysis by researching information about the cryptocurrencies listed on the platform. This may include reading whitepapers, researching the development team and project founders, analyzing market trends and adoption metrics, and staying informed about news and developments in the cryptocurrency space.

- To perform fundamental analysis on Binance, follow these steps: a. Research the fundamentals of the cryptocurrency or project you’re interested in. b. Evaluate factors such as the technology behind the project, its use case and utility, the strength of its development team and community, and its market adoption and growth potential. c. Consider external factors such as regulatory developments, partnerships, and industry trends that may impact the project’s value and future prospects. d. Use this information to make informed decisions about whether to invest in or trade the cryptocurrency on Binance.

What are the tax implications of trading, and how do I report my earnings?

The tax implications of trading, including trading on platforms like Binance, can vary depending on your jurisdiction and the specific tax laws that apply to you. It’s essential to understand your tax obligations and report your earnings accurately to comply with tax regulations. Here are some general considerations regarding the tax implications of trading and how you can report your earnings on Binance:

- Capital Gains Tax: In many jurisdictions, including the United States, profits from trading cryptocurrencies are subject to capital gains tax. Capital gains tax is applied to the difference between the purchase price and the selling price of an asset when it is sold for a profit. Short-term capital gains, on assets held for less than one year, are typically taxed at a higher rate than long-term capital gains, on assets held for more than one year.

- Tax Reporting Requirements: Traders are generally required to report their capital gains and losses from trading activities on their tax returns. This may involve filing specific tax forms, such as Schedule D in the United States, to report capital gains and losses from investment activities. It’s essential to keep accurate records of all your trades, including the date of purchase, sale price, and any associated fees or expenses.

- FIFO or Specific Identification Method: When calculating your capital gains and losses from trading on Binance, you may use either the FIFO (First-In, First-Out) method or the Specific Identification method. FIFO involves selling the oldest assets in your portfolio first, while the Specific Identification method allows you to choose which assets to sell based on their individual purchase prices.

- Tax Events: Various trading activities on Binance can trigger taxable events, including buying, selling, exchanging, and converting cryptocurrencies. Each taxable event may result in capital gains or losses that need to be reported on your tax return. It’s essential to understand the tax implications of each trading activity and keep accurate records of all transactions.

- Tax Deductions and Credits: Traders may be eligible for certain tax deductions and credits related to their trading activities, such as deductions for trading-related expenses or credits for foreign taxes paid on international trades. Consult with a tax professional or accountant familiar with cryptocurrency taxation to identify any potential deductions or credits you may be eligible for.

- Compliance and Reporting: Ensure that you comply with all tax regulations and reporting requirements applicable to your jurisdiction. Failure to report your trading earnings accurately or pay the appropriate taxes can result in penalties, fines, or legal consequences. Consult with a tax professional or accountant to ensure that you understand your tax obligations and report your earnings correctly.

How can I stay updated on market news and trends?

Staying updated on market news and trends is crucial for traders looking to make informed decisions and stay ahead of developments in the dynamic world of cryptocurrency trading. Binance provides several resources and tools to help traders stay informed about market news and trends:

- Binance Academy: Binance Academy is an educational platform that offers a wide range of articles, tutorials, videos, and courses covering various topics related to cryptocurrency trading, blockchain technology, and finance. Traders can access Binance Academy for free to learn about fundamental concepts, trading strategies, market analysis, and industry trends.

- Binance Blog: The Binance Blog features regular updates, announcements, and insights from the Binance team and industry experts. Traders can stay informed about new listings, product updates, regulatory developments, and other important news and events impacting the cryptocurrency markets. The blog also provides analysis and commentary on market trends and emerging opportunities.

- Binance Research: Binance Research is a dedicated research and analysis team that provides in-depth reports and analysis on cryptocurrencies, blockchain projects, and market trends. Traders can access research reports, market insights, and data analysis to gain a deeper understanding of specific assets and market dynamics. Binance Research also publishes regular articles and updates on market trends and developments.

- Binance News: Binance News is a news aggregator platform that curates the latest headlines and articles from leading cryptocurrency news sources and media outlets. Traders can access real-time news updates, market analysis, and commentary from a variety of sources to stay informed about market trends, regulatory developments, and industry events.

- Social Media Channels: Binance maintains active social media channels on platforms such as Twitter, Facebook, LinkedIn, and Telegram, where traders can follow official Binance accounts for updates, announcements, and insights. Binance’s social media channels provide real-time updates on market news, product launches, events, and promotions, allowing traders to stay connected and engaged with the Binance community.

- TradingView Integration: Binance has integrated with TradingView, a popular charting platform used by traders worldwide. Traders can access advanced charting tools, technical indicators, and real-time market data directly on the Binance trading interface, enabling them to analyze market trends, conduct technical analysis, and make informed trading decisions.

What resources are available for learning about trading, such as books, courses, and online communities?

Binance offers a variety of resources for learning about trading, catering to traders of all experience levels and preferences. Here are some of the key resources available on Binance for learning about trading:

- Binance Academy: Binance Academy is an educational platform that provides a wealth of educational content, including articles, tutorials, videos, and courses covering various topics related to cryptocurrency trading, blockchain technology, and finance. Traders can access Binance Academy for free to learn about fundamental concepts, trading strategies, market analysis, and industry trends. The platform offers content suitable for beginners, intermediate traders, and advanced professionals, making it a valuable resource for traders looking to expand their knowledge and skills.

- Binance Blog: The Binance Blog features regular updates, announcements, and insights from the Binance team and industry experts. Traders can stay informed about new listings, product updates, regulatory developments, and other important news and events impacting the cryptocurrency markets. The blog also provides analysis and commentary on market trends, trading strategies, and emerging opportunities, making it a valuable resource for traders seeking timely and relevant information.

- Binance Research: Binance Research is a dedicated research and analysis team that provides in-depth reports and analysis on cryptocurrencies, blockchain projects, and market trends. Traders can access research reports, market insights, and data analysis to gain a deeper understanding of specific assets and market dynamics. Binance Research covers a wide range of topics, including fundamental analysis, technical analysis, market trends, and investment strategies, making it a valuable resource for traders seeking comprehensive and reliable research.

- Binance Academy Courses: Binance Academy offers a series of interactive courses designed to help traders learn about various aspects of cryptocurrency trading and blockchain technology. These courses cover topics such as cryptocurrency basics, trading strategies, technical analysis, fundamental analysis, risk management, and security best practices. Traders can enroll in courses at their own pace and track their progress as they learn new skills and concepts.

- Binance Community: Binance has a vibrant and active community of traders, investors, developers, and enthusiasts from around the world. Traders can participate in online communities such as the Binance official Telegram groups, Reddit forums, and social media channels to connect with like-minded individuals, share knowledge and insights, ask questions, and discuss market trends and trading strategies. Engaging with the Binance community can provide valuable networking opportunities, support, and camaraderie for traders seeking to learn and grow together.

How do I create and stick to a trading plan?

Creating and sticking to a trading plan is essential for traders looking to achieve consistency and long-term success in their trading endeavors, including on platforms like Binance. Here’s a step-by-step guide on how to create and adhere to a trading plan:

- Set Clear Goals: Start by defining your trading goals and objectives. Determine what you aim to achieve through trading, whether it’s generating consistent profits, building wealth over time, or achieving financial independence. Establish specific, measurable, and realistic goals that align with your risk tolerance and investment timeframe.

- Define Your Strategy: Develop a clear and concise trading strategy that outlines your approach to trading. Determine the types of assets you’ll trade, the timeframes you’ll focus on (e.g., day trading, swing trading, long-term investing), and the indicators or signals you’ll use to identify trading opportunities. Consider factors such as market conditions, volatility, and risk management principles when defining your strategy.

- Establish Entry and Exit Criteria: Define clear entry and exit criteria for your trades based on your trading strategy and risk-reward preferences. Determine the conditions under which you’ll enter a trade, such as specific price levels, technical indicators, or fundamental catalysts. Similarly, establish criteria for exiting trades, including profit targets, stop-loss levels, and trailing stops, to manage risk and protect your capital.

- Develop Risk Management Rules: Implement effective risk management rules to protect your trading capital and minimize potential losses. Determine the maximum amount of capital you’ll risk on each trade (e.g., a percentage of your total account balance), and use position sizing techniques to calculate the appropriate trade size based on your risk tolerance and stop-loss level. Additionally, consider diversifying your portfolio across different assets and trading strategies to spread risk and enhance overall stability.

- Maintain Discipline and Consistency: Stick to your trading plan consistently and avoid making impulsive or emotional decisions based on fear, greed, or market sentiment. Follow your predefined entry and exit criteria rigorously, and resist the temptation to deviate from your plan during periods of market volatility or uncertainty. Maintain discipline in executing your trades and adhere to your risk management rules at all times.

- Review and Adjust as Needed: Regularly review and evaluate your trading plan to assess its effectiveness and identify areas for improvement. Keep track of your trading performance, including wins, losses, and overall profitability, and analyze your trades to identify patterns, trends, and areas for optimization. Adjust your trading plan as needed based on your evolving experience, market conditions, and feedback from your trading results.

What are the differences between long-term investing and short-term trading?

Long-term investing and short-term trading are two distinct approaches to participating in the financial markets, each with its own characteristics, objectives, and strategies. Here are the key differences between long-term investing and short-term trading, with considerations for traders on platforms like Binance:

- Investment Horizon:

- Long-Term Investing: Long-term investing involves holding assets for an extended period, typically years or decades, with the expectation of capital appreciation over time. Long-term investors focus on the fundamentals of an asset, such as its underlying technology, market potential, and competitive advantage, and aim to generate wealth gradually through compound growth.

- Short-Term Trading: Short-term trading, also known as active trading or day trading, involves buying and selling assets within a short time frame, typically hours, days, or weeks. Short-term traders capitalize on short-term price movements and market inefficiencies to generate quick profits, often employing technical analysis and trading strategies to identify trading opportunities.

- Investment Objectives:

- Long-Term Investing: Long-term investors prioritize wealth preservation and long-term capital appreciation over time. They seek to build a diversified portfolio of assets with the aim of achieving financial goals such as retirement planning, wealth accumulation, or funding major life expenses.

- Short-Term Trading: Short-term traders focus on generating short-term profits from market fluctuations and price volatility. They aim to capitalize on short-term price movements and market trends to execute trades quickly and profitably, often employing leverage and risk management techniques to maximize returns.

- Approach to Risk:

- Long-Term Investing: Long-term investors tend to take a more conservative approach to risk, focusing on the fundamentals of an asset and its long-term growth potential. They may tolerate short-term fluctuations in asset prices and focus on the overall performance of their portfolio over time.

- Short-Term Trading: Short-term traders are typically more aggressive in their approach to risk, seeking to capitalize on short-term price movements and market volatility. They may employ leverage and margin trading to amplify their returns but also face higher levels of risk and potential losses.

- Trading Strategies:

- Long-Term Investing: Long-term investors often employ a buy-and-hold strategy, where they purchase assets with strong fundamentals and hold them for the long term, regardless of short-term price fluctuations. They may periodically rebalance their portfolio to maintain asset allocation and risk levels.

- Short-Term Trading: Short-term traders use a variety of trading strategies, including day trading, swing trading, and scalping, to capitalize on short-term price movements. They rely on technical analysis, chart patterns, and trading indicators to identify entry and exit points for trades and may execute multiple trades within a single trading session.

- Tax Considerations:

- Long-Term Investing: Long-term investments are subject to long-term capital gains tax rates, which are generally lower than short-term capital gains tax rates. Holding assets for more than one year may qualify investors for preferential tax treatment, allowing them to minimize their tax liabilities over time.

- Short-Term Trading: Short-term trading activities may result in higher tax liabilities due to short-term capital gains tax rates, which are typically taxed at the investor’s ordinary income tax rate. Traders should consider the tax implications of their trading activities and plan accordingly to minimize tax liabilities.

How can I stay disciplined and control my emotions while trading?

Staying disciplined and controlling emotions while trading is crucial for maintaining consistency and making rational decisions in the dynamic and often volatile cryptocurrency markets, including on platforms like Binance. Here are some strategies to help you stay disciplined and control emotions while trading:

- Develop a Trading Plan: Establish a clear and well-defined trading plan that outlines your trading goals, strategies, risk management rules, and criteria for entering and exiting trades. Having a structured plan in place can help you stay focused and disciplined in your trading approach, reducing the likelihood of making impulsive or emotional decisions.

- Set Realistic Expectations: Set realistic and achievable goals for your trading activities, taking into account your risk tolerance, trading experience, and financial objectives. Avoid setting unrealistic expectations or chasing unrealistic returns, as this can lead to frustration, disappointment, and emotional decision-making.

- Stick to Your Plan: Once you’ve developed a trading plan, stick to it consistently and avoid deviating from your predefined rules and strategies. Trust in your plan and avoid making impulsive decisions based on fear, greed, or market sentiment. Discipline yourself to follow your plan rigorously, even when faced with uncertainty or market volatility.

- Practice Patience and Discipline: Trading requires patience and discipline, especially during periods of market turbulence or extended periods of consolidation. Avoid succumbing to the temptation to overtrade or chase after quick profits. Instead, exercise patience and discipline in waiting for high-probability trading opportunities that align with your plan and strategy.

- Manage Risk Effectively: Implement robust risk management techniques to protect your trading capital and minimize potential losses. Use stop-loss orders, position sizing, and proper portfolio diversification to manage risk and preserve capital. By focusing on capital preservation and risk management, you can trade with confidence and control emotions during periods of market uncertainty.

- Monitor Your Emotions: Be mindful of your emotions and psychological state while trading. Pay attention to signs of fear, greed, overconfidence, or impulsivity, which can lead to irrational decision-making and poor trading outcomes. Take regular breaks, practice relaxation techniques, and maintain a healthy work-life balance to keep emotions in check and maintain mental clarity.

- Review and Learn from Mistakes: Learn from your trading mistakes and losses by conducting regular reviews of your trading performance. Analyze your trades, identify patterns, and reflect on your emotions and decision-making process. Use your mistakes as learning opportunities to refine your trading strategies, improve discipline, and grow as a trader over time.

Sign up here to receive a complimentary $100 upon registration.

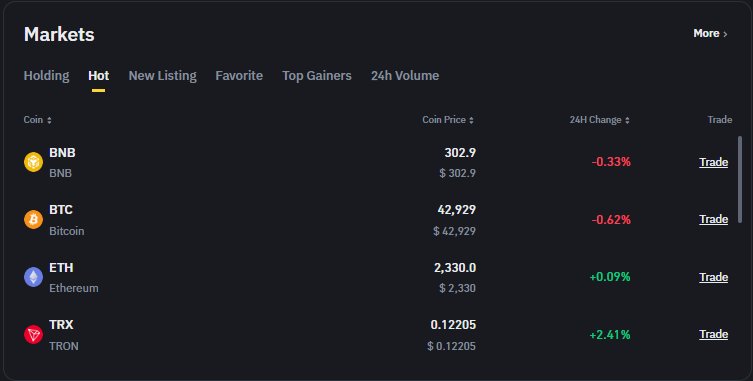

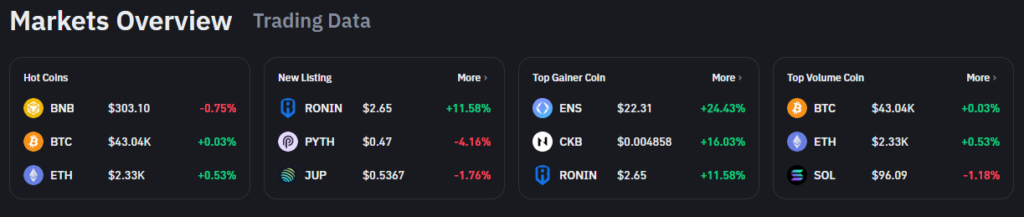

Trading Coins :

“Bitcoin“

In the ever-evolving landscape of finance, few phenomena have captured the world’s attention quite like Bitcoin. Since its inception in 2009 by the mysterious Satoshi Nakamoto, Bitcoin has transformed from an obscure digital currency into a global economic force, challenging traditional financial systems and captivating both investors and technologists alike.

The Rise of Bitcoin:

Bitcoin, often referred to as digital gold, operates on a decentralized network known as blockchain technology. This innovative approach eliminates the need for intermediaries like banks, allowing users to conduct peer-to-peer transactions securely and transparently. With a finite supply capped at 21 million coins, Bitcoin’s scarcity has contributed to its meteoric rise in value over the years, making it a sought-after asset for investors seeking diversification and hedging against fiat currency inflation.

The Mechanics Behind Bitcoin:

At its core, Bitcoin relies on cryptographic principles to secure transactions and maintain the integrity of the network. Transactions are verified by miners through a process known as proof-of-work, where powerful computers compete to solve complex mathematical puzzles. This decentralized consensus mechanism ensures the immutability and censorship resistance of the Bitcoin network, making it highly resilient to tampering and manipulation.

Bitcoin as a Store of Value:

One of Bitcoin’s most compelling attributes is its potential to serve as a store of value in an increasingly uncertain economic environment. With its deflationary supply dynamics and global accessibility, Bitcoin offers individuals and institutions a hedge against currency devaluation and geopolitical instability. As central banks continue to engage in unprecedented monetary stimulus measures, Bitcoin’s digital scarcity and decentralized nature have positioned it as a viable alternative to traditional stores of value like gold.

The Future of Bitcoin:

While Bitcoin’s journey has been marked by volatility and skepticism, its resilience and growing adoption signal a paradigm shift in the world of finance. As institutional investors and corporations embrace Bitcoin as a legitimate asset class, its role in shaping the future of money and finance cannot be overstated. With technological advancements such as the Lightning Network promising to enhance scalability and transaction throughput, Bitcoin is poised to usher in a new era of financial innovation and inclusion.

“Ethereum“

Unveiling Ethereum: The Future of Decentralized Finance

In the realm of cryptocurrency, Ethereum stands as a beacon of innovation and potential, offering a platform for decentralized applications and smart contracts that have revolutionized the landscape of finance and technology. Created by Vitalik Buterin in 2015, Ethereum has rapidly emerged as a frontrunner in the world of blockchain, presenting limitless possibilities for developers, investors, and users alike.

The Genesis of Ethereum:

Ethereum was conceived with the vision of expanding the capabilities of blockchain beyond simple transactions, enabling developers to build decentralized applications (DApps) and smart contracts. Unlike Bitcoin, which primarily serves as digital currency, Ethereum operates as a decentralized computing platform, allowing users to execute programmable contracts without the need for intermediaries. This flexibility and programmability have paved the way for a multitude of use cases across various industries, from finance and supply chain management to gaming and decentralized finance (DeFi).

The Power of Smart Contracts:

At the heart of Ethereum lies the concept of smart contracts, self-executing agreements with predefined rules and conditions written directly into the blockchain. These smart contracts enable a wide range of automated processes and transactions, eliminating the need for intermediaries and reducing the risk of fraud and manipulation. Whether it’s facilitating peer-to-peer lending, executing complex financial instruments, or powering decentralized exchanges, smart contracts have unlocked new possibilities for innovation and efficiency in the global economy.

The Rise of Decentralized Finance (DeFi):

One of the most compelling use cases for Ethereum is decentralized finance (DeFi), a rapidly growing ecosystem of financial applications built on the Ethereum blockchain. DeFi platforms enable users to access a wide range of financial services, including lending, borrowing, trading, and asset management, without relying on traditional intermediaries such as banks or brokerage firms. With the proliferation of DeFi protocols and decentralized exchanges (DEXs), Ethereum has democratized access to financial services, empowering individuals around the world to participate in the global economy on their own terms.

Scalability and the Road Ahead:

Despite its revolutionary potential, Ethereum faces challenges related to scalability and network congestion, particularly during periods of high demand. To address these issues, Ethereum developers are actively working on solutions such as Ethereum 2.0, a major upgrade designed to improve scalability, security, and sustainability. With features like proof-of-stake (PoS) consensus mechanism and sharding, Ethereum 2.0 aims to enhance the network’s capacity to handle a larger volume of transactions and support a growing ecosystem of decentralized applications.

“TetherUS“

Unlocking Stability and Utility: Exploring TetherUS (USDT) in the Crypto Landscape

In the ever-evolving world of cryptocurrency, TetherUS (USDT) has emerged as a leading stablecoin, providing stability and liquidity to traders and investors across the globe. Designed to maintain a 1:1 peg to the US dollar, TetherUS offers a reliable bridge between traditional fiat currencies and the digital asset ecosystem, facilitating seamless transactions and mitigating volatility risks.

The Foundation of Stability:

TetherUS was launched in 2014 with the aim of addressing the inherent volatility of cryptocurrencies like Bitcoin and Ethereum. By pegging its value to the US dollar, TetherUS provides users with a stable medium of exchange and store of value, making it an invaluable tool for traders seeking to hedge against market fluctuations or access liquidity without exiting the cryptocurrency market.

The Mechanics of TetherUS:

At its core, TetherUS operates on blockchain technology, leveraging the Omni Layer protocol (and later Ethereum and other blockchains) to issue and transact USDT tokens. Each USDT token is backed by an equivalent amount of fiat currency held in reserve, ensuring full transparency and accountability. This reserve-backed model instills confidence in the stability and reliability of TetherUS, making it a preferred choice for traders, investors, and businesses operating in the digital asset space.

The Role of TetherUS in Crypto Trading:

TetherUS plays a vital role in facilitating trading activities on cryptocurrency exchanges worldwide. Traders often use USDT as a trading pair against other cryptocurrencies, enabling them to quickly and efficiently move funds in and out of the market without the need to convert to fiat currency. This seamless integration of TetherUS into trading platforms has contributed to its widespread adoption and liquidity, further solidifying its position as a cornerstone of the cryptocurrency ecosystem.

The Evolution of TetherUS:

Over the years, TetherUS has evolved to meet the growing demands of the cryptocurrency market. In addition to its original USDT token pegged to the US dollar, Tether Limited—the company behind TetherUS—has introduced alternative stablecoins pegged to other fiat currencies, such as TetherEuro (EURT) and TetherChinese Yuan (CNYT). These multi-currency stablecoins offer users additional options for accessing stable liquidity and hedging against currency risks in a globalized digital economy.

“BNB“

Unveiling the Power of Binance Coin (BNB) in the Cryptocurrency Universe

In the vast and dynamic world of cryptocurrency, Binance Coin (BNB) has emerged as a formidable force, revolutionizing the way users interact with the Binance exchange and the broader digital asset ecosystem. As the native token of the Binance platform, BNB offers a myriad of utilities and benefits, making it an indispensable asset for traders, investors, and enthusiasts worldwide.

The Genesis of Binance Coin:

Binance Coin was introduced in July 2017 as part of the Binance exchange’s initial coin offering (ICO), with the vision of creating a native digital asset that could fuel the Binance ecosystem and provide users with various incentives and benefits. Since its inception, BNB has evolved from a simple utility token to a multifaceted asset with diverse use cases and functionalities.

The Multifunctionality of Binance Coin:

At its core, Binance Coin serves as the primary utility token of the Binance exchange, offering users discounts on trading fees, access to premium features, and participation in token sales and other platform activities. Additionally, BNB has expanded its utility beyond the Binance platform, with applications ranging from payment processing and remittances to decentralized finance (DeFi) and non-fungible tokens (NFTs).

The Benefits of Holding Binance Coin:

Holding Binance Coin confers several benefits to users, including discounted trading fees, staking rewards, voting rights in governance decisions, and participation in token burns and buybacks. Furthermore, Binance periodically introduces innovative initiatives and partnerships that leverage the utility of BNB, further enhancing its value proposition and utility for holders.

The Future of Binance Coin:

As Binance continues to innovate and expand its ecosystem, the future of Binance Coin looks promising. With the upcoming launch of Binance Smart Chain (BSC) and the integration of decentralized finance (DeFi) protocols and applications, BNB is poised to play a pivotal role in shaping the future of finance and revolutionizing the way we transact and interact with digital assets.

“Solana“

Unveiling Solana: The High-Performance Blockchain Leading the Future of Decentralized Finance

In the rapidly evolving landscape of blockchain technology, Solana has emerged as a frontrunner, offering unparalleled scalability, speed, and security to power the next generation of decentralized applications (DApps) and digital assets. Founded by Anatoly Yakovenko in 2017, Solana has quickly gained traction as a leading blockchain platform, attracting developers, investors, and users seeking a robust and efficient solution for building scalable decentralized applications.

The Genesis of Solana:

Solana was conceived with the vision of addressing the scalability limitations of existing blockchain networks such as Ethereum. Leveraging a unique combination of innovations, including a novel consensus mechanism called Proof of History (PoH) and a high-performance architecture known as Tower BFT (Byzantine Fault Tolerance), Solana is able to achieve throughput of over 65,000 transactions per second (TPS) and sub-second confirmation times, making it one of the fastest and most scalable blockchain platforms in existence.

The Architecture of Solana:

At the heart of Solana’s architecture lies the innovative Proof of History (PoH) consensus mechanism, which timestamps transactions before they are included in a block, ensuring a linear and verifiable order of events. This allows Solana to achieve high throughput and low latency without sacrificing security or decentralization. Coupled with its scalable network of nodes and validators, Solana offers developers a robust and reliable platform for building complex and high-performance decentralized applications.

The Applications of Solana:

Solana’s high-performance blockchain has enabled a wide range of use cases and applications across various industries, including decentralized finance (DeFi), non-fungible tokens (NFTs), gaming, and decentralized exchanges (DEXs). Projects built on Solana benefit from its fast transaction speeds, low fees, and secure infrastructure, allowing developers to create innovative solutions that scale to meet the demands of millions of users.

The Future of Solana:

As Solana continues to gain momentum and adoption, the future looks bright for this innovative blockchain platform. With ongoing developments such as the Solana Season Hackathon, ecosystem grants, and partnerships with leading projects and protocols, Solana is poised to play a pivotal role in shaping the future of decentralized finance and Web3.0. With its scalable architecture, high-performance consensus mechanism, and vibrant developer community, Solana is well-positioned to lead the charge towards a more decentralized, interconnected, and inclusive digital economy.

“Ripple“

Unraveling Ripple: Revolutionizing Cross-Border Payments with Blockchain Technology

In the ever-evolving landscape of financial technology, Ripple has emerged as a pioneering force, leveraging blockchain technology to transform the way money moves across borders. Founded in 2012 by Chris Larsen and Jed McCaleb, Ripple aims to create a more efficient and inclusive global payments network by enabling instant, low-cost, and secure transactions.

The Genesis of Ripple:

Ripple was created with the vision of addressing the inefficiencies and limitations of traditional cross-border payment systems, which are often slow, expensive, and prone to errors. Unlike Bitcoin and Ethereum, which focus primarily on decentralized currency and smart contracts, respectively, Ripple is designed specifically for facilitating fast and frictionless cross-border payments for financial institutions and businesses.

The RippleNet Ecosystem:

At the heart of Ripple’s solution is RippleNet, a global payments network that connects banks, payment providers, and other financial institutions worldwide. RippleNet enables participants to send and receive payments seamlessly in real-time using Ripple’s native digital asset, XRP, or through Ripple’s On-Demand Liquidity (ODL) service, which utilizes XRP as a bridge currency to facilitate instant settlements.

The Benefits of Ripple:

Ripple offers several key advantages over traditional payment systems, including faster transaction speeds, lower fees, enhanced transparency, and greater liquidity. By leveraging blockchain technology and XRP’s liquidity, Ripple enables financial institutions to streamline their cross-border payment processes, reduce settlement times from days to seconds, and lower transaction costs significantly.

The Impact of Ripple:

Since its inception, Ripple has made significant strides in reshaping the global payments landscape. The platform has forged partnerships with leading banks, remittance providers, and payment networks worldwide, enabling millions of people to access faster, more affordable, and more reliable cross-border payment solutions. Ripple’s technology has also garnered attention from regulators and policymakers, who recognize its potential to improve financial inclusion and foster economic growth.

The Future of Ripple:

As Ripple continues to expand its network and offerings, the future looks promising for this innovative fintech company. With ongoing developments such as the expansion of RippleNet, the integration of new financial products and services, and the exploration of use cases beyond payments, Ripple is well-positioned to lead the charge towards a more efficient, transparent, and inclusive global financial system.

“USD Coin”

Unlocking the Power of USD Coin (USDC) in the Digital Economy

In the rapidly evolving world of cryptocurrency, USD Coin (USDC) has emerged as a stable and reliable digital asset pegged to the value of the US dollar. Created by Circle and Coinbase in 2018, USDC offers users a seamless bridge between traditional fiat currency and the burgeoning digital economy, providing stability, security, and interoperability for individuals, businesses, and developers alike.

The Genesis of USD Coin:

USD Coin was launched with the vision of providing a trustworthy and transparent stablecoin that could serve as a universal medium of exchange and store of value in the digital ecosystem. Unlike volatile cryptocurrencies such as Bitcoin and Ethereum, USDC maintains a 1:1 peg to the US dollar, backed by a reserve of fiat currency held in regulated banks and subject to regular audits to ensure transparency and accountability.

The Utility of USD Coin:

At its core, USD Coin serves as a reliable and efficient means of transacting value on the blockchain. Whether it’s facilitating cross-border payments, remittances, or peer-to-peer transactions, USDC offers users a fast, low-cost, and secure alternative to traditional financial systems. Additionally, USDC can be seamlessly integrated into decentralized applications (DApps), decentralized finance (DeFi) protocols, and non-fungible token (NFT) marketplaces, enabling a wide range of use cases across various industries.

The Benefits of USD Coin:

USDC offers several key advantages over traditional fiat currencies and other stablecoins, including instant settlement, global accessibility, and transparency. By leveraging blockchain technology, USDC enables users to transact value with greater speed, efficiency, and security, while maintaining the stability and reliability of the US dollar. Furthermore, USDC is supported by a robust ecosystem of partners, exchanges, and wallet providers, ensuring widespread adoption and liquidity for users worldwide.

The Future of USD Coin:

As the digital economy continues to evolve, the future looks bright for USD Coin and stablecoins in general. With increasing adoption and acceptance from regulators, financial institutions, and consumers, USDC is poised to play a pivotal role in shaping the future of finance and commerce. Whether it’s powering cross-border payments, enabling decentralized finance applications, or facilitating global remittances, USD Coin offers a versatile and reliable solution for individuals and businesses seeking stability and efficiency in the digital age.

“Cardano”

Unveiling the Potential of Cardano: Redefining Blockchain Technology for the Future

In the fast-paced world of cryptocurrency, Cardano stands out as a leading blockchain platform that aims to revolutionize the way decentralized applications are built, deployed, and scaled. Founded by Charles Hoskinson and Jeremy Wood in 2017, Cardano has garnered attention for its innovative approach to scalability, interoperability, and sustainability, offering a robust and secure foundation for the next generation of blockchain applications.

The Genesis of Cardano:

Cardano was conceived with the vision of creating a blockchain platform that could address the scalability and sustainability challenges faced by existing networks such as Bitcoin and Ethereum. Built on a foundation of peer-reviewed research and scientific rigor, Cardano employs a layered architecture that separates the settlement layer from the computation layer, allowing for greater flexibility, security, and scalability.

The Three Pillars of Cardano:

At its core, Cardano is guided by three key principles: scalability, interoperability, and sustainability. By focusing on these pillars, Cardano aims to create a blockchain platform that can support a wide range of decentralized applications, from financial services and supply chain management to identity verification and voting systems. Through its innovative Ouroboros consensus algorithm and layered architecture, Cardano offers high throughput, low latency, and low transaction fees, making it an ideal platform for building scalable and efficient blockchain applications.

The ADA Cryptocurrency:

At the heart of the Cardano ecosystem is ADA, the native cryptocurrency used to power transactions and smart contracts on the platform. ADA holders can participate in the governance of the Cardano network by staking their tokens and voting on protocol upgrades and changes. With a fixed supply capped at 45 billion tokens, ADA offers a deflationary model that incentivizes participation and secures the network against malicious actors.

The Roadmap for Cardano:

Cardano’s development roadmap is guided by a commitment to research, innovation, and collaboration. The platform’s development is driven by a global community of developers, researchers, and enthusiasts who contribute to its ongoing evolution and improvement. With upcoming features such as smart contracts, multi-asset support, and governance enhancements, Cardano is poised to become a leading blockchain platform for enterprise adoption and mainstream use.

“Avalanche”

Unveiling Avalanche: Redefining Scalability and Security in Blockchain Technology

In the rapidly evolving landscape of blockchain technology, Avalanche has emerged as a groundbreaking platform that seeks to address the scalability, security, and decentralization challenges faced by existing blockchain networks. Founded by Emin Gün Sirer in 2018, Avalanche leverages innovative consensus mechanisms and architecture to offer high throughput, low latency, and unparalleled security, making it an ideal platform for building decentralized applications (DApps) and digital assets.

The Genesis of Avalanche:

Avalanche was born out of the need for a scalable and efficient blockchain platform capable of supporting large-scale decentralized applications and financial systems. Built on a foundation of rigorous research and engineering excellence, Avalanche introduces novel consensus protocols, such as Avalanche consensus and Snowman consensus, which enable rapid transaction finality and high throughput without compromising on security or decentralization.

The Three Pillars of Avalanche:

At its core, Avalanche is guided by three key principles: scalability, security, and decentralization. By focusing on these pillars, Avalanche aims to create a blockchain platform that can support a wide range of use cases, from decentralized finance (DeFi) and decentralized exchanges (DEXs) to supply chain management and identity verification systems. Through its innovative architecture and consensus mechanisms, Avalanche offers unmatched scalability, security, and decentralization, making it an ideal platform for building the next generation of blockchain applications.

The AVAX Cryptocurrency:

At the heart of the Avalanche ecosystem is the native cryptocurrency AVAX, which serves as the fuel for transactions and smart contracts on the platform. AVAX holders can participate in the governance of the Avalanche network by staking their tokens and voting on protocol upgrades and changes. With a fixed supply capped at 720 million tokens, AVAX offers a deflationary model that incentivizes participation and secures the network against malicious actors.

The Roadmap for Avalanche:

Avalanche’s development roadmap is driven by a commitment to innovation, collaboration, and community involvement. The platform’s development is guided by a global community of developers, researchers, and enthusiasts who contribute to its ongoing evolution and improvement. With upcoming features such as cross-chain interoperability, subnets, and advanced governance mechanisms, Avalanche is poised to become a leading blockchain platform for enterprise adoption and mainstream use.

“Dogecoin”

Unveiling Dogecoin: Exploring the Rise of the People’s Cryptocurrency

In the dynamic world of cryptocurrency, Dogecoin has captured the hearts and minds of millions as a fun and accessible digital currency with a vibrant community and unique culture. Created in 2013 by Billy Markus and Jackson Palmer as a lighthearted joke based on the popular “Doge” meme, Dogecoin has since evolved into a global phenomenon, gaining popularity for its charitable endeavors, meme culture, and enthusiastic community of supporters.

The Genesis of Dogecoin:

Dogecoin was born out of a spirit of community, humor, and inclusivity, with its creators aiming to create a cryptocurrency that was accessible to everyone, regardless of technical expertise or financial background. Initially introduced as a “joke currency” with no real-world utility, Dogecoin quickly gained traction on social media platforms such as Reddit and Twitter, attracting a dedicated following and fostering a vibrant community of enthusiasts.

The Unique Features of Dogecoin:

Despite its origins as a joke, Dogecoin possesses several unique features that have contributed to its enduring popularity and widespread adoption. With its fast transaction speeds, low fees, and friendly community, Dogecoin has become a preferred choice for microtransactions, online tipping, and charitable donations. Additionally, Dogecoin’s inflationary supply model, which issues a fixed amount of coins each year, ensures a steady and predictable rate of distribution, making it a more equitable and inclusive currency.

The Dogecoin Community:

One of the defining characteristics of Dogecoin is its passionate and supportive community, known affectionately as the “Doge Army.” Comprising individuals from all walks of life, the Dogecoin community is united by a shared sense of camaraderie, humor, and altruism. From sponsoring charitable initiatives and fundraising campaigns to organizing community events and supporting meme culture, the Dogecoin community embodies the spirit of inclusivity and generosity that has made Dogecoin a beloved and enduring cryptocurrency.

The Rise of Dogecoin:

In recent years, Dogecoin has experienced a surge in popularity and mainstream adoption, propelled by high-profile endorsements from celebrities, influencers, and prominent figures in the cryptocurrency industry. With its iconic Shiba Inu mascot and lighthearted branding, Dogecoin has transcended its origins as a meme currency to become a symbol of community, resilience, and optimism in the world of digital assets.

“ChainLink”

Unraveling Chainlink: Revolutionizing Decentralized Oracle Networks

In the fast-paced world of blockchain technology, Chainlink has emerged as a pioneering platform that aims to bridge the gap between smart contracts and real-world data, unlocking new possibilities for decentralized applications (DApps) and blockchain ecosystems. Founded by Sergey Nazarov and Steve Ellis in 2017, Chainlink leverages decentralized oracle networks to securely and reliably connect smart contracts with external data sources, enabling smart contracts to interact with the world beyond the blockchain.

The Genesis of Chainlink:

Chainlink was created with the vision of solving the “oracle problem”—the challenge of securely and reliably obtaining external data and executing smart contracts based on that data. By harnessing the power of decentralized networks, Chainlink provides a decentralized infrastructure for fetching, validating, and delivering external data to smart contracts on various blockchain platforms, including Ethereum, Binance Smart Chain, and more.

The Role of Oracles in Chainlink:

At the core of Chainlink’s solution lies decentralized oracles, which act as trusted intermediaries between blockchain smart contracts and external data sources. Oracles aggregate data from multiple sources, verify its authenticity, and deliver it to smart contracts on-chain, ensuring the integrity and reliability of the data used in decentralized applications. This allows developers to create DApps that can securely interact with real-world events, such as weather conditions, stock prices, and sports outcomes, in a trustless and decentralized manner.

The Benefits of Chainlink:

Chainlink offers several key advantages over traditional oracle solutions, including decentralization, security, and scalability. By leveraging decentralized networks of oracles, Chainlink eliminates single points of failure and reduces the risk of data manipulation or tampering, ensuring the integrity and reliability of data used in smart contracts. Additionally, Chainlink’s modular architecture and wide range of data feeds enable developers to customize and tailor oracle solutions to meet the specific needs of their DApps.

The Applications of Chainlink:

Chainlink’s decentralized oracle networks have enabled a wide range of use cases and applications across various industries, including decentralized finance (DeFi), insurance, supply chain management, and gaming. Projects built on Chainlink benefit from its secure and reliable data feeds, enabling them to create DApps that can execute complex logic and trigger actions based on real-world events, without relying on centralized intermediaries.

The Future of Chainlink:

As the demand for reliable and secure oracle solutions continues to grow, the future looks promising for Chainlink and decentralized oracle networks. With ongoing developments such as the integration of off-chain data aggregation and advanced cryptographic techniques, Chainlink is poised to become the standard oracle solution for the next generation of decentralized applications and blockchain ecosystems.

“TRON”

Unveiling TRON: Empowering Decentralized Entertainment and Content Sharing

In the dynamic landscape of blockchain technology, TRON has emerged as a leading platform dedicated to building a decentralized internet infrastructure for the digital entertainment industry. Founded by Justin Sun in 2017, TRON aims to revolutionize the way digital content is created, distributed, and consumed, offering users a decentralized platform for entertainment, gaming, and social networking.

The Genesis of TRON:

TRON was born out of a vision to create a decentralized internet ecosystem where content creators, consumers, and developers could interact freely and securely without the need for intermediaries or centralized gatekeepers. Leveraging blockchain technology and decentralized protocols, TRON provides a transparent and censorship-resistant platform for sharing and monetizing digital content, empowering creators to retain ownership and control over their creations.

The Features of TRON:

At its core, TRON offers several key features that differentiate it from traditional content sharing platforms. These include high throughput, low latency, and minimal transaction fees, thanks to its delegated proof-of-stake (DPoS) consensus mechanism and scalable architecture. Additionally, TRON supports smart contracts and decentralized applications (DApps), enabling developers to create a wide range of innovative solutions for gaming, social networking, and digital media distribution.

The TRON Ecosystem:

TRON’s ecosystem is comprised of several key components, including the TRON blockchain, the TRON Virtual Machine (TVM), and the TRONIX (TRX) cryptocurrency. TRX serves as the native currency of the TRON network, facilitating transactions, powering smart contracts, and incentivizing participation in the ecosystem. With its growing community of developers, content creators, and users, TRON is fostering a vibrant and decentralized ecosystem for digital entertainment and content sharing.

The Use Cases of TRON:

TRON’s decentralized platform has enabled a wide range of use cases and applications across various industries, including gaming, social networking, content creation, and digital media distribution. Projects built on TRON benefit from its high throughput, low fees, and seamless integration with existing digital platforms, enabling them to reach a global audience and monetize their content more effectively.

The Future of TRON:

As the digital entertainment industry continues to evolve, the future looks bright for TRON and its decentralized platform. With ongoing developments such as the integration of non-fungible tokens (NFTs), decentralized finance (DeFi) protocols, and cross-chain interoperability, TRON is poised to become a leading ecosystem for digital entertainment and content sharing. Whether you’re a content creator, developer, or consumer, TRON invites you to join the journey towards a more decentralized, inclusive, and empowering internet.

“Polkadot”

Unlocking the Potential of Polkadot: Revolutionizing Interoperability in Blockchain Networks