Trading on Binance can be an exciting venture for both novice and experienced traders. Utilizing its robust trading platform, you can explore various strategies, analyze market trends, and execute trades effectively. This guide will walk you through the essentials of trading on Binance, covering everything from basic chart setups to advanced trading strategies.

Table of Contents

How to Trade on Binance

To get started with trading on Binance, you first need to create an account. Once your account is set up, you can deposit funds and begin trading. Binance provides an intuitive interface that is easy to navigate.

After logging in, navigate to the trading section. Here, you will find various options such as spot trading, futures, and options. For beginners, spot trading is recommended as it allows you to buy and sell cryptocurrencies directly.

Trade Crypto on Binance

Once you have funds in your account, you can start trading cryptocurrencies. Binance offers a wide range of cryptocurrencies to trade, including Bitcoin (BTC), Ethereum (ETH), and many altcoins. To trade, select the cryptocurrency pair you wish to trade, such as BTC/USDT.

Next, you can choose between a market order, where you buy or sell at the current market price, or a limit order, where you set a specific price at which you want to buy or sell. Limit orders provide greater control over the price you pay, while market orders execute immediately at the current market price.

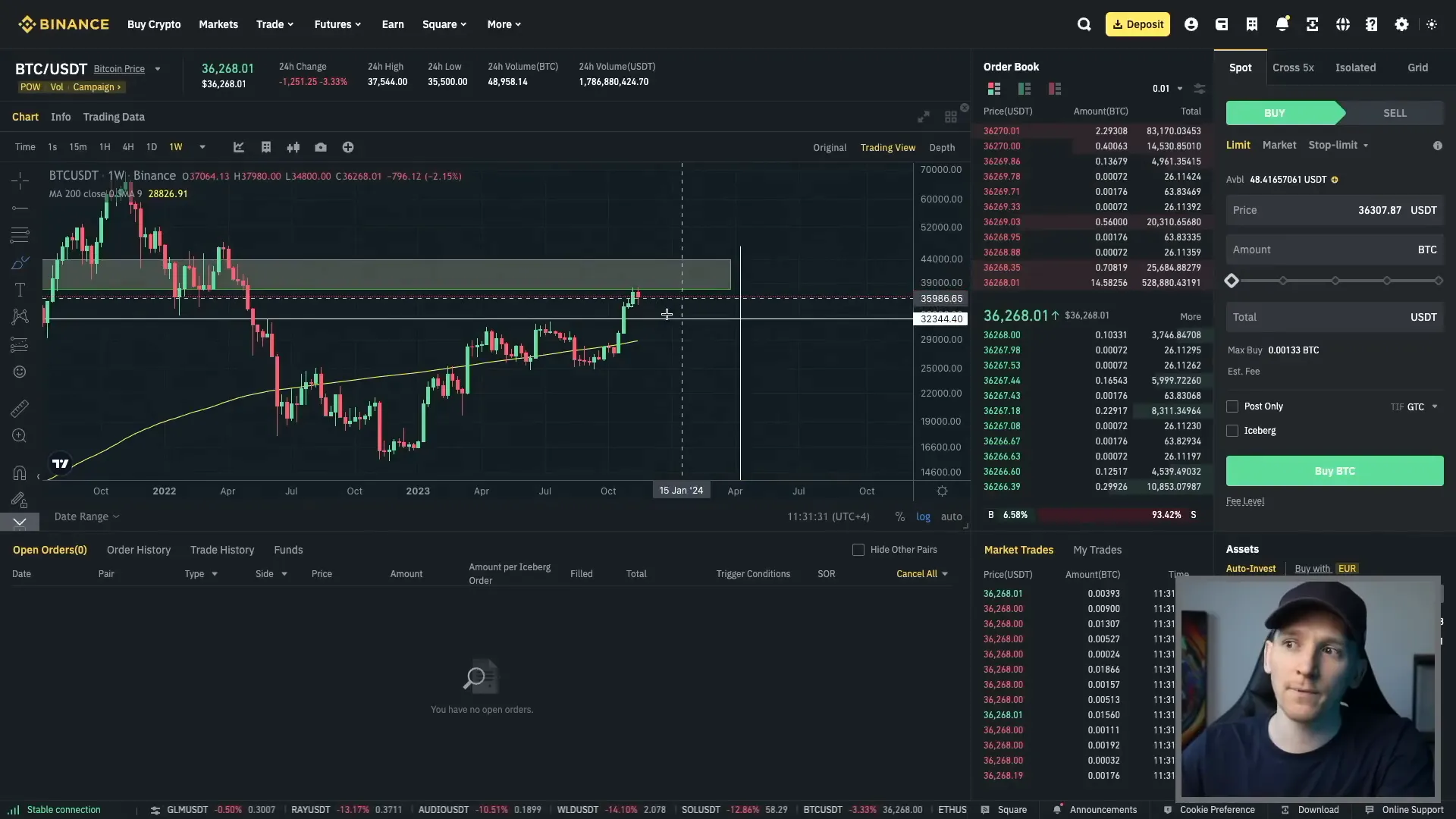

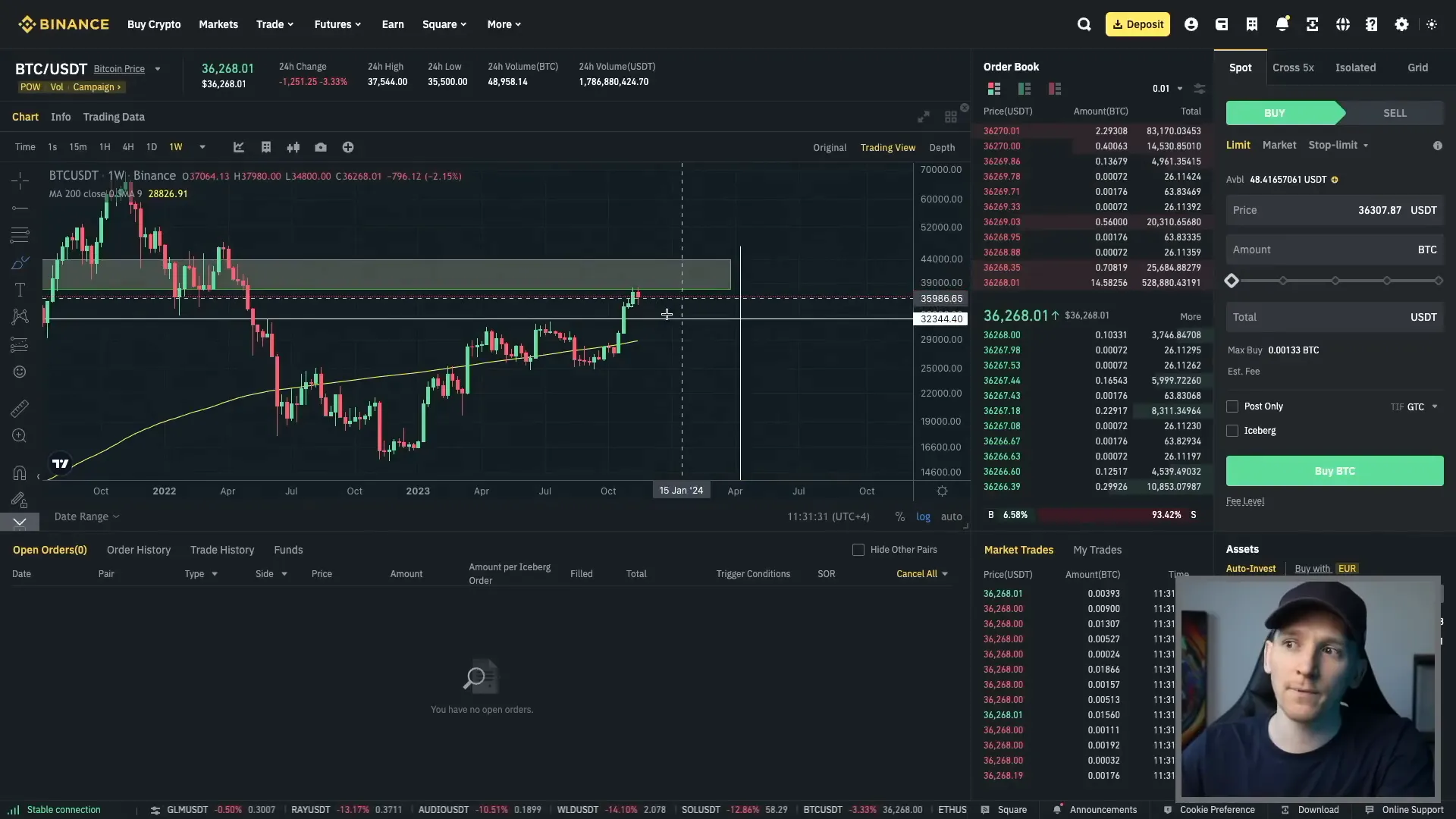

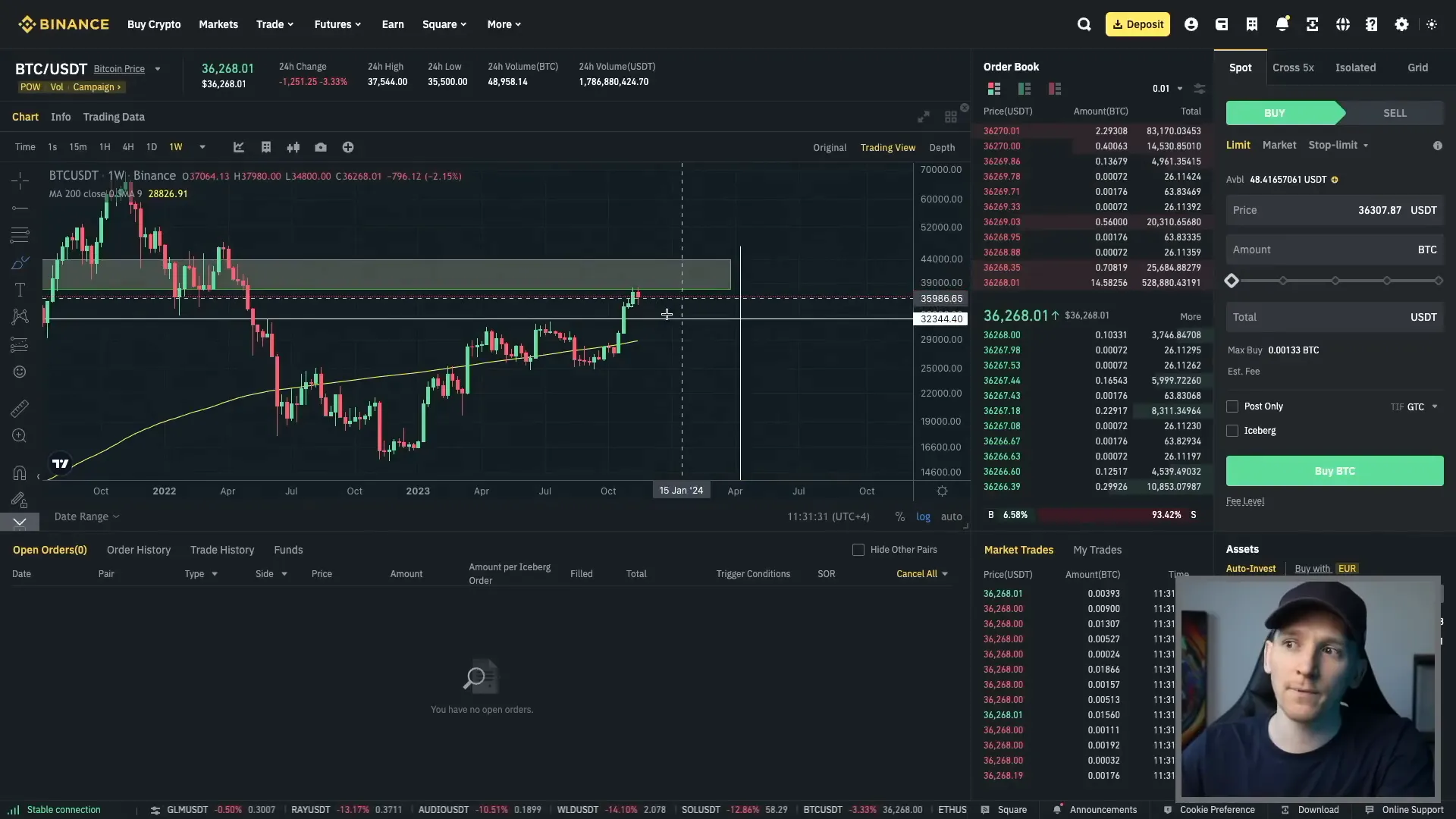

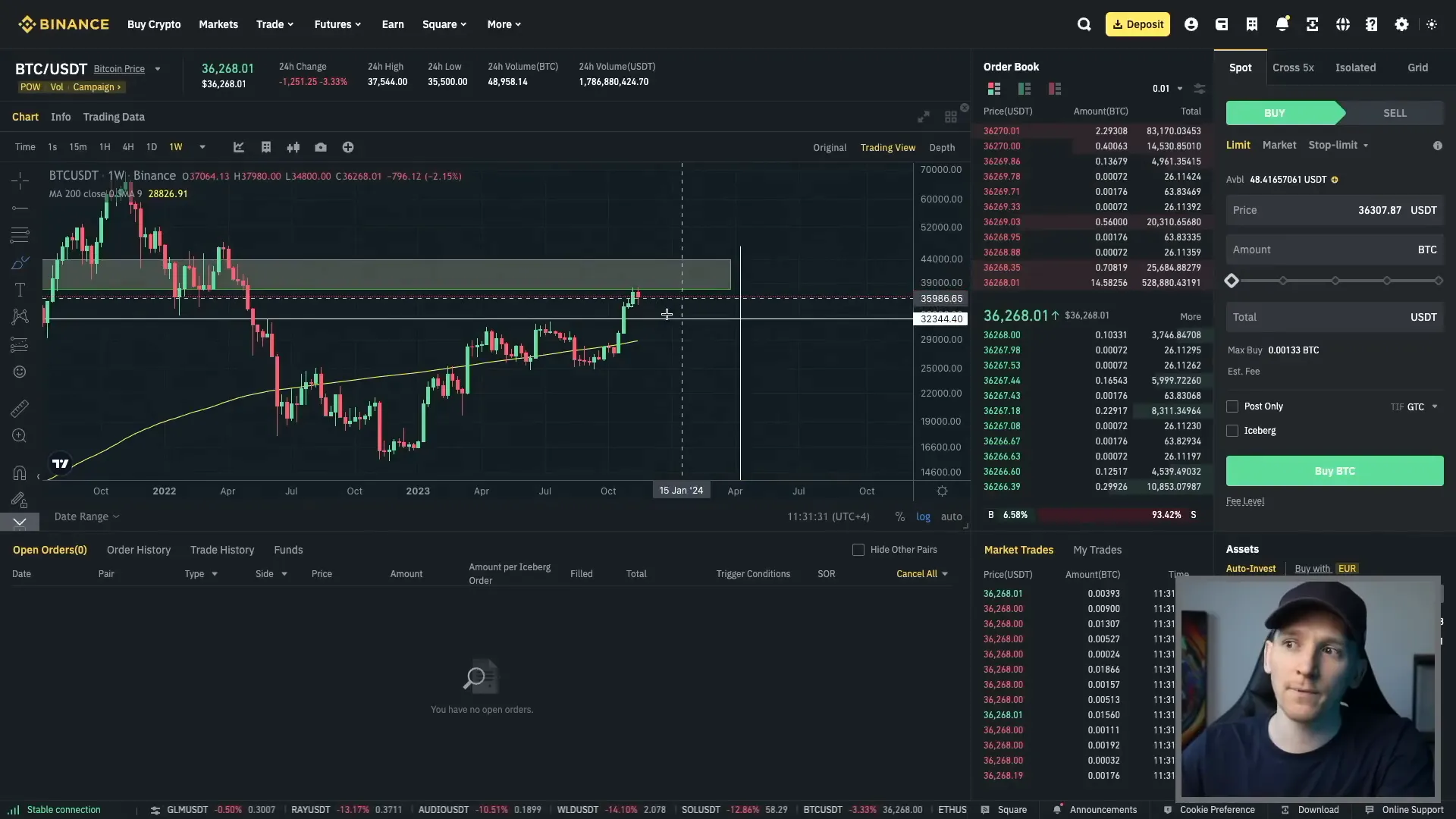

Binance Chart Setup

Setting up charts on Binance is crucial for analyzing price movements. Binance uses TradingView for charting, which is a professional charting software. To set up your chart, select the time frame that aligns with your trading strategy.

If you are trading short-term, consider using one-minute to one-hour charts. For longer-term trading, daily and weekly charts are more appropriate. You can easily switch between these time frames using the chart settings.

Simple Technical Analysis

Technical analysis is vital for making informed trading decisions. Start by identifying trends on your chart. Look for patterns such as higher highs and higher lows in an uptrend, and lower highs and lower lows in a downtrend.

Use indicators like moving averages to smooth out price data and identify potential buy and sell signals. For example, a simple moving average can help you determine the overall trend direction. If the price is above the moving average, it may indicate an uptrend, while a price below suggests a downtrend.

When to Buy or Sell Crypto

Knowing when to enter or exit a trade is crucial for success in trading. Look for key support and resistance levels on your charts. Support levels indicate where the price may bounce back up, while resistance levels indicate where the price may reverse down.

Utilize the news and market sentiment to gauge when to buy or sell. If positive news is circulating about a cryptocurrency, it may present a good buying opportunity. Conversely, negative news can be a signal to sell.

Support and Resistance

Support and resistance levels are fundamental concepts in technical analysis. Support levels are prices where buying interest is strong enough to overcome selling pressure, preventing the price from falling further. Conversely, resistance levels are prices where selling interest is strong enough to overcome buying pressure, preventing the price from rising further.

To identify these levels, look at historical price data. If a price level has been tested multiple times without being broken, it is likely a significant support or resistance level.

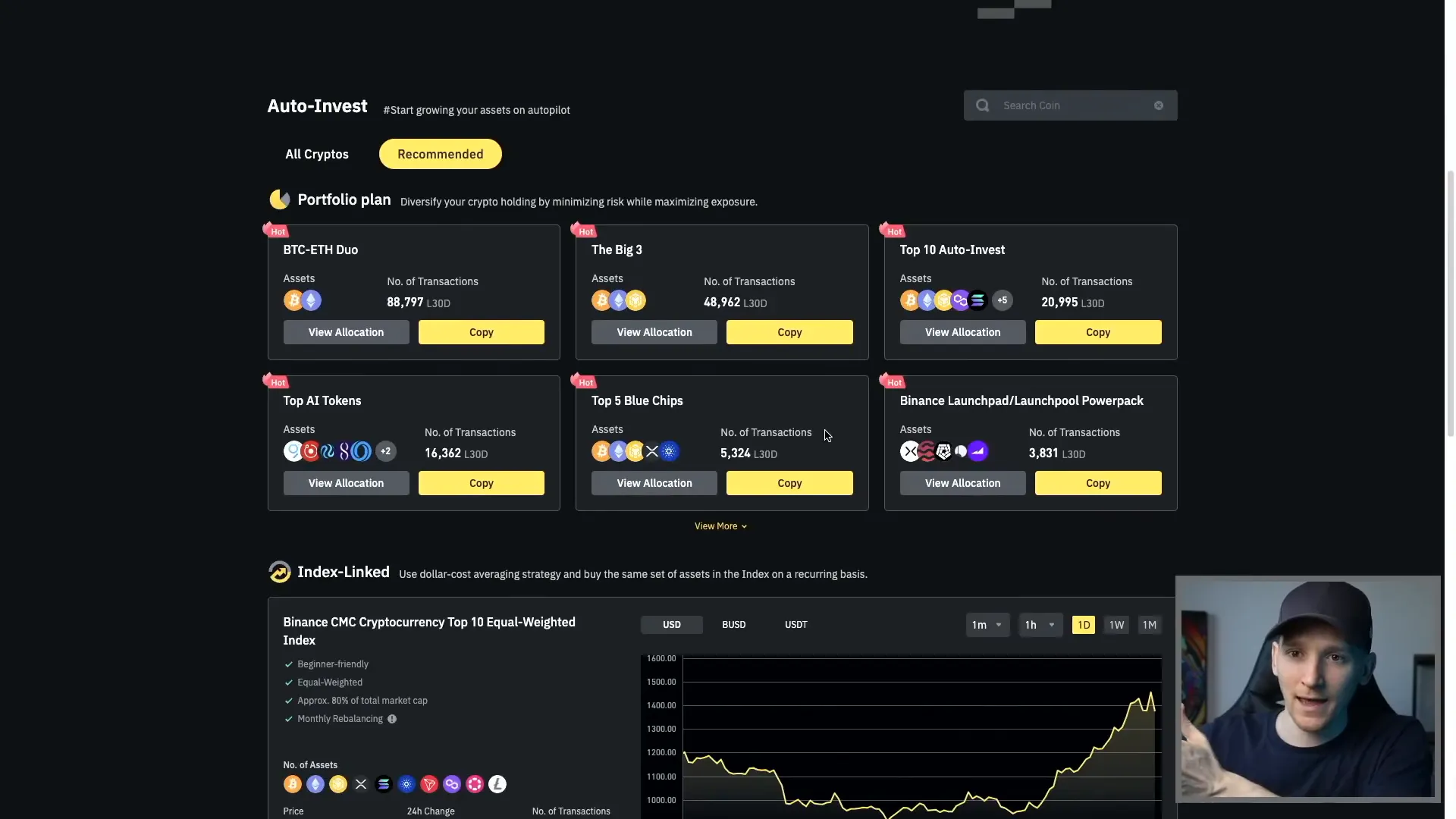

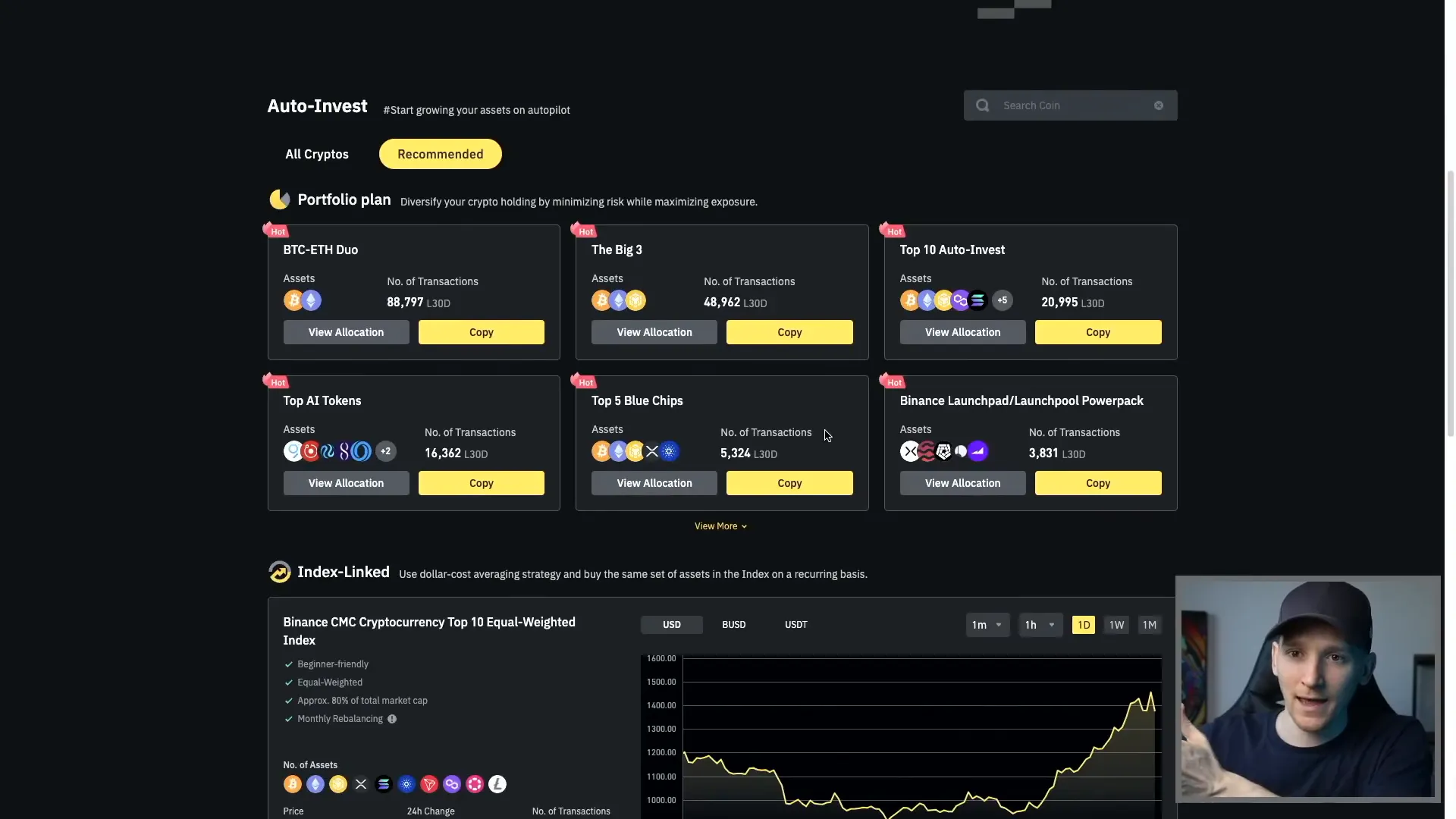

Binance Auto Invest

Binance offers an auto-invest feature that allows you to set up automatic investments in your chosen cryptocurrencies. This is ideal for users who prefer a hands-off approach and wish to dollar-cost average their investments over time.

To use this feature, select the assets you wish to invest in, the amount, and the frequency of investments. The auto-invest feature can help mitigate the emotional aspect of trading by allowing you to invest consistently without needing to time the market.

Binance Limit Orders

Limit orders are a powerful tool for traders. They allow you to set a specific price at which you want to buy or sell a cryptocurrency. This means you can wait for the market to reach your desired price before executing a trade.

To place a limit order, enter the price at which you want to buy or sell and the amount you wish to trade. Your order will remain open until it is filled or canceled. Limit orders are especially useful in volatile markets, as they help you avoid slippage.

Sell Crypto

When you decide to sell your crypto, you can choose between several order types, including market orders and limit orders. Market orders will execute immediately at the current market price, while limit orders allow you to set your selling price.

Evaluate the market conditions before selling. If the price is approaching a resistance level, it may be wise to sell to secure profits. Conversely, if the price is near a support level, consider holding off on selling.

Binance Stop Orders

Stop orders are used to limit losses or protect profits. A stop-loss order automatically sells your cryptocurrency when it reaches a predetermined price. This can help you minimize losses in a declining market.

To set a stop order, enter the stop price at which you want the order to be triggered and the limit price at which you want to sell. This strategy is particularly useful for traders who cannot constantly monitor the market.

Binance Trailing Stop

A trailing stop order is a more advanced order type that adjusts the stop-loss price as the market price moves in your favor. This allows you to lock in profits while still giving your trade room to grow.

To set a trailing stop, specify the trailing amount (e.g., 5% below the current price). If the price rises, your stop price will also rise, but if the price falls, the stop price will not move down. This strategy helps protect profits while allowing for potential price increases.

Binance Algo (TWAP, POV)

Binance also offers algorithmic trading options such as TWAP (Time Weighted Average Price) and POV (Percentage of Volume). These strategies allow you to execute trades over a specified time frame or based on market volume, helping to minimize the impact of your trades on the market.

Using these algorithms can be beneficial for larger orders, as they allow for smoother execution and can help achieve better average prices over time. You can customize the parameters according to your trading strategy and market conditions.

Conclusion

Trading on Binance offers a plethora of opportunities for both new and seasoned traders. By utilizing the tools and strategies discussed, you can enhance your trading experience and potentially improve your returns. Always remember to do your research and trade responsibly.

For further information, consider exploring the Binance platform, and don’t hesitate to seek out additional educational resources to sharpen your trading skills.