Trading cryptocurrencies can be both exciting and profitable, especially if you have the right strategies in place. In this guide, we will walk you through the steps to make $100 a day trading Bitcoin or Altcoins using Binance and other platforms. This method is beginner-friendly and involves using various tools and techniques to maximize your profits.

Step 1: Understanding Coin Market Cap

The first step in your trading journey is to familiarize yourself with CoinMarketCap. This website aggregates data on all cryptocurrencies, showing price movements, market capitalization, and trading volumes.

Start your day by logging into CoinMarketCap to check the prices and your portfolio. You can also track the general health of the market. One of the best features of CoinMarketCap is the ability to filter cryptocurrencies by their performance over the last 24 hours or 7 days.

For example, if you notice a coin that has gained significantly in the last 24 hours, it may be worth considering for trading. Conversely, if a coin has lost value, it could present a buying opportunity.

Step 2: Identifying Potential Coins

Once you are familiar with CoinMarketCap, the next step is to identify which coins to trade. Look for coins that have a market cap and a decent trading volume — ideally above $50 million. This ensures that you can enter and exit trades easily without significant slippage.

Some coins to consider might include Kusama, Amp, or Polkadot. These are not obscure coins; they have significant market caps and are well-regarded in the crypto community. Make sure to evaluate the volume as well; low-volume coins can be risky for trading.

Step 3: Using Crypto Bubbles for Fun Analysis

Another useful tool is Crypto Bubbles. This website provides a visual representation of how various cryptocurrencies are performing over different time frames. You can filter by hour, day, week, or even month.

This visual approach can make it easier to spot trends and potential coins to trade. If you notice a coin that has experienced a significant drop in value recently, it may be a good buying opportunity.

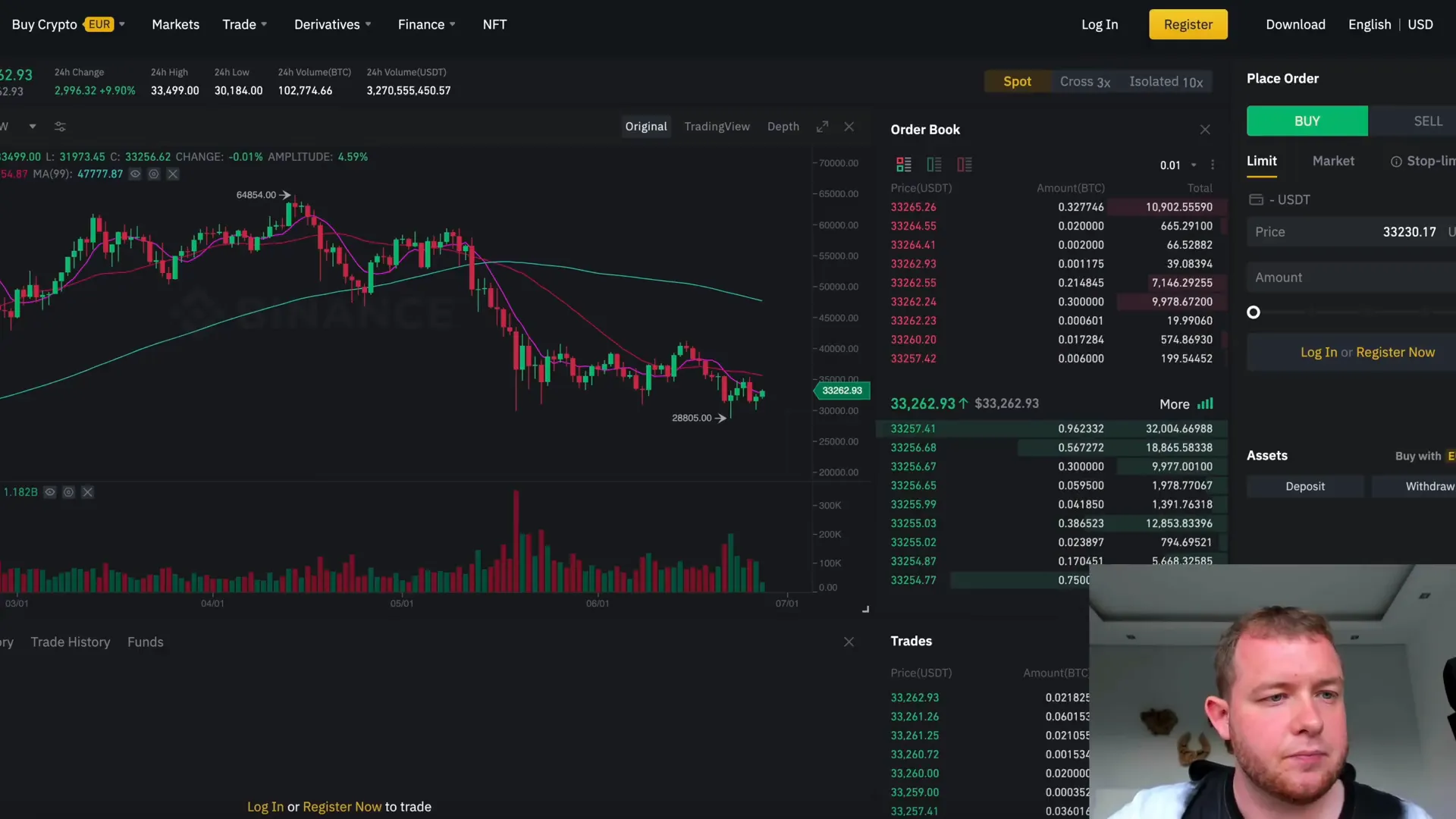

Step 4: Setting Up Your Binance Account

Now that you have identified potential coins, it’s time to set up your trading account on Binance. If you don’t have an account yet, you can register and take advantage of bonuses offered by the platform.

Once registered, make sure to complete the identity verification process. This is crucial for ensuring the security of your account and complying with regulations. After verification, set up your preferred payment methods for easy deposits and withdrawals.

Step 5: Trading on Binance

After setting up your account, you can start trading. Using the coins you identified earlier, navigate to the trading section of Binance. Select the coin you want to trade, such as KSM (Kusama), and look for its trading pair, typically with USDT (Tether).

Make sure to check the price movements and volume trends on Binance before placing your trades. It’s essential to use both short-term and long-term analysis to make informed decisions.

Step 6: Analyzing with TradingView

To further enhance your trading strategy, utilize TradingView. This platform allows you to analyze price charts and apply various technical indicators.

For day trading, a great approach is to use the 4-hour chart. This time frame gives you a good balance of detail without overwhelming you with information.

Step 7: Utilizing Indicators for Better Trading Decisions

To make informed trading decisions, you can use indicators like Bollinger Bands and the Relative Strength Index (RSI). Bollinger Bands will help you identify potential buy and sell points based on price volatility.

Meanwhile, the RSI can indicate whether an asset is overbought or oversold. Look for situations where the RSI drops below 30 (oversold) and the price touches the lower Bollinger Band, indicating a potential buying opportunity.

Step 8: Executing Your Trades

Once you’ve analyzed the charts and identified a good entry point, it’s time to execute your trade. Aim to be in and out of trades within the same day to reach your $100 profit goal. This might involve targeting small profits of around 2-5% per trade.

Remember, not every day will yield profit. Some days you may face losses, but maintaining a steady approach will help you achieve your overall goal.

Step 9: Tracking Your Progress

Keeping track of your trades is essential for improving your trading strategies over time. Use spreadsheets or trading journal apps to log your trades, profits, and losses. This will help you identify what works and what doesn’t in your trading approach.

Step 10: Continuous Learning and Adaptation

The cryptocurrency market is always changing. To stay ahead, continually educate yourself on new trading techniques, market trends, and emerging cryptocurrencies. Consider joining communities or forums where experienced traders share their insights.

In addition, don’t forget to check out the Bitcoin Blueprint linked below. This comprehensive guide offers valuable strategies for both day trading and long-term investment in cryptocurrency.

Conclusion

In conclusion, making $100 a day trading cryptocurrency is achievable with the right tools, strategies, and platforms like Binance. By following this step-by-step guide, you can start your trading journey effectively. Remember to keep learning, stay disciplined, and adapt to the market changes. Happy trading!