In the world of trading, the potential to transform a modest investment into significant profits is an alluring prospect. This guide will walk you through a systematic approach to trading on Binance Futures, focusing on how to turn $100 into $10,000 using a specific strategy. This method emphasizes safety and reasonable chances of success, which is crucial for both new and experienced traders.

Understanding Binance Futures

Before diving into the strategy, it’s essential to grasp what Binance Futures is and how it works. Futures contracts allow you to leverage your capital, meaning you can control a larger position than your initial investment. This leverage amplifies both potential gains and losses, making it vital to understand the risks involved.

Setting Up Your Binance Account

If you haven’t already, you need to create a Binance account. Doing so not only allows you to trade but also gives you access to bonuses and educational resources. When you sign up, you can receive up to a $600 bonus, which can significantly boost your trading capital.

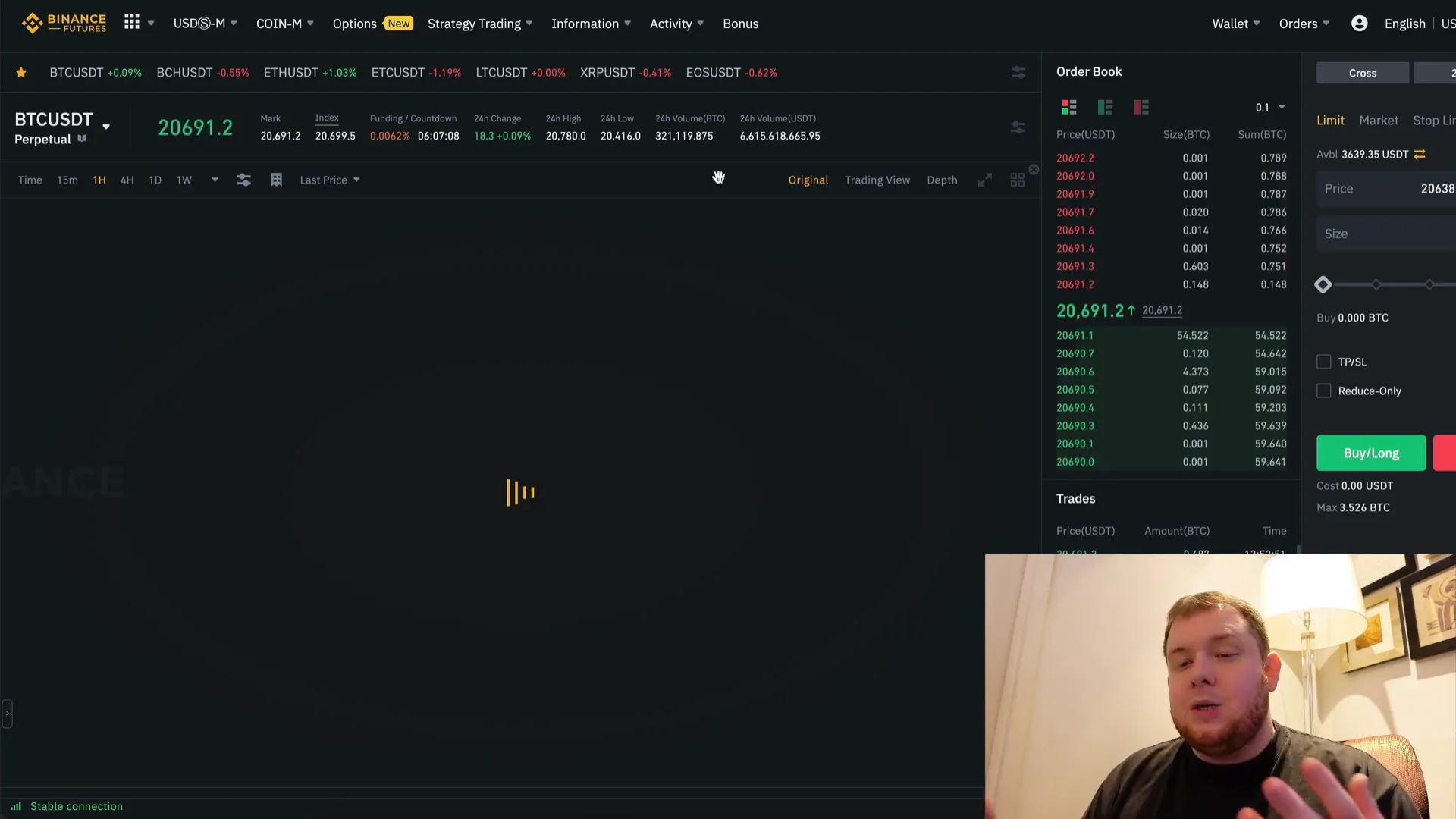

Once your account is set, familiarize yourself with the Binance interface, especially the derivatives section where you will find USDm Futures. You can switch to the trading view to get a better visual representation of market movements.

Essential Indicators for Trading

Successful trading often relies on technical analysis, which involves using various indicators to make informed decisions. Two crucial indicators for the strategy we’ll explore are the Heikin Ashi candles and the 200-period moving average.

Using Heikin Ashi Candles

Heikin Ashi candles are beneficial because they smooth out price fluctuations, allowing for a clearer view of market trends. This method makes it easier to identify strong uptrends and downtrends, which is vital for making trading decisions.

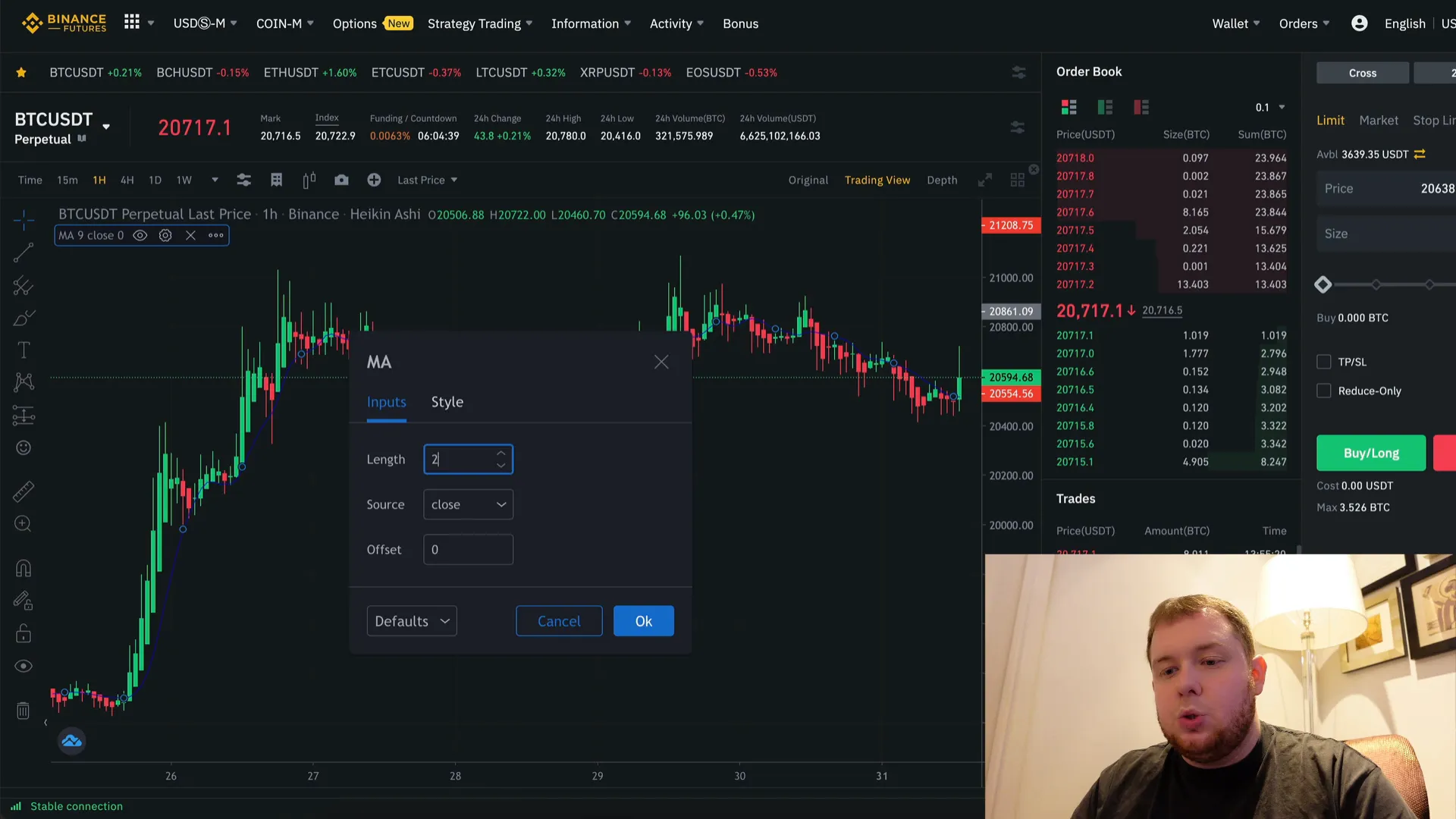

Setting the 200-Period Moving Average

The 200-period moving average is another critical tool. It helps traders identify the overall trend direction. When the price is above this average, it indicates a bullish trend; conversely, if the price is below, it suggests a bearish trend. Adjusting the moving average’s appearance by changing its color and thickness can enhance visibility on your charts.

The Trading Strategy

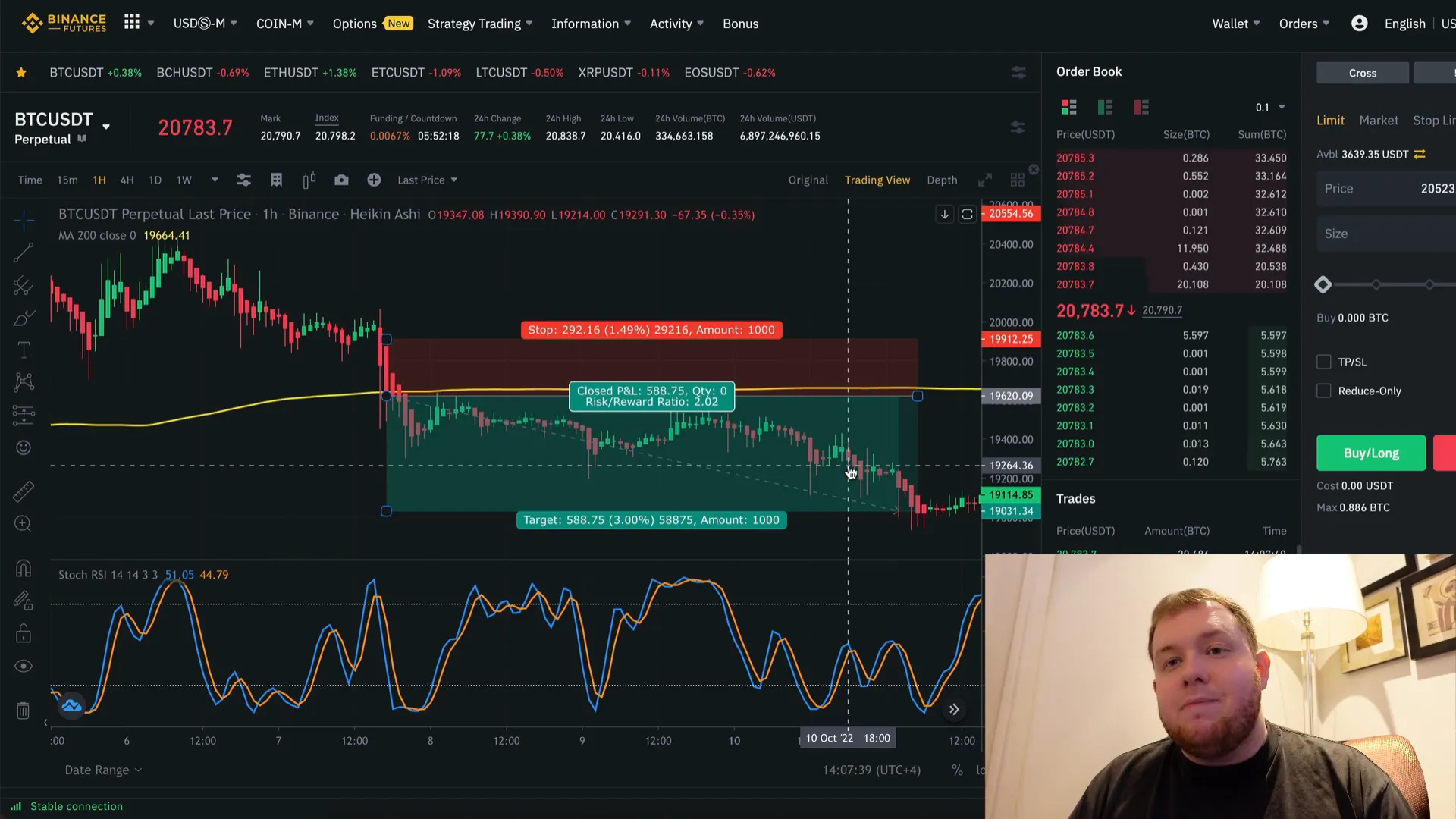

The core of this guide revolves around a straightforward trading strategy that combines the Heikin Ashi candles with the 200-period moving average and the Stochastic RSI. Here’s how it works:

Long Positions

To enter a long position, follow these steps:

- Ensure the price is above the 200 moving average.

- Check that the Stochastic RSI is in the oversold position (below the lower dotted line).

- Look for multiple bullish Heikin Ashi candles to confirm the upward trend.

Once these conditions are met, you can enter a trade, setting a target profit of around 3% and a stop loss of 1.5% to 1%. This risk-reward ratio can lead to consistent profits over time.

Short Positions

Shorting is the opposite of longing. To enter a short position:

- Confirm that the price is below the 200 moving average.

- Ensure the Stochastic RSI is in the overbought area (above the upper dotted line).

- Look for multiple bearish Heikin Ashi candles.

Similar to the long position, set a profit target of 3% and a stop loss of 1.5% to 1%. This method can also yield profitable trades when executed correctly.

Risk Management

In trading, risk management is paramount. Always be prepared for potential losses and never invest more than you can afford to lose. Setting stop-loss orders is a crucial part of managing risk and protecting your capital.

Final Thoughts

Trading on Binance Futures can be a lucrative endeavor if approached with the right strategy and mindset. By utilizing the techniques outlined in this guide, you can increase your chances of turning $100 into a more significant sum over time. Remember to stay disciplined, manage your risks, and continuously learn from your trading experiences.

If you haven’t already, consider signing up for a Binance account through the link provided. This not only gives you access to a powerful trading platform but also allows you to take advantage of various bonuses and educational resources.